|

Merger derailment upheld

|

|

July 14, 2000: 2:10 p.m. ET

Court OKs freeze on rail combinations that blocked CN-BNSF deal

|

NEW YORK (CNNfn) - A deal to create North America's largest railroad came off the tracks Friday when the U.S. Court of Appeals in Washington, D.C., upheld a 15-month moratorium on rail mergers imposed by federal regulators in March.

The decision was a setback for Canadian National Railway Co. and Burlington Northern Santa Fe Corp., which had their $19 billion merger proposal frozen by the moratorium. But the decision cheered investors, who worried about the service disruptions and financial problems that often accompany such deals.

The railroads issued a joint statement saying the ruling disappoints them and that they will consult with their respective boards of directors as to their next option. But analysts say this is probably the final stop for the attempts to join the two.

"I sat across table from (BNSF Chairman) Rob Krebs three or four months ago and he said if the moratorium was allowed to stand, he would call off the merger," said Jim Valentine, analyst with Morgan Stanley Dean Witter. "I think if the eastern carriers have improved their service levels a year from now, BN will have more options which way to go, not just to Montreal." "I sat across table from (BNSF Chairman) Rob Krebs three or four months ago and he said if the moratorium was allowed to stand, he would call off the merger," said Jim Valentine, analyst with Morgan Stanley Dean Witter. "I think if the eastern carriers have improved their service levels a year from now, BN will have more options which way to go, not just to Montreal."

The deal, announced Dec. 20, would have been a merger of equals with no premium paid to either railroad's shareholders. It would have created a network of 50,000 miles of track from Nova Scotia to Los Angeles and the Gulf of Mexico to Vancouver, British Columbia.

The two railroads argued their relatively successful record in previous deals would spar rail customer the service problems that have plagued other recent combinations, such as the purchase by Union Pacific Corp. (UNP: Research, Estimates) of Southern Pacific or the combined purchase of the former Conrail by CSX Corp. (CSX: Research, Estimates) and Norfolk Southern Corp. (NSC: Research, Estimates). CSX service is still being impacted more than a year after it integrated its half of Conrail into its system.

But the continent's other major railroads joined to urge regulators not to approve the deal. They argued that competitive pressures and the need to strike the best deal possible would force them into a new round of mergers if the BNSF-CN deal was OK, before they were ready to do so.

The U.S. regulators at the Surface Transportation Board agreed, saying imposing the moratorium in March, saying they needed the time to draft new rules that would apply to a final round of rail combination. Most industry observers expect the industry's final round of mergers to result in two major railroads which each cover most of the continent. The U.S. regulators at the Surface Transportation Board agreed, saying imposing the moratorium in March, saying they needed the time to draft new rules that would apply to a final round of rail combination. Most industry observers expect the industry's final round of mergers to result in two major railroads which each cover most of the continent.

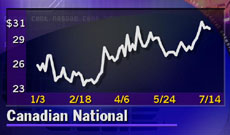

Both Canadian National (CNI: Research, Estimates) and Burlington Northern (BNI: Research, Estimates) saw their stocks rise on the decision Friday, as did the other major railroads. Analysts said that investor fears of a new round of mergers were depressing stocks in the sector.

"I upgraded CN based on the news," said Valentine. "Now they can stick to knitting, concentrate on what they do best, running a classic textbook railroad." He now ranked the stock as outperform, rather than neutral. He said he didn't upgrade BNSF's stock do to concerns that Krebs may now choose to retire, raising succession concerns for investors.

STB officials were unavailable for comment about the court's decision Friday, but officials with CSX and Union Pacific praised the ruling. STB officials were unavailable for comment about the court's decision Friday, but officials with CSX and Union Pacific praised the ruling.

"We think the court decision is a significant step to restore stability to the rail industry," said John Bromley, spokesman for UP. "Mainly we just wanted the board to revisit the way mergers are reviewed. We welcome that decision as a breather."

Court ruling based on regulators' authority

The court of appeals voted 2-to-1 to uphold the moratorium, with the decision based on whether or not the STB had the authority to issue such a freeze, not whether or not the merger would be good or bad.

"Where, as in this case, there is no evidence (or indeed, allegation) of bad faith on the part of the agency, and the agency has demonstrated a reasonable need for delay, we have no reason to think that judicial intervention would advance either fairness or Congress's policy objectives," said the majority decision.

But Judge David Sentelle dissented, arguing that Congress is trying to reduce the time that regulators have to consider rail mergers, and that such a moratorium runs counter to that objective.

"It seems to me unreasonable to believe that Congress could have intended to expedite all completed applications by deadlines on handling of such filed applications only to leave the agency with the unbridled discretion to thwart the congressional mandate of expedition by the exercise of a power nowhere expressly granted - to refuse filing in the first instance," he wrote.

Arguments in the case were heard June 13, and a decision had been expected before Friday. Many observers had assumed the delay was a bad sign for the chances of have the STB decision overturned.

More rail mergers due

The rail analysts say they think mergers are only delayed by this decision, not abandoned.

"I do think we'll see additional consolidation in the industry," said Jim Higgins, analyst with Donaldson Lufkin and Jenrette Securities. He believes that within six months of the end of the moratorium, a final round of deals could be announced. But he said that railroads would be better able to handle both the combination and the regulatory environment that oversees such deals.

"If we give ourselves 12-plus months, the railroads will have better control over dialog of any regulatory changes," he said.

Shares of Canadian National gained 40 Canadian cents to C$44.85 in Toronto trading Friday, while in New York its shares rose 3/16 to 30-1/4. BNSF shares climbed 5/16 to 26-9/16. Among other rail stocks UP shares advanced 1-15/16 to 42-15/16, CSX rose 9/16 to 23-11/16, and Norfolk Southern edged up 1/16 to 16-3/8.

|

|

|

|

|

|

|