|

'Can I have a loan, Mom?'

|

|

August 7, 2000: 8:39 a.m. ET

'No' may be the smart answer on many occasions, experts say

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Your adult kids may have lost that puppy-dog look fashionable among four-year-olds, but when they ask to borrow serious money, their pleas can still do a number on your heartstrings.

Like many parents, you might have a hard time saying "No," even if it means putting yourself in jeopardy.

But financial experts say "No" may be the best response for all concerned, especially when your retirement money and estate are at risk.

"You really need to think through the ramifications," said DeWitt, Iowa-based certified financial planner (CFP) Barry Vosler. They may include staggering penalties for retirement plan withdrawals, lost investment opportunity and resentment among other family members.

Giving the green light

Of course, a loan may not be a bad idea if you have enough in liquid cash that you won't miss some of it for awhile.

If, on top of that, your child is hard-working and fiscally responsible, experts say by all means offer assistance for a serious purpose, such as a new home or business.

"There can be a lot of joy derived from seeing (your kids) get what they want and helping them along the way," Vosler said.

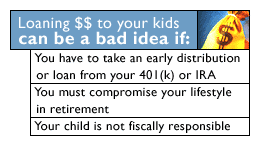

When loans are a bad idea

But there are many occasions when lending money can be a high-risk proposition.

Adult children who never save money and are forever out of pocket can be like a fiscal black hole. You may want to help out of guilt because you think you failed to teach them properly. But, Vosler said, at this point "they need an event in their life to teach them that discipline." Adult children who never save money and are forever out of pocket can be like a fiscal black hole. You may want to help out of guilt because you think you failed to teach them properly. But, Vosler said, at this point "they need an event in their life to teach them that discipline."

Neglecting your long-term needs to fund your kids is also a no-no. Whatever you do, experts say, don't jeopardize your retirement. That means adopting a hands-off approach to your 401(k) and IRA.

"You want your retirement money to be seen as a last resort. It's in there for a purpose," said CFP Mari Adam of Boca Raton, Fla.

Early retirees, take heed

Consider some of the consequences if you tamper with that purpose.

The average age of CFP Bud Kasper's clients is 53; many of them are retirees.

"And there lies the problem," said Kasper, who is based in Lee's Summit, Mo. He explained that many early retirees set up a distribution schedule from their IRAs under Internal Revenue Service Code Regulation 72(t).

Under that regulation, using a formula based on your and your beneficiary's life expectancies, you agree to take out substantial and equal amounts on a periodic basis for a five-year period or until you turn 59-1/2. Anything over that amount subjects the IRA holder to a withdrawal penalty of 10 percent not just on the excess withdrawn, but on the entire amount distributed up to that point, Kasper said.

Say you have taken a total of $200,000 in distributions in the first three years of a five-year period and you wish to take out an extra $50,000 on top of your normal distribution in order to help your son with a down payment. You'll pay a 10 percent penalty on the full $250,000 in addition to the income tax on the $50,000.

Add to that the loss of investment opportunity plus tax-deferred growth, and you internal red alert should sound.

Try a home equity loan

If you insist on touching your IRA to make a loan, Kasper suggests setting up multiple IRA accounts to reduce the penalty. If you have $400,000, for example, put $200,000 in one account; $150,000 in another; and $50,000 in a third.

You can set up Regulation 72(t) agreements on all three simultaneously. That way you can make the loan from the $50,000 IRA and you will pay the smallest possible penalty, he said.

If you're tempted to take a loan or withdrawal from your 401(k), check to see if your plan allows you to for the purpose of lending money to a child. If you may, then beware: you must pay back loans plus interest with after-tax money; and you pay a 10 percent penalty plus income tax on early withdrawals. If you're tempted to take a loan or withdrawal from your 401(k), check to see if your plan allows you to for the purpose of lending money to a child. If you may, then beware: you must pay back loans plus interest with after-tax money; and you pay a 10 percent penalty plus income tax on early withdrawals.

In any case, these routes are the least desirable, Kasper and Adam said. You'd be better off with a home equity loan, they said, since you get to deduct the interest, and you can set up a loan agreement such that your child pays you back the principal plus interest.

If you're pulling money from taxable investments such as stocks, avoid selling highly appreciated assets since you will pay more in capital gains, Vosler said.

Mind your emotions

Whatever you decide, know that in many ways "this isn't a dollar-and-cents decision. It's really an emotional decision," Vosler said.

That's in part why Adam suggests if you do want to make a loan, work with a third-party professional before giving your consent. "Always run this by a tax adviser or attorney," she said.

They can advise you of all potential problems concerning tax, cash-flow and penalties.

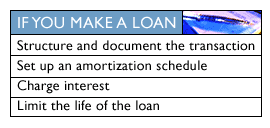

Keep it business-like

They also can help you draw up a written loan agreement, something experts say is key to insuring a successful transaction.

"Kids are kids," Adam said, noting that it's easy for many to think "Mom doesn't really expect me to pay her back."

That is less likely to happen if they sign an official document before a lawyer. "It gives it a sense of legitimacy so the children don't think this is something they can walk away from," Vosler said.

Structure the loan as tightly as a bank would, detailing an amortization schedule, an interest rate that insures a fair return and other conditions upon which the loan is based.

If you don't put it in writing

If you don't document the transaction you risk not getting paid back and have little recourse legally.

"You're counting on everything working out perfectly, and life isn't like that," Adam said. Most parents "don't like to play the heavy," she added, which is why a legal document and a lawyer can relieve you of that burden.

If you loan money to your child and his or her spouse, a written agreement insures that each party has an obligation to you in the event of premature death or divorce.

Or let's say your child simply doesn't honor obligations. You may grow very resentful if you see your son or daughter squandering your money and making little effort to pay you back.

Or, maybe you'd rather have an informal agreement with your child, who agrees to pay you back at a nominal interest rate. Since the Internal Revenue Service views with suspicion loans made at rates far below market value, it may recharacterize the loan as a gift, Adam said.

The consequences of that are manifold: you will not be owed anything; the loan will be subject to a gift tax if it exceeds $10,000; and the money will no longer be included as part of your estate and hence cannot be counted as part of your $675,000 exemption from estate tax.

"Why put yourself in a position when the burden of proof is on you and you're arguing with the IRS?" she said.

Limit the resentment

Feelings are as important as any financial consequences when you loan money to family, experts say.

The potential for long-term jealousy and bitterness is great if you don't treat your kids equally or if you are too discreet in your dealings with one child.

So if you're thinking of making a loan, consider the effects on your other kids and whether you might be in a position to help them if they needed it.

And if you do make a loan, be open about it with everyone in the family and even show them the loan agreement, Adam suggested. "If you don't, they'll find out and assume the worst."

|

|

|

|

|

|

|