|

Mexico, Brazil end bullish

|

|

July 3, 2000: 6:39 p.m. ET

Latin American stocks rally amid post-electoral fiesta in Mexico

|

NEW YORK (CNNfn) - Latin American financial markets ended sharply higher on Monday after Mexico's opposition candidate Vicente Fox won a heated presidential election over the weekend.

The post-electoral fiesta ended 70 years of one-party ruling in Mexico and sent the stocks soaring over 6 percent as the peso jumped nearly 3 percent.

Brazilian stocks also soared, led by telephone shares and oil company Petrobras, as investors shuffled their assets following the exit of three key stocks from the benchmark index.

Elsewhere in the region, Argentine stocks closed sharply higher as last week's Mercosur auto trade agreement infused the bourse with a healthy dose of optimism. The MerVal index closed up 3.42 percent, gaining 17 points to 513.9.

With little influence from the shortened trading session on Wall Street, Venezuela's IBC index finished 54.76 points, or 0.78 percent, higher at 7,032.68, and Chilean stocks closed 0.3 percent higher at 98.82.

The Toronto Stock Exchange was closed on Monday for the Canada Day holiday.

Mexico stocks rise on vote

Fox, a former Coca-Cola executive, knocked out the ruling Institutional Revolutionary Party (PRI) in a surprise win Sunday.

In response, Mexico's leading IPC index jumped 425.04 points, or 6.12 percent, to 7,373.37 points on Monday. The Mexican peso also strengthened. In response, Mexico's leading IPC index jumped 425.04 points, or 6.12 percent, to 7,373.37 points on Monday. The Mexican peso also strengthened.

The benchmark 48-hour peso closed 26.5 centavos firmer against the dollar at 9.57 peso, a level not seen since June 2. On Friday, this contract finished at 9.84.

The IPC notched its firmest close since April 10, when the key stock gauge finished at 7375.54 points at the same time that it scored its biggest percentage advance since June 2, when shares had risen 7.27 percent, according to bolsa records.

Of 84 active issues, 54 ended up, 15 fell and 10 closed unchanged. Turnover resulted in a hefty 2.155 billion pesos, or $225.06 million.

Market watchers say the election helps assuage investor uncertainty over Mexico's political future.

"Our view is very positive," said Thierry Wizman, emerging markets equity strategist at Bear Stearns in New York. "Regardless of the new president's orientation, we would see the election as an indication of political maturity" for the country.

During Fox's transition to power over the next five months, investors will be waiting for any signals the president-elect sends about his plans for the country's economy, Wizman said.

"I think the markets will be closely watching what he says and does," he said. "That will determine whether there is a true break in policy or not."

Markets had traded cautiously ahead of the election, amid investor uncertainty about the close race. Mexican presidential elections, which are held every six years, traditionally have led to instability in the economy amid jitters about potential turmoil stemming from the vote.

Despite Monday's gains, the benchmark IPC index of 35 leading shares is still well off an all-time high of 8,417 in March after Mexico received a key debt upgrade from Moody's Investors Service.

But that upgrade could be followed by a similar move by Standard & Poor's, another major credit rating service, by the end of the year, said Joyce Chang, director of emerging market research at Chase Securities. Such an upgrade from S&P likely would inject more investor confidence in Mexico's economy.

Mexican ADRs soar

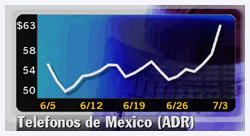

Gains also were seen early Monday on the New York Stock Exchange, where American depositary receipts (ADRs) of Mexican companies rose.

In an abbreviated session on Wall Street ahead of the Independence Day holiday, ADRs of telecom firm Telefonos de Mexico (Telmex) (TMX: Research, Estimates) gained 5-11/16 to 62-7/8, while media firm Grupo Televisa (TV: Research, Estimates) added 5-5/8 to 74-9/16. TV Azteca (TZA: Research, Estimates) rose 1 to 14-3/16. In an abbreviated session on Wall Street ahead of the Independence Day holiday, ADRs of telecom firm Telefonos de Mexico (Telmex) (TMX: Research, Estimates) gained 5-11/16 to 62-7/8, while media firm Grupo Televisa (TV: Research, Estimates) added 5-5/8 to 74-9/16. TV Azteca (TZA: Research, Estimates) rose 1 to 14-3/16.

Also, ADRs of cement maker Cemex (CX: Research, Estimates) gained 15/16 to 24-5/16, and shares of beverage company Femsa (KOF: Research, Estimates) edged up 5/8 to 19-1/2.

In a research note, ABN Amro raised the weighting of Mexican stocks in its portfolio, saying that Mexican shares were undervalued.

The brokerage's picks include Telmex, Cemex, Femsa and paper products maker Kimberly Clark de Mexico.

For U.S. companies interested in expanding in Mexico, the election could signal a market-opening opportunity as the country becomes more democratic, said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum. Mexico is the United States' second biggest trading partner, after Canada.

"This is a bellwether event in Mexico," he told CNNfn's "Market Call." "I'm sure there's a lot of corporations here who are immediately starting to look at Mexico and say, 'How do we get down there and what's our best way to play it?'"

Bovespa jumps; index gets new heavyweights

Brazil's Bovespa index gained 2.2 percent to 17.089 on the first day of trading under the gauge's new configuration.

The preferred and common shares of phone company Telesp, a former index heavyweight, and Tele Sudeste exited the index of the most widely traded shares. That sent investors shopping for alternatives.

"This is the first day with Telesp out of the index, so money got distributed to other shares," said a trader at Banco Fator brokerage in Sao Paulo.

Telesp and Tele Sudeste bowed out of the index after parent company Telefonica of Spain ended Friday an all-share buyout offer for the company's stock, closing the offer with a participation of more than 87 percent in both companies' capital.

Shares of Telemar gained 4.3 percent to 44.05 reals. Telemar became the index's most heavily weighted telecom stock with the exit of Telesp and is No. 2 on the index as a whole, according to the Sao Paulo stock exchange.

Telemar and Brazil's biggest private bank Bradesco signed a contract to extend free Internet access connections in 16 states, the companies said. Bradesco gained 0.6 percent to 15.80 reals.

Tele Centro Oeste jumped 5.1 percent to 7.65 reals and long-distance phone company Embratel gained 2.1 percent to 44 reals.

Oil company Petrobras, now the index's most heavily traded stock, gained 2.3 percent to 55.75 reals.

Trading volume was relatively weak, reaching 586 million reals ($323 million).

"Foreign investors were scarce," the trader said. Wall Street markets closed early Monday afternoon in the United States ahead of America's July 4 Independence Day holiday.

Nevertheless, Brazil was buoyed by a wave of enthusiasm for U.S. equities in the shortened Wall Street trading sessions.

Euphoria for Mexican shares also contributed to the positive tone in the Sao Paulo market.

Mexico's benchmark index rallied 6.1 percent following the victory of opposition candidate Vicente Fox in presidential elections.

Brazil's index is now off just 0.02 percent since the start of the year.

-- from staff and wire reports

|

|

|

|

|

|

|