|

Merrill mulls 2,000 layoffs?

|

|

July 7, 2000: 4:15 p.m. ET

Brokerage division targeted for cutbacks as securities firm streamlines

|

NEW YORK (CNNfn) - Merrill Lynch & Co., the world's largest brokerage firm, is considering cutting up to 2,000 jobs, or 3 percent of its work force, according to published reports.

A Merrill spokesman declined to comment on the possible cuts, but according to a Wall Street Journal report Friday, the firm could target up to 2,000 workers in its brokerage division. The layoffs would not affect stockbrokers but those employees involved in technology, marketing and strategy, the report said.

Sources close to the matter told CNNfn that cuts are already underway at the company, reflecting a follow-through on a previous announcement that it intends to trim expenses.

Should they occur, the cuts would be the largest for the Wall Street firm since it jettisoned 3,400 workers in the aftermath of a bond market rout in 1998. The cuts also would come at a time when Merrill is ramping up its Internet efforts to compete with online and discount brokerages. Should they occur, the cuts would be the largest for the Wall Street firm since it jettisoned 3,400 workers in the aftermath of a bond market rout in 1998. The cuts also would come at a time when Merrill is ramping up its Internet efforts to compete with online and discount brokerages.

The purge is part of cost-cutting measures being pushed E. Stanley O'Neal, the former chief financial officer who took over as head of the company's brokerage division from John "Launny" Steffens in February, the report said.

O'Neal is considering eliminating 5.4 percent of the 37,000-strong brokerage division, which would amount to a 3 percent reduction in Merrill's overall work force of 68,600.

Mark Constant, an analyst with Lehman Bros., said the cuts are part of Merrill's plan to step back and take stock of its needs, particularly after a hiring spree over the last few years in the steamrolling economy.

"I think it's very common in a bull market to put on a lot of people. You can never manage that process quite as leanly as you'd like," Constant said. "It's a very healthy exercise to step back and say, 'OK, what did we add that we didn't need?'"

Michael Flanagan, an analyst with Financial Service Analytics, agreed.

"Increasingly, firms have been adding expensive technology supports and perhaps haven't seen the real benefit of it," Flanagan said. "In the face of perhaps a slower revenue growth in the future, (profit) margins could become strained."

Merrill, like other securities firms, in the first quarter reported record profits of more than $1 billion, buoyed by strong stock markets and fees from helping companies go public and advising them on mergers. But a recent slump in the Nasdaq stock market and a dearth of new stock offerings has put a dent in the long-running bull market for stocks.

"This is an orderly belt-tightening. Expense growth has been overshadowed by strong revenue growth," Flanagan, said. "What is really driving the issue here is that even the most optimistic firms cannot expect to sustain revenue growth at these levels."

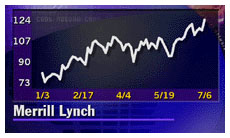

Shortly before the closing bell on Friday, shares of Merrill Lynch (MER: Research, Estimates) were down 1-9/16 to 122-7/16. The stock had fallen as low as 120 in Friday afternoon trading on the New York Stock Exchange before recovering slightly.

|

|

|

Merrill Lynch

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|