|

WorldCom eyes disconnect

|

|

July 27, 2000: 1:18 p.m. ET

Long-distance sale or tracking stock mulled; hits 2Q target, drops guidance

|

NEW YORK (CNNfn) - WorldCom Inc. met second-quarter earnings forecasts Thursday, driven by strong revenue gains from data, Internet and international operations, and said it is looking at possibly splitting off its traditional long-distance business from those growth areas.

"We are exploring opportunities to separate portions of our switched voice operations into separate companies or tracking stocks," President and CEO Bernard J. Ebbers said in a statement.

"This would allow more efficient management of the voice business while enhancing WorldCom's effectiveness in targeting commercial customers," the statement said. "This would allow more efficient management of the voice business while enhancing WorldCom's effectiveness in targeting commercial customers," the statement said.

Ebbers said the company likely would hang on to long-distance voice business for business clients, because it is integrated into its other business offerings. But he said there likely will be some move away from the slow-growing consumer and wholesale long-distance service that once was the core of the company.

While the company did meet earnings estimates for the quarter, revenue from Internet business grew a little more slowly than expected, and the company edged earnings guidance for the rest of this year and for next year slightly lower in comments to analysts.

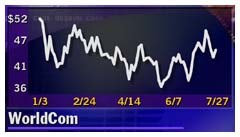

Those last two facts apparently helped send shares of WorldCom (WCOM: Research, Estimates) down sharply, as the stock lost 4-5/8, or 10 percent, to 40-1/8 in midday trading, although that was up from the low of the day of 38.

Softer-than-expected earnings ahead

Company officials nudged earnings guidance somewhat lower for the remainder of this year and for next year in their comments to analysts. They said they were comfortable with the current range of analyst estimates for 2000 of between $1.87 and $1.95 a share, although it is more comfortable in the lower end of that range, which would put it below the current First Call consensus of $1.90 a share for the year.

For 2001 earnings the company said it expects earnings would be in the $2.35-to-$2.45 a share range, which would be below the current First Call forecast of $2.46 for the year. But at the next moment Scott Sullivan, the company's chief financial officer, said he also is comfortable with the consensus forecast for next year.

Company officials stress all these forecasts change if or when the long-distance business is sold or spun off.

Ebbers said the consumer long-distance and wholesale businesses have been doing well in a difficult market. Revenue from consumer long-distance gained in the quarter that saw the sector decline overall due to price competition. Ebbers said he's confident the business will do well, even better, if it is sold, spun-off to shareholders or run as a stand-alone operation with its own tracking stock.

"As the consumer business exists in WorldCom today, is a tough business to keep growing on a going forward basis," he said. "But there are a lot of other opportunities the consumer side could get into that we have not allowed them to get into as part of WorldCom, such as running call centers. I'm very confident that would be a sustainable business over the long term."

Ebbers said the consumer and whole business generates about 30 cents a share annually to earnings. He said the units considerable cash flow had been used to fund the investment in the growth areas of the company, but that those areas now were producing the cash necessary to sustain their own growth.

The company did not give a time frame for a decision on such a move. Ebbers said if it is sold to an outside company, it could be completed rather quickly. He said creation of a tracking stock would take longer and it would be still if it was spun-off to shareholders as a separate company.

"I believe we are going to do something to address this issue soon. We're very serious about it," he said.

Second quarter meets estimates

The nation's second-largest long-distance carrier after AT&T Corp. (T: Research, Estimates) reported earnings excluding special items of $1.3 billion, or 46 cents a share, for the period, in line with the forecast of analysts surveyed by earnings tracker First Call. A year earlier, earnings were $865 million, or 30 cents a share.

WorldCom took a $55 million charge, or about 2 cents a share, for its attempted merger with Sprint Corp. (FON: Research, Estimates), which was terminated earlier this month due to objections from anti-trust regulators.

Revenue increased 14 percent to $10.2 billion from $8.9 billion a year earlier.

Revenue from the voice business the company is considering splitting off had only single-digit growth. Consumers and wholesale communication business edged up just 1 percent to $2.9 billion, while business phone service showed modest growth, rising 4 percent to $2.8 billion.

Internet revenue jumped 40 percent to $1.17 billion, but that was slightly below the forecast of $1.2 billion from that business. The company said that was primarily due to flat traffic from modem banks that Worldcom provides to dial-in customers of America Online (AOL: Research, Estimates). Ebbers said it's not clear if that is a season slump or a sign of more of the customers shifting to high-speed connections.

Missing that target and lowering earnings forecasts aren't serious problems in themselves, according to analysts, but WorldCom has had a history of beating forecasts rather than meeting or missing, so the market reaction was more severe.

"The important thing is that it's first time ever they disappointed on revenue side," said Greg Miller, analyst with ING Barings. "It's probably oversold. But even coming up marginally short, people are punishing it."

Miller said he wants to see a decision and details on a sale or spin-off before he comments on its effect on the stock. Steve Shook of Wachovia Securities thinks it will help the share price once the uncertainty is passed. He said he believes the second quarter results are very good considering the distractions involved in the failed Sprint deal.

"It could be people had expectations that they'd do better than expected," he said about the stock price fall Thursday. "To me, to hit expectations with all the extraneous factors going on last quarter is pretty impressive."

Revenue from data communication over dedicated networks rose 30 percent to $1.9 billion, and international revenue grew 31 percent to $1.4 billion.

Overall the units that WorldCom wants to keep - commercial service, Internet, data and international business saw growth of 20 percent in the quarter to $7.3 billion. Ebbers said the company reported that group together to make it easier for investors to see what to expect after the sale or spin-off.

"Investors should start looking at company as if it is already accomplished," he told analysts.

|

|

|

|

|

|

WorldCom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|