|

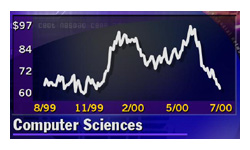

Computer Sciences falters

|

|

July 31, 2000: 6:46 p.m. ET

Computer services company says post-Y2K slowdown tempers growth

|

NEW YORK (CNNfn) - Computer Sciences Corp. Monday reported a fiscal first-quarter profit that missed analysts' expectations by a penny.

The company, which provides information technology services to commercial and government clients, said it earned $96 million, or 56 cents per share, during the period ended June 30. That's up 13.5 percent from the same period last year, but just shy of the 57 cents per share analysts polled by earnings tracker First Call had expected from the company.

Revenue for the quarter was $2.5 billion, up 11.8 percent from $2.2 billion a year ago. That was in line with the reduced revenue forecast the company put out in June, when it said revenue growth in the first quarter would be in the range of 11 percent to 13 percent versus expectations of 14 percent to 15 percent.

Even so, for the full fiscal year, Computer Sciences (CSC: Research, Estimates) is on track to achieve its revenue target of $11 billion, Leon Level, its chief financial officer, told analysts during a conference call Monday evening.

Van B. Honeycutt, CSC's chairman and chief executive, said the overall revenue growth was stronger during last year's first quarter because government agencies and corporations were scrambling to make sure their systems were prepared to handle the millennium changeover.

"The absence this year of the Year 2000-related revenue present during last year's first quarter, coupled with the pace of the rebound in enterprise-wide application demand, had a moderating influence on our first quarter revenue growth rate," Honeycutt said.

That resulted in more limited growth in consulting and systems integration services, as well as in the banking and insurance financial services markets, Honeycutt said.

But on the upside, the company posted strong growth in its large-scale outsourcing, Asia-Pacific and U.S. federal government businesses, Honeycutt said.

During the quarter, global commercial revenue grew 10 percent, to $1.8 billion compared with $1.6 billion a year ago. U.S. commercial revenue increased 12.3 percent to $980.8 million from last year's $873 million.

Other international revenue, due to strong gains in Australia and Asia, rose 26.5 percent to $262.5 million, compared with $207.5 million in last year's first quarter. European revenue rose less than 1 percent to $572.2 million, but was up more than 9 percent in constant currency terms, the company said.

Looking ahead, CSC executives said they see growing strength in the federal government market as well as the business-to-business e-commerce market. Looking ahead, CSC executives said they see growing strength in the federal government market as well as the business-to-business e-commerce market.

"We remain on track to achieve our target of about $1 billion in e-business related revenue for this fiscal year," Honeycutt said.

CSC shares edged up 1/8 to 62-1/2 in New York Stock Exchange trade ahead of the earnings announcement. Over the past year, the stock has reached a high of 99-7/8 and sunk to a low of 57-15/16.

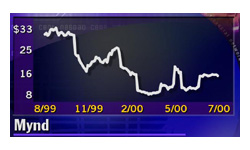

Mynd buyout offer extended

Separately, Honeycutt told analysts that the company had extended until Aug. 12 its buyout offer for insurance software company Mynd after receiving a request for additional information from federal regulators.

CSC in June agreed to acquire the Columbia, S.C.-based, company, formerly known as Policy Management Systems Corp. (PMS: Research, Estimates), for $16 per share, or roughly $568 million.

Honeycutt said the company has received a second request from the Securities and Exchange Commission for information under the Hart-Scott-Rodino antitrust improvement act.

As of July 28, roughly 9.4 million Mynd shares, representing about 27 percent of the total outstanding, had been validly tendered into the offer, according to Honeycutt. As of July 28, roughly 9.4 million Mynd shares, representing about 27 percent of the total outstanding, had been validly tendered into the offer, according to Honeycutt.

The original tender offer has been set to expire Aug. 2. Honeycutt said it is unclear now when the deal will get the nod from federal regulators.

"We are not in a position to estimate how long it might take to obtain ... approval," he said.

Shares of Mynd, which continue to trade under the Policy Management name, slid 1-1/4, or 8.3 percent, to 13-7/8 in heavy-volume New York Stock Exchange trade Monday.

- Reuters contributed to this report

|

|

|

|

|

|

|