|

Manufacturing index slips

|

|

July 3, 2000: 12:16 p.m. ET

NAPM June index at 51.8, below forecasts, in further sign of slowdown

|

NEW YORK (CNNfn) - U.S. manufacturing eased for the fourth straight month in June to the slowest pace in a year and a half, while prices paid for materials fell, a private industry report released Monday showed. The numbers suggest industrial activity may be starting to feel the effects of higher interest rates.

In a separate report, the Commerce Department said construction spending remained relatively subdued in May.

The National Association of Purchasing Management (NAPM) said its index of manufacturing activity fell to 51.8, below the 53.0 reading expected by economists polled by Briefing.com, and the 53.2 registered in May. June's reading was the lowest since January 1999, when manufacturing began to rebound on renewed demand for American-made goods from Asia and Latin America. The National Association of Purchasing Management (NAPM) said its index of manufacturing activity fell to 51.8, below the 53.0 reading expected by economists polled by Briefing.com, and the 53.2 registered in May. June's reading was the lowest since January 1999, when manufacturing began to rebound on renewed demand for American-made goods from Asia and Latin America.

The report offered more evidence that the U.S. economy, now in its 10th year of expansion, may be starting to slow, reducing the threat of more inflation-fighting rate increases by the Federal Reserve. The Fed last week opted to leave rates unchanged amid evidence of slower economic activity.

In particular, the decline in what producers paid for materials relieved concern about inflation posing a threat. Higher costs tend to spur manufacturers to raise their prices to retailers, who in turn pass those increases on to consumers. The "prices paid" component -- a measure of producers' costs -- slipped to 61.2 in June, its lowest since August 1999, from 65.8 in May.

"It confirms that the (Fed) was correct in pausing their tightening cycle at last week's meeting," said Steven Wood, an economist with Banc of America Securities in San Francisco.

Decelerating pace of growth

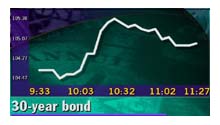

Stocks registered little reaction to the numbers in a shortened trading session ahead of the July 4 national holiday. Bonds, though, reacted positively to the news, with the 30-year benchmark gaining 9/32 of a point in price, pushing its yield to 5.87 percent from 5.89 percent late Friday. They later retraced some of their gains.

The NAPM, an organization that provides information and resources for the purchasing profession, surveys some 350 of its 45,000 members each month to track economic activity in 20 industries across the United States. Purchasing managers are the people who buy and sell the goods and services a company needs to produce its final products. The NAPM, an organization that provides information and resources for the purchasing profession, surveys some 350 of its 45,000 members each month to track economic activity in 20 industries across the United States. Purchasing managers are the people who buy and sell the goods and services a company needs to produce its final products.

In its report, the NAPM said its production index, which measures current output, fell to 53.6 from 56.3, while its new orders index, which gauges current demand, fell to 50.6 from 51.1. Its index of order backlogs fell to 48.5 in June from 49, its first drop below 50 since February 1999, while its export index, a measure of international demand, fell to 53.2 from 56.3. NAPM's imports index bucked the trend, rising to 56 from 54.7.

"The manufacturing sector continued to grow in June, but at a decelerating rate," said Norbert Ore, who heads the survey committee at NAPM, "The rate of growth has moderated significantly."

Subdued construction spending

Separately, the Commerce Department reported Monday that spending on new commercial, residential and public construction rose 0.1 percent in May versus the 0.2 percent decline expected by economists. April's spending fell a revised 1.1 percent, weaker than the originally reported 0.6 percent drop.

Overall spending on private construction projects in May rose to an annual rate of $639.9 billion from $634 billion in April. Residential building projects spending fell to $368 billion compared to $369.5 billion. Within the residential sector, funding for new housing units -- including single- and multi-family homes -- fell to $266.7 billion in May from $268.6 billion. Overall spending on private construction projects in May rose to an annual rate of $639.9 billion from $634 billion in April. Residential building projects spending fell to $368 billion compared to $369.5 billion. Within the residential sector, funding for new housing units -- including single- and multi-family homes -- fell to $266.7 billion in May from $268.6 billion.

Spending on nonresidential buildings, meantime, rose to a record $225.9 billion in May from $218.3 billion in April. Spending on industrial facilities rose to an $42.5 billion from $38.5 billion. Public construction spending on projects such as housing and redevelopment, industrial facilities and highways and streets fell in May to $169.3 billion from $174.2 billion in the previous month.

The Commerce Department said May spending on public construction projects was the lowest since $168.1 billion in June 1999.

|

|

|

|

|

|

|