|

FTSE leads Europe gains

|

|

July 3, 2000: 7:02 a.m. ET

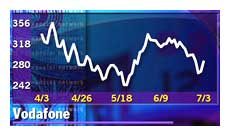

Vodafone, telecoms lift London 2.5%, Paris techs spur 1% gain

|

LONDON (CNNfn) - Europe's leading markets closed higher Monday, with London's benchmark index rallying sharply behind a 9.7-percent advance for index heavyweight Vodafone AirTouch and technology issues lifting the major index in Paris.

London's benchmark FTSE 100 surged 157.7 points, or 2.5 percent, to 6,431.2, with top telecom and media stocks doing the heavy lifting.

In Paris, the CAC 40 index closed up 61.93 points, or 1 percent, to 6,508.47, with three of the top four gainers in the telecom and tech sectors.

The Xetra Dax in Frankfurt rose 60.75, 0.88 percent, to 6,958.96 with electronics components maker Epcos (FEPC) rising 8 percent.

The FTSE Eurotop 300, which includes a basket of leading stocks from across Europe, rose 1.4 percent, with the telecom sub-index up 4 percent and the information technology hardware segment rising 2.8 percent. Finnish mobile phone maker Nokia gained 2.7 percent and Swedish rival Ericsson was up 5.2 percent.

Martin Gilles, head of equity research with brokerage WestLB Panmure in Frankfurt, said he's expecting this week's U.S. economic reports on manufacturing and the labor market to be good for shares. He said the technology sector in particular might have bottomed out.

"There has been a clear change in the valuations in the technology sector due to the price correction since mid-March," said Gilles. "While valuations are still high, they have come down."

As Europe's leading markets closed, Wall Street was turning into positive terrain. The Dow Jones industrial average and the Nasdaq composite were both up 0.5 percent. U.S. markets are open for trading for just a half day Monday and are closed Tuesday.

In the currency markets, the euro slipped to just above 95.16 U.S. cents from 95.25 cents in late New York trade Friday.

Mixed media picture in London

In London, other phone companies following Vodafone higher included Colt Telecom (CTM), up 9.1 percent, and former telecom monopoly British Telecommunications (BT-), rising 5.4 percent.

Information technology consultant Logica (LOG) rose 8.4 percent.

Media stocks were mixed. Music publisher EMI Group (EMI), which was volatile last week, soared 13.3 percent. ABN Amro lowered its ratings on publisher Reed International (REED) and Financial Times publisher Pearson (PSON) to "hold" from "buy," causing Reed to fall 2.8 percent and Pearson to sink 4.8 percent.

Financial news and data provider Reuters (RTR) jumped 5.5 percent. ABN Amro reiterated its "buy" recommendation on the company's shares.

U.K. financial-services shares weakened after banking giant HSBC Holdings (HSBA) lowered its basic mortgage lending rate by nearly a full percentage point, in a move that could spark a price war. Mortgage bank Halifax (HFX) slid 6.1 percent, bank Abbey National (ANL) fell 4.4 percent, and Bank of Scotland (BSCT) fell 2.9 percent.

Hilton Group (HG-) fell 3.9 percent to 225 pence after UBS Warburg cut its price target on the hotel operator to 210 pence a share from 250 pence.

Shares of German retailer Metro (FMEO) jumped 7 percent after a weekend news report said U.K.-based Tesco (TSCO) is planning a bid for Real, a hypermarket chain that's owned by Metro. The companies denied to comment. Tesco shares fell 1.9 percent, paring their earlier losses.

German financials mixed

Also in Frankfurt, Metro's retail rival Karstadt Quelle (FKAR) rose 4.5 percent. In the automotive sector, truck maker MAN (FMAN) added 2.9 percent.

Top banking stocks were mixed, with HypoVereinsbank (FHVM) the best performer among the Dax's financial-services stocks with a 4.8 percent advance, while Deutsche Bank (FDBK) added 2.6 percent.

On the downside, Commerzbank (FCBK) lost 2.5 percent after a weekend management board meeting failed to reach any agreement over talks the bank has been holding about an alliance with Dresdner Bank (FDRB). Dresdner shares fell 2.4 percent.

Deutsche Telekom (FDTE) shed 2.1 percent. That was after Hungarian telephone operator Matav said Telekom agreed to buy U.S.-based SBC Communications' stake in Matav for about $2.2 billion. Weekend reports said DT was in buyout talks with U.S. long-distance operator Sprint (FON: Research, Estimates), whose shares rose 5 percent on Wall Street.

Diversified utility RWE (FRWE) fell 2.3 percent after warning that full-year earnings would be hit by falls in consumer electricity prices.

In the German technology sector, chipmaker Infineon (FIFX) fell 5.8 percent, leading the list of Dax losers, after parent company Siemens (FSIE) announced plans to issue bonds that would be convertible into Infineon shares.

In Paris, cosmetics maker L'Oréal (POR) fell 6.8 percent, leading the market lower. Bank Crédit Lyonnais (PCL) dropped 3.6 percent and municipal bank Dexia (PDEX) slipped 2.6 percent.

Techs spur Paris gains

Hi-tech gainers included Dutch network operator Equant (PEQU), up 6.9 percent, engineering firm Alstom (PALS) rising 7 percent and chip maker STMicroelectronics (PSTM), up 4.9 percent.

PSA Peugeot Citroen (PUG) rose 5.6 percent. A report Monday said new auto sales in France jumped 75 percent in June from the same month a year earlier, although that reflected a change to carmakers' selling practices that had artificially depressed the figures for June 1999. Elsewhere in the automotive sector, tire maker Michelin (PML) rose 3.5 percent.

The CAC 40 was the best performer among the major bourses in the second quarter of 2000, gaining 2.5 percent. London's FTSE 100 lost 3.5 percent in the same period.

-- from staff and wire reports

|

|

|

|

|

|

|