|

Treasurys under pressure

|

|

July 10, 2000: 3:21 p.m. ET

Investors cautious ahead of Greenspan, economic data; dollar drops

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury securities ended moderately lower Monday, as investors expressed caution ahead of two public appearances from Federal Reserve Chairman Alan Greenspan and key economic data slated to be released this week.

In the currency markets, the dollar weakened against the yen amid expectations the Bank of Japan will raise interest rates in the months ahead.

Shortly before 3 p.m. ET, the 10-year Treasury note, considered the market benchmark, fell 7/32 of a point in price to 103-10/32. The yield, which moves in the opposite direction to price, rose to 6.03 percent from 6 percent late Friday.

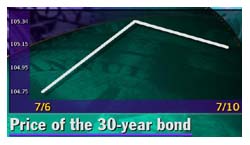

The 30-year bond retreated 7/32 to 105-4/32, its yield rising to 5.88 percent  from 5.86 percent. from 5.86 percent.

As investors focused on the outlook for the U.S. economy and interest rates, all eyes will be on Greenspan. The Fed chief is scheduled to speak on the new economy at the National Governors Association conference in State College, Pa., Tuesday morning and on global economy decision-making Wednesday evening in New York.

However, analysts said it is unlikely Greenspan will say anything about interest rates in front of his forthcoming testimony before the Senate  Banking Committee in Washington, D.C. He is scheduled to give his semiannual Humphrey-Hawkins report on the economy and monetary policy on July 20. Banking Committee in Washington, D.C. He is scheduled to give his semiannual Humphrey-Hawkins report on the economy and monetary policy on July 20.

"Greenspan usually refrains from saying anything market moving ahead of speeches before Congress," said Tony Crescenzi, chief market strategist at Miller Tabak & Co.

Along with Greenspan, the market faces key economic data due later this week, including June producer prices, which measure inflation at the wholesale level, and June retail sales. Both reports are slated for release Friday.

In an effort to slow the economy and curb inflation, the Fed hiked short-term interest rates six times in the past year.

Last week, Treasurys benefited from economic reports showing a cooling in job growth and manufacturing activity, thereby diminishing fears of higher interest rates in the near-term.

Some analysts now expect the Fed to stay sidelined at its next monetary policy meeting on Aug. 22.

Michael Marzano, bond futures trader at Greenwich NatWest Futures, told CNNfn's Before Hours market participants are "waiting for the right signals" before investing. (163K WAV) (163K AIFF)

A large amount of corporate and agency bonds expected to enter the market also pressured Treasurys. Some of the issues include a $4 billion deal from Fannie Mae this week and a $3 billion deal from the nation's No. 1 telecommunications firm, AT&T Corp. (T: Research, Estimates) next week.

Corporate and agency bonds are seen as attractive as their higher yields could draw investors away from Treasurys.

(Click here for a look at Briefing.com's economic calendar.)

Dollar slides

The dollar declined against the yen Monday, falling as much as 106.56 yen after a robust Japanese economic report pointed to strength in the economy. Analysts said the 4.5 percent increase in machine tool orders in May fueled expectations the Bank of Japan (BOJ) may end its zero interest rate policy.

"The Japanese economy is turning around, as evidenced by the machine tool orders," said Brian Arabia, vice president of foreign exchange at ABN Amro Bank in Chicago. "If signs of growth in the economy continue,  eventually they (Japan) will depart from the zero interest rate policy." eventually they (Japan) will depart from the zero interest rate policy."

The next BOJ policy meeting is July 17.

Tomas Jelf, currency strategist at UBS Warburg, said a delayed reaction to Friday's U.S. employment report also contributed to the dollar's weakness. "The dollar is reacting to the numbers we saw Friday. We are waiting for further confirmation of the U.S. slowdown," he said.

Shortly before 3 p.m. ET, the dollar traded at 107.16 yen, down from 107.84 yen Friday, a 0.6 percent loss in the dollar's value. Meanwhile, the dollar dropped against the euro, trading in a narrow range throughout the day. The euro was at 95.46 cents, up from 94.87 cents Friday.

|

|

|

|

|

|

|