|

Banks keep Europe afloat

|

|

August 22, 2000: 1:28 p.m. ET

Rise for Fed-wary financials helps bourses withstand telecom selling

|

LONDON (CNNfn) - Europe's major markets closed mostly higher Tuesday as investors in Frankfurt and London bought financial service stocks in the expectation U.S. Federal Reserve policymakers will hold the line on interest rates later in the day. Leading telecom stocks fell sharply.

The FTSE 100 index in London, home to Europe's biggest stock market, ended up 42.6 points, or 0.65 percent, to 6,584.8 as strong financial issues offset declines for media and telecommunications stocks.

In Paris, the CAC 40 index closed down 57.92 points, or 0.9 percent, to 6,513.71. As other leading bourses closed, Frankfurt's Xetra Dax added 49.86 points, or 0.69 percent to 7,249.20, with tour operator Preussag (FPRS) climbing 3.9 percent.

In Europe's other leading markets, Italy's blue-chip MIB 30 index fell 0.5 percent, Amsterdam's AEX rose 0.4 percent and the SMI in Zurich climbed 0.3 percent.

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, rose 0.4 percent to 1,664.48. Its mining industry sub-index rose 3 percent while the telecom component fell 2.5 percent and the media component dropped 1.4 percent.

In the currency market, the euro fell to 89.73 U.S. cents from 90.13 cents late Monday in New York. Germany's Ifo institute said business confidence fell in July, suggesting that interest-rate pressures triggered by the pace of economic growth might not be a strong as first thought.

As the top bourses closed, Wall Street's top indexes were higher. The Nasdaq composite was up 0.6 percent and the Dow Jones industrial average rose 71.79 points, or 0.65 percent, to 11,151.60 as investors kept watch for results of the Federal Reserve meeting expected later in the day.

Rates seen on hold

"We expect no change in interest rates," Joe Rooney, an economist at Lehman Brothers, told CNNfn. "The market has been factoring in better interest rates for the last four months."

In the currency markets, the euro fell one-half cent to 89.63 U.S. cents, compared to late New York trading Monday. It came after Germany's Ifo institute said business confidence fell in July, suggesting that interest-rate pressures triggered by the pace of economic growth might not be a strong as first thought. The euro hit a record low against the dollar is 88.45. U.S. cents, reached in May.

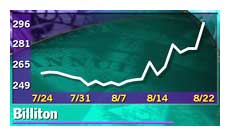

Companies involved in extracting natural resources were in vogue as investors flocked to more-stable bets. In London, mining company Billiton (BLT) jumped 6.1 percent and rival Anglo-American (AAL), which had risen roughly 20 percent in less than three weeks, rose 3.1 percent.

But steel company Corus Group (CS-) tumbled 5.8 percent, leading FTSE 100 losers. Among other old-line companies, utility National Power (NPR) fell 3.1 percent and Scottish Power (SPW) fell 2.7 percent.

Europe's top telecom stocks continued to come under pressure, erasing early gains as investors thought twice about the high cost of acquiring third-generation mobile licenses and building their high-tech networks. Vodafone AirTouch (VOD), Europe's leading mobile-phone company, shed 1.1 percent and British Telecommunications (BT-A) sank 3.7 percent. Europe's top telecom stocks continued to come under pressure, erasing early gains as investors thought twice about the high cost of acquiring third-generation mobile licenses and building their high-tech networks. Vodafone AirTouch (VOD), Europe's leading mobile-phone company, shed 1.1 percent and British Telecommunications (BT-A) sank 3.7 percent.

In Paris, shares of France Telecom (PFTE) fell 3.2 percent, and German rival Deutsche Telekom (FDTE) dropped 3.6 percent in Frankfurt. Elsewhere in the telecom sector, Finnish mobile-phone service provider Sonera fell 8.1 percent, Switzerland's Swisscom shed 3.9 percent, Spain's Telefónica fell 4.7 percent, Netherlands-based KPN declined 3.4 percent and Telecom Italia Mobile, or TIM, dropped 4 percent.

Media stocks in London also came under pressure, with broadcaster BSkyB (BSY) falling 4.3 percent, publisher Pearson (PSON) down 3.4 percent, and financial news and data provider Reuters (RTR) dropping 2.2 percent.

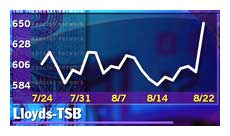

Banks lead the way

Financial-services companies, which are among the most sensitive to interest-rate movements, headed higher on hopes the Federal Reserve would decide not to hike U.S. rates. In London, Lloyds-TSB (LLOY) jumped 5.6 percent, Bank of Scotland (BOS) tacked on 3.5 percent and Abbey National (ANL) gained 3.6 percent.

In Paris, insurer Axa (PCS) rose 0.5 percent and Société Générale (PGLE) added 1.2 percent, while Frankfurt-listed HypoVereinsbank (FHVM) rose 2.2 percent and German insurer Allianz (FALZ) rose 2.7 percent.

Topping the leader board in Paris was missiles and media company Lagardere (PMMB) added 4.5 percent and computer consulting firm Cap Gemini (PCAP) rose 4.2 percent. Leading decliners was catering company Sodexho Alliance (PSW), down 3.3 percent.

An early rally for automotive stocks in Frankfurt ran out of gas. BMW (FBMW) ended up 1.4 percent and rival Volkswagen (FVOW) climbed 1.3 percent and DaimlerChrysler (FDCX) rallied 1.8 percent.

Shares of utility E.On (FEON) fell 0.6 percent in Frankfurt after the company announced plans to shut down several power plants because of overcapacity.

In Switzerland, Europe's third-biggest bank UBS fell 1.3 percent after saying its assets under management declined 3 percent to 1.71 trillion Swiss francs ($1 trillion) in the second quarter as clients shifted funds to other money managers.

Swiss aviation conglomerate SAirGroup slipped 2.7 percent after first-half net profit plunged to 3 million Swiss francs from 87 million a year earlier. The company predicted it would stay in profit for the whole of 2000.

In the European pharmaceutical sector, Germany's BASF (FBAS) added 1.5 percent and France's Sanofi Synthélabo (PSAN) climbed 4.3 percent. Switzerland's Roche added 1.3 percent.

-- from staff and wire reports

|

|

|

|

|

|

|