|

Treasurys drift lower

|

|

July 11, 2000: 3:26 p.m. ET

New corporate, agency bond issues pressure market; dollar posts gains

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury securities ended slightly lower Tuesday as a heavy amount of new corporate and agency bonds entering the market drew investors away from government securities.

In the currency markets, the dollar rose against the yen and the euro.

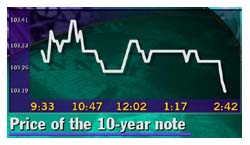

Shortly before 3 p.m. ET, the 10-year Treasury note, considered the market benchmark, fell 3/32 of a point in price to 103-6/32. The yield, which moves  inversely to price, rose to 6.05 percent from 6.04 percent late Monday. inversely to price, rose to 6.05 percent from 6.04 percent late Monday.

The 30-year bond retreated 4/32 to 105, its yield rising to 5.89 percent from 5.88 percent.

Treasurys were weighed on by the large amount of corporate and agency bonds expected to be sold over the next few weeks. These bonds often pressure Treasurys as their higher yields can turn buyers away from government securities. One deal on the calendar is Fannie Mae, who said it will sell $5.5 billion five-year notes Wednesday.

Although Treasurys initially advanced following a speech by Federal Reserve Chairman Alan Greenspan, overall there was little market impact.  Addressing the National Governors Association in State College, Pa., Greenspan focused on technology and productivity. Addressing the National Governors Association in State College, Pa., Greenspan focused on technology and productivity.

Analysts said investors expressed relief that the Fed chief said nothing hawkish regarding the economy or monetary policy. "People thought he might take an opportunity to send out a cautionary note, given the market's favorable response to the jobs report," said Jim Glassman, senior U.S. economist at Chase Securities, referring to last Friday's June employment report.

The Fed hiked short-term interest rates six times in the past year. But with data pointing to a slowing in the economy, it opted to keep rates steady last month.

The June jobs report provided further evidence of a slowdown, and many analysts expect the Fed to stay sidelined at the next policy meeting Aug. 22.

Bill Hornbarger, fixed income strategist at A.G. Edwards, told CNNfn's Before Hours there is widespread belief that if the Fed does hike rates again, it will do so at the August meeting so as to not interfere with the presidential election in November. (204K WAV) (204K AIFF)

Despite another public appearance by Greenspan, who is scheduled to speak in New York Wednesday on global economic challenges, analysts expect activity to remain light until later in the week.

Two key government reports are slated for release Friday - the June producer price index and June retail sales. The data may shed further light on the outlook for the economy.

(Click here for a look at Briefing.com's economic calendar.)

Dollar gains

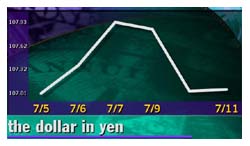

The dollar advanced against the yen and the euro Tuesday in subdued trading. With little economic news, analysts said there was no reason for the dollar to break out of its current ranges.

"It's lifeless," said Craig Puffenberger, head of global foreign exchange trading at Credit Suisse First Boston. "A lot of the currencies don't have the impetus to go anywhere."

Traders continue to speculate whether the Bank of Japan (BOJ) will hike rates at its July 17 policy meeting. Expectations that the BOJ will abandon  its 17-month-long zero interest rate policy recently have bolstered the yen. its 17-month-long zero interest rate policy recently have bolstered the yen.

But even if the central bank raises rates, the yen's gains may be limited.

Anne Mills, senior currency economist at Brown Brothers Harriman, said the BOJ may stress the reason behind the action was to restore Japan to a normal monetary policy regime.

Shortly before 3 p.m. ET, the dollar traded at 107.06 yen, up from 107.03 yen Monday. Meanwhile, the euro was at 95.20 cents, down from 95.47 cents Monday, a 0.3 percent gain in the dollar's value.

|

|

|

|

|

|

|