|

IBM teams with Compaq

|

|

July 6, 2000: 4:07 p.m. ET

Aiming to unseat EMC, computing powerhouses ink data-storage pact

|

NEW YORK (CNNfn) - Lining up against a common rival, IBM Corp. and Compaq Corp. said Thursday that they would together sell data-storage products and make the storage hardware and software products each company sells interoperable with the other.

IBM and Compaq said they may invest more than $1 billion in the partnership, and some analysts characterized it as a shot across the bow of EMC Corp., currently the leading supplier of enterprise storage systems.

Under the terms of their agreement, each company said it would provide equipment, software and staffing to support the other's open storage networking customer centers. They also said they would sell significant products from each other's storage-product portfolios.

Compaq said it will sell IBM's "Shark" enterprise storage servers and select "Tivoli" systems management software. IBM said it will sell Compaq's "StorageWorks" modular array storage systems and software.

IBM executives called the partnership a "game-changing play" in the market for disk-storage systems and storage-management software. Compaq's top executive said the deal will bring "significant" sales to both companies starting later this year. IBM executives called the partnership a "game-changing play" in the market for disk-storage systems and storage-management software. Compaq's top executive said the deal will bring "significant" sales to both companies starting later this year.

"We see significant revenue flow in the fourth quarter of this year," Michael Capellas, Compaq's chief executive officer, said in a conference call Thursday.

Industry analysts said the move will put pressure on EMC to make its storage management software compatible with non-EMC hardware, especially in open systems.

"For them to compete actively, they'll have to radically change," said Ron Johnson, a partner at Evaluator Group, a storage research company in Englewood, Colo. "They'll still do OK on the mainframes end, but in open systems, they'll be facing, I believe, a losing battle."

John McArthur, an analyst at International Data Corp. in Framingham, Mass., also pointed to EMC's proprietary approach to its data-storage software.

"What EMC does not do is manage non-EMC products with their EMC control center software," McArthur said. "So this is clearly a volley at EMC, which in the external storage space is the market leader."

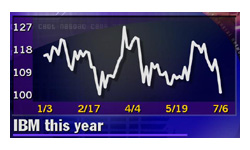

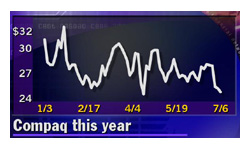

Meanwhile, reaction on Wall Street was muted. IBM (IBM: Research, Estimates) shares were off 3-9/16, or 3.4 percent, at 101-7/16. Compaq (CPQ: Research, Estimates) edged down 1/8 to 24-7/8. Meanwhile, reaction on Wall Street was muted. IBM (IBM: Research, Estimates) shares were off 3-9/16, or 3.4 percent, at 101-7/16. Compaq (CPQ: Research, Estimates) edged down 1/8 to 24-7/8.

Bear Stearns analyst Andrew Neff said it was too early to tell if the deal would allow either IBM or Compaq to push EMC out of the lead position.

"It's good for Compaq at the margin, because it helps them fill out their product line, and it is good for IBM at the margin because it helps them to sell storage," Neff said.

Following the leader

Despite the combined effort of the two computing powerhouses and their apparent offensive in the data storage market, EMC expressed very little concern Thursday.

"Leaders need followers, and the thing we like about announcements like this that they shine more of a spotlight on the storage industry," said EMC spokesman Mark Fredrickson.

"We've been saying for 10 years that information is at the center of an IT strategy, the server is peripheral and storage is where it happens. It's gratifying that the largest computer companies are recognizing that, but their ability to actually contribute to it is another matter."

For its part, EMC already has been working toward interoperability in storage area networking, "and that's one of the reasons we keep gaining market share against people like IBM and Compaq," Fredrickson said.

Fredrickson also characterized the partnership as defensive rather than offensive, pointing out that both Compaq and IBM are, at their core, computer companies, each of which has been losing share on the server market to competitors such as Sun Microsystems, Dell and Hewlett-Packard.

"Now they've turned to storage where they've each struggled and lost share to EMC as well," he said. "So it really seems like a sign of dual desperation."

"They're going to resell each other's products, which is a sign of weakness," Fredrickson added. "From Compaq's standpoint, that's an acknowledgement that they lack a high-end storage product. From IBM's standpoint, it's an acknowledgment that they've been unable to sell the Shark product outside of the very narrow mainframe market that they cater to."

EMC (EMC: Research, Estimates) shares were down 1 at 74-5/8, a 1.3 percent decline on the day.

-- Reuters contributed to this report

|

|

|

|

|

|

|