|

Compaq makes 2Q mark

|

|

July 25, 2000: 7:11 p.m. ET

PC maker meets estimates, restores profit in commercial business

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Compaq Computer Corp. turned in a second-quarter operating profit that matched Wall Street's forecasts Tuesday and said its commercial PC business had regained profitability sooner than expected.

And moving into the second half of the year, which typically is the strongest for personal computer makers, the company's top executive said the company will post "strong double-digit revenue growth" as it tries to take back some of the market share it has been losing to competitors such as Dell Computer.

The Houston-based company said its second-quarter net income was $387 million, or 22 cents per share. Excluding one-time investment gains of $25 million after tax, Compaq earned 21 cents per share, matching the consensus estimate of analysts polled by First Call.

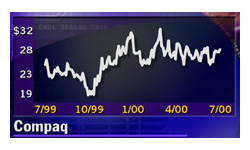

Compaq's (CPQ: Research, Estimates) revenue rose 7.4 percent to $10.1 billion from $9.4 billion during last year's second quarter.

The second quarter's financial results compare with a net loss of $184 million, or 10 cents per share, during the same period last year.

Michael Capellas, who took over as chief executive of the world's largest supplier of PCs last June, said the company showed particular strength in its server and commercial PC businesses.

"The big story of this quarter is the return to profitability of our commercial PC business," Capellas told analysts on a teleconference Tuesday evening. "That's been one of out top priorities, and we achieved it one quarter ahead of schedule." "The big story of this quarter is the return to profitability of our commercial PC business," Capellas told analysts on a teleconference Tuesday evening. "That's been one of out top priorities, and we achieved it one quarter ahead of schedule."

The company's Commercial Personal Computing Group posted revenue of $3.3 billion, up 3 percent from last year. Its operating profit was $62 million, which represents an improvement of $286 million over the loss it posted in last year's second quarter.

Meanwhile, Compaq's Enterprise Computing Group's revenue was $3.4 billion, up 9 percent year-over-year. That group's operating income was $467 million, an increase of $347 million from last year's second quarter.

Not all of Compaq's business lines turned in improved results in the most recent quarter. Profit in the company's Consumer and Global Services divisions declined.

Operating income from consumer PCs slipped $15 million to $31 million, while consumer PC sales rose 32 percent to $1.6 billion. Global Services revenue fell 4 percent to $1.7 billion while operating income declined $36 million to $228 million.

Even so, investors cheered the results.

Compaq shares closed up 11/16 at 27-7/16 in New York Stock Exchange trade ahead of the earnings announcement Tuesday. They added another 5/8 to 28-1/16 in after-hours activity on the Instinet trading system, with more than 700,000 shares changing hands.

A sharpened focus on market share

Jesse Greene, Compaq's chief financial officer, said the company is on track to meet the revenue and earnings forecasts Wall Street had made for it in the third quarter.

"We remain comfortable with Street's revenue and earnings estimates of $10.8 billion and 29 cents, respectively," Greene said.

The second and third quarters are typically stronger for PC makers as sales increase during the back-to-school and holiday seasons. The second and third quarters are typically stronger for PC makers as sales increase during the back-to-school and holiday seasons.

Acknowledging the lingering weakness in some of Compaq's business lines, Capellas gave an upbeat forecast for the remainder of the year, characterizing it as a turning point of sorts for the company.

"Clearly we have some work to do, but momentum is building for a strong second half," he said.

During his tenure as chief executive, Capellas has focused on restoring the struggling company to profitability. Compaq achieved that goal largely by reducing expenses. In the most recent quarter, operating expenses decreased five percentage points from the same period last year.

But while Compaq has focused its efforts on reducing expenses, it has been steadily losing market share to its cross-state rival, Dell Computer (DELL: Research, Estimates).

Dell, the world's second largest PC supplier and closing, last year edged out Compaq as the PC market-share leader in the United States. And the most recent figures from technology research firm International Data Corp. shows that Dell widened that gap during the second quarter.

Compaq's U.S. unit shipments slipped 5.6 percent, while Dell's rose 26.6 percent, IDC said.

Capellas vowed to take some of that back.

"For the past year, we focused on profitability rather than market share," he said. "But I guarantee you, we will aggressively pursue profitable growth in market share over the second half of the year."

|

|

|

|

|

|

|