|

Europe rides U.S. data up

|

|

July 7, 2000: 5:00 a.m. ET

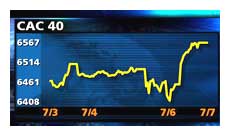

Benign jobs report powers techs and telecoms as Paris leads the way, up 1.7%

|

LONDON (CNNfn) - Europe's key markets closed solidly higher Friday after benign U.S. jobs data eased concerns about rising interest rates and sparked a rally for major telecom and technology stocks that are especially susceptible to rate rises.

A report showed the U.S. economy created 11,000 jobs last month, fewer than expected, easing the likelihood that the U.S. Federal Reserve will raise interest rates at its next meeting in August. Markets in Europe have been on edge about possible rate increases.

In Paris, the blue-chip CAC 40 index rose 112 points, or 1.7 percent, to 6,565.97, with telecom and technology stocks accounting for three of the top four gainers. That Friday jump accounted for nearly all of the index's 1.8-percent gain on the week.

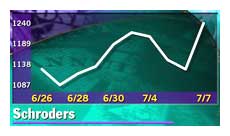

London's benchmark FTSE 100 climbed 77.9 points, or 1.2 percent, to 6,494.6, with telecom equipment maker Marconi (MNI) jumping 8.4 percent while investment firm Schroders (SDR) rocketed 10.1 percent. For the week, the leading U.K. index was up 2.9 percent.

The Xetra Dax in Frankfurt jumped 101.13 points, or 1.45 percetn, to close at 7,052.22. Index heavyweight Deutsche Telekom (FDTE) led the way, up 4.3 percent.

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, rose 1.5 percent to 1,623.61. The information technology hardware segment rallied 5 percent, with Swedish mobile-phone company Ericsson up 6.6 percent and its Finnish rival Nokia rising 4.5 percent.

Wall Street was up sharply as bourses closed. The Nasdaq composite index was up 1.9 percent and the Dow Jones industrial average was up 1.3 percent.

In the currency market, the euro slipped to 94.82 U.S. cents, giving back gains sparked by the jobs report, from 95.05 cents late Thursday in New York.

London software stocks rebound

In London, computer consultant Logica (LOG) rose 4.5 percent, rebounding from a loss the previous session. Rival consultant CMG (CMG) rose 3.9 percent.

Leading the losers was cable company BSkyB (BSY), off 2.9 percent after French business daily Les Echos said Jean-Marie Messier, chairman of key BSkyB shareholder Vivendi, won't contribute his 20 percent stake to planned digital distribution company Sky Global unless he wins an active role for Vivendi's new interactive operations in Sky Global.

British Telecommunications (BT-A) rose 2.1 percent, reversing earlier losses after the Financial Times reported Concert, BT's international joint venture with AT&T Corp (T: Research, Estimates), is struggling to find its feet amid signs of tension between the company and its parents.

Food and beverage company Diageo (DGE), parent of the Burger King fast food chain, fell 1.8 percent and British American Tobacco (BAT) dropped 2.2 percent after its Imperial Tobacco unit said it and two other tobacco companies in Canada have launched a legal challenge to a new Canadian law requiring health warnings on tobacco packaging.

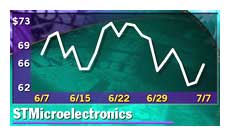

In Paris, in the telecom sector, network equipment maker Alcatel (PCGE) rose 3.4 percent and STMicroelectronics (PSTM), a maker of chips for use in mobile phones, rose 5.6 percent, leading the list of CAC 40 gainers.

Index heavyweight France Telecom (PFTE) rose 3.6 percent while rival Bouygues (PEN), which is both a telecom and construction firm, rose 5 percent. On the downside was the Dutch network operator Equant (PEQU), off 3.3 percent and topping the list of CAC losers.

Elsewhere in Paris, information technology consultant Cap Gemini (PCAP) advanced 3.5 percent. Power engineering company Alstom (PALS) rose 2.3 percent and leading media play Canal Plus (PAN), a pay-TV operator, shed 1.9 percent. Rival broadcaster TF1 [PAR:TF1] shed 1.3 percent.

Upgrade for Lafarge shares

Cement firm Lafarge (PLG) rose 4.1 percent after analysts at JP Morgan raised their rating on its shares to "buy" from "market perform".

In the German retailing sector, Metro (FMEO) added 4.2 percent, leading the Dax's gainers.

Drug maker Schering (FSCH) jumped 3.3 percent to  63 a share, after Deutsche Bank lifted its price target to 63 a share, after Deutsche Bank lifted its price target to  68 a share from 68 a share from  60. Fellow health- care firm Fresenius Medical Care (FFME) climbed 4.1 percent. 60. Fellow health- care firm Fresenius Medical Care (FFME) climbed 4.1 percent.

In Germany's financial sector, HypoVereinsbank (FHVM) fell 1.4 percent. Insurer Allianz (FALZ) fell 1.3 percent, while reinsurer Munich Re [FSE:FMUV2] was the leading Dax loser, off 1.7 percent.

The auto sector was mixed in Germany. DaimlerChrysler (FDCX) added 2.1 percent and truck maker MAN (FMAN) added 1.6 percent while BMW (FBMW) was the leading Dax loser, dropping 1.5 percent.

-- from staff and wire reports

|

|

|

|

|

|

|