|

BP pumps up 2Q profit

|

|

August 8, 2000: 8:41 a.m. ET

Oil and gas giant posts 164% rise in profits helped by merger, cost cuts

|

LONDON (CNNfn) - BP Amoco PLC reported a 164 percent jump in second-quarter earnings Tuesday, topping analysts' forecasts, as the world's second-largest oil and gas company benefited from its recent acquisition of Atlantic Richfield Co., cost cuts and rising oil and gasoline prices.

The Anglo-American company said second-quarter adjusted replacement cost profit, a key benchmark for an oil company, rose to $3.67 billion from $1.37 billion in the year-earlier quarter. Analysts polled by Reuters had expected BP Amoco to earn between $3.3 billion and $3.5 billion.

Pro forma earnings adjusted for special items rose to 99 cents per share during the quarter, from 42 cents a year ago and 84 cents in the first quarter. The cost of integrating Atlantic Richfield, better known as Arco, accounted for the bulk of the one-time charges. The deal closed in April.

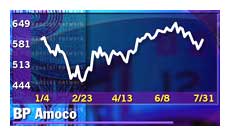

Shares in BP Amoco (BPA), the second-most valuable company in London's FTSE 100 index after Vodafone AirTouch, slipped 5 pence, or 0.8 percent, to 602-1/2 in Tuesday afternoon trading shortly after the results were published.

By market segment, operating earnings in its profit from exploration and production, the so-called "upstream" business, rose 143 percent to $3.63 billion.

At the "downstream" end - refining and marketing - earnings rose 150 percent to $1.48 billion, while operating profit in its smaller chemicals business rose 44 percent to $370 million. Those operating profit numbers exclude the cost of taxes, interest expenses and special items.

"On the face of it, the numbers look pretty good. The bottom line is that exploration and production results came in broadly in line, while chemicals and refining-and-manufacturing came in better than expected," Jon Rigby, an analyst with Paribas, told CNNfn.com. He has a "neutral" rating and a price target of 600 pence per share on BP stock.

But Rigby said he's reluctant to reach any conclusions about the company right away, saying its array of acquisitions and divestitures complicates the picture.

"There are so many moving parts, that they'd really have to blow the roof off to see the stock move," he said.

BP reports profits on an adjusted replacement cost basis to take into account the cost of replenishing its oil reserves based on the current market prices and to strip out one-time items.

Rigby said better clarity is likely come this autumn, but early signs showed that the company deserved to fall somewhere between market leader Exxon and Royal Dutch/Shell in terms of market valuation.

The report comes as rising oil prices have lifted many companies in the industry. Between April 1 and June 30, the price of Brent crude oil soared 25 percent to $30.57 per barrel.

Exxon Mobil Corp. (XOM: Research, Estimates), the world's largest oil company, last month reported its second-quarter profit more than doubled, while Royal Dutch/Shell Group (SHEL) reported a 95 percent jump in second-quarter earnings last week to $3.15 billion, powered by higher gas prices and improved refining margins.

BP Amoco also reiterated its quarterly dividend of 5 cents per share.

|

|

|

|

|

|

BP

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|