|

Nortel buys Alteon for $7.8B

|

|

July 28, 2000: 2:55 p.m. ET

Net traffic management company to help Nortel speed data delivery

|

NEW YORK (CNNfn) - Nortel Networks Corp. said Friday it will buy Alteon Web Systems Inc. for roughly $7.8 billion in stock, marking its first foray into the fast-growing Web hosting market.

Nortel, the world's second-largest supplier of telecommunications equipment, said it is buying Alteon for its high-speed Internet switching technology, which uses sophisticated traffic-control techniques to accelerate the delivery speed of Web content.

With Alteon in its fold, Nortel executives said, they will be able to build next-generation Internet data centers, which house the computer equipment such as servers, routers and storage systems that run the Internet.

That's a fast-growing market, and one into which Nortel has not made much headway, according to Chase H&Q analyst Michael Neiberg.

"The whole area of Web hosting is growing at a rapid rate, and its an area that Nortel traditionally had not served," Neiberg said in an interview on CNNfn Friday.

Clarence Chandran, Nortel's chief operating officer, said the deal is the first step in a broader long-term strategy under which the company aims to accelerate the delivery of Web content seamlessly across high-performance fiber-optic as well as wireless networks.

"It really defines a new sector, which we call our 'Wings of Light' strategy, where the optical Internet and the wireless Internet come together," Chandran told CNNfn. "It really defines a new sector, which we call our 'Wings of Light' strategy, where the optical Internet and the wireless Internet come together," Chandran told CNNfn.

Alteon's technology also ultimately will give Nortel the ability to develop Internet data center products that enable users on mobile devices to make wireless Internet transactions as they are in transit, making sure that the transaction is safely handed off as the device switches between cell sites, Chandran said. [212K WAV or 212K AIFF]

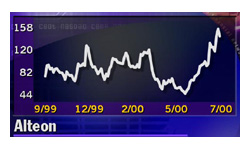

Under terms of the acquisition, Alteon shareholders will receive 1.83148 Nortel shares for each Alteon share. Based on Nortel's closing price Thursday of $78.625 per share, that equals $144 per share of Alteon stock, which closed Thursday at 143. The deal is slated to close in the fourth quarter.

Nortel said the impact on its operating earnings per share is expected to be neutral in 2000 and slightly accretive in 2001.

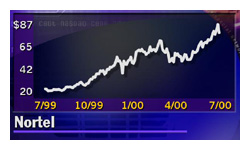

Stocks stumble in down day on Wall Street

Shares of both companies headed lower Friday. Nortel (NT: Research, Estimates) was off 5-9/16 at 72-15/16, a 7.1 percent decline. Alteon (ATON: Research, Estimates) fell 14, or 9.8 percent, to 129.

Chandran chalked up those losses to the negative tone that had overtaken the broader market Friday and not to negative sentiment about the deal.

Chase H&Q's Neiberg also pointed out that the market had turned down and all the communications technology sectors were getting hit. He added however, that Nortel shares might be getting hit a little harder in light of recent expectations. Chase H&Q's Neiberg also pointed out that the market had turned down and all the communications technology sectors were getting hit. He added however, that Nortel shares might be getting hit a little harder in light of recent expectations.

On Thursday, Corning Inc. (GLW: Research, Estimates) said it ended talks about buying Nortel's optical components business, a deal that reportedly could have been worth $100 billion.

"I think a lot of people were looking for Nortel to make a big deal in the optical space, where they've been making a lot of acquisitions," Neiberg said. "They went a little bit off the beaten track to go into the Web hosting space."

Neiberg currently has a "strong buy" rating on Nortel and a price target of 115.

Nortel has been on an acquisition tear recently, purchasing companies such as fiber-optic developers Xros, CoreTek and Qtera, and Internet software developers such as Shasta Networks, X-Cel Communications and Periphonics. Nortel has been on an acquisition tear recently, purchasing companies such as fiber-optic developers Xros, CoreTek and Qtera, and Internet software developers such as Shasta Networks, X-Cel Communications and Periphonics.

Friday's deal, which comes on the heels of rival Cisco Systems' (CSCO: Research, Estimates) acquisition of Arrowpoint Communications, another switch maker, in May for $5.7 billion in stock, is Nortel's first in that blossoming market.

Analysts at technology research firm International Data Corp. forecast the market for Internet switching technology to rise from $203 million in 1999 to more than $4 billion by 2004.

Alteon recorded sales of $51.5 million in its most recent quarter, ended June 30, a gain of 82 percent from the prior quarter. Dominic Orr, its chief executive, will head a new content network business unit under Nortel when the transaction is complete.

-- Reuters contributed to this report

|

|

|

|

|

|

|