|

Re-lacing Reebok

|

|

August 28, 2000: 6:04 a.m. ET

Footwear maker is reinventing itself with sleek styles and a futuristic HQ

By Staff Writer John Chartier

|

NEW YORK (CNNfn) - After a decade of losing market share to its rivals, Reebok International is emerging as a "survivor" in the rebounding footwear market.

For the second time in more than a decade, Paul Fireman, the No. 3 (in terms of sales) U.S. footwear maker's irrepressible chairman and chief executive officer, laced up his game shoes and took on the additional role of president in January following the departure of Carl Yankowski the month before after just 14 months on the job.

Fireman, 56, is driving a rebirth of the brand, which had virtually the same market share as No. 1 U.S. footwear maker Nike during the fitness and aerobics craze of the 1980s. (By the way, a reebok is an African gazelle known for its speed and gracefulness.) Fireman, 56, is driving a rebirth of the brand, which had virtually the same market share as No. 1 U.S. footwear maker Nike during the fitness and aerobics craze of the 1980s. (By the way, a reebok is an African gazelle known for its speed and gracefulness.)

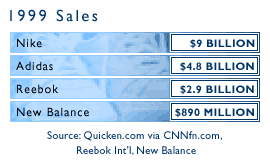

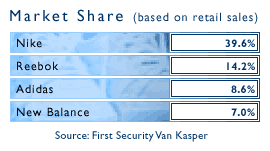

And he's doing it in a tightening market with few big players on the court. Combined, Nike (NKE: Research, Estimates), Reebok (RBK: Research, Estimates), Adidas-Salomon AG, and New Balance own more than 50 percent of the market share. The rest belongs to a host of smaller manufacturers, Amy Hylan, a spokeswoman for the Port Washington, N.Y.-based market research firm, NPD Group Inc said.

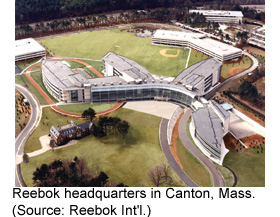

With a line of sleek, fashionable and high-tech sports shoes set to launch next month, and a sprawling new corporate headquarters, the Canton, Mass.-based footwear manufacturer is redefining itself as an exciting company out to dazzle consumers. Considering the company's successful second quarter and an endorsement deal with Richard Hatch, the million-dollar winner of the "Survivor" game show, their bid for the top is more than just a head fake.

"I think that collectively the stock is moving in the right direction. That's the most confidence building you can have," Fireman said in an interview with CNNfn.com at the company's sleek new 522,000 square-foot headquarters in the Boston suburb of Canton. "And we're making progress we're succeeding in bite size pieces and hopefully collectively we'll move to more synergistic growth and you know we've got a good plan we have a focus and we're happy about it."

The headquarters is a big part of the new face. Located on 44,000 acres, the complex is actually a series of four buildings connected by a "spine." Windows are everywhere allowing in waves of sunlight and views from every angle of on-site athletic fields.

Stock on the rebound

The efforts on all fronts seem to be paying off. Reebok's shares are trading near their 52-week high of 20-15/16, a far cry from just six months ago when the stock was trading at just 6-15/16. The shares are working their way back toward the 50 it traded at three years ago.

On Friday, the stock closed down 1/8 to 20-5/16.

Fireman, with his wife, owns about a 20 percent stake in the company.

In the second-quarter ended June 30, Reebok, which also owns the Rockport shoe brand, the Greg Norman Collection and the Ralph Lauren footwear division, posted net income of $10.7 million, or 19 cents a share, compared with net income of $4.6 million, or 8 cents a share in the year-earlier quarter. The company handily beat the expectations of Wall Street analysts who forecast net income of 10 cents a share, according to earnings tracker First Call/Thomson Financial.

The results came despite a slight decline in sales to $685.1 million from $697.4 million in the year-ago quarter. But that can be attributed to the weakening euro overseas and a change in the company's overseas distribution networks, Ken Watchmaker, Reebok's chief financial officer, said. The results came despite a slight decline in sales to $685.1 million from $697.4 million in the year-ago quarter. But that can be attributed to the weakening euro overseas and a change in the company's overseas distribution networks, Ken Watchmaker, Reebok's chief financial officer, said.

The company also reported improved gross margins and a healthy backlog of orders, reflecting a growing consumer demand. That's the second quarter in a row in which Reebok has seen order backlogs in a long time, Watchmaker said.

Fashionable sneakers

Analysts are encouraged by Reebok's promise of a sorely needed fashion statement to shakeup what had been lackluster sales throughout the athletic footwear industry.

"I don't think there's any question they are going to pick up some market share position in the back half of the year and the spring of 2001," said John Shanley, an analyst with First Security Van Kasper. "The reason for that is a significant improvement in terms of the styling content of their product line. We're seeing a renewed consumer interest in athletic footwear overall, and they're filling a fairly large void in the marketplace right now."

Analysts project third-quarter earnings of 51 cents a share, bringing Reebok's full-year 2000 earnings to $1.33 a share, according to First Call. Analysts also forecast earnings of $1.53 a share for fiscal 2001.

Retailers, which had been cutting back on the amount of Reebok stock on their shelves, are now looking more favorably at the company. Many have even gone out of their way to compliment Reebok during earnings conferences with analysts, another positive sign, Shanley said. Retailers, which had been cutting back on the amount of Reebok stock on their shelves, are now looking more favorably at the company. Many have even gone out of their way to compliment Reebok during earnings conferences with analysts, another positive sign, Shanley said.

"Retailers were a little nervous, quite frankly, in putting a bigger stake of their commitments into Reebok," said Shanley, who has a "strong buy" rating on the stock. "I still think they've got some room to improve in Rockport, but they seem to really be going out of their way to reassure retail customers that their resurrection is real."

Fireman is credited by many within the company for aiding that resurrection.

"I think we've made some strategic decisions to align with a partnership relationship with our key retailers throughout the world. We've been successful almost 100 percent getting them aligned, giving them creative ideas," Fireman said. "In some cases we're giving them exclusive properties of ours to use. They're effectively enjoying it, we're enjoying it and it's helping bring both the relationship and the retail presence much stronger for Reebok than it has been, and I think that's the beginning steps."

Fireman declined to say whether he was comfortable with analysts' predictions. But he did say the company was back in bounds and going full court with its new women's line as a centerpiece, and a "smart shoe" that comes equipped with a chip that measures speed and height jumped (a kids' version has been out for about a year now).

Other newly designed, highly stylized lines and a collection reflecting aspects of founder J.W. Foster's designs, Fireman said, is rekindling retailer interest and is sure to fulfill the company's new mission to discover, design and delight the consumer.

Cutting edge the key

"Fundamentally it's to bring back the creativity, the cutting edge forwardness of Reebok, what it always stood for. To do that we have to do it in step-by- step procedure," Fireman said. "The first thing was to get everybody aligned and focused just on one strategic plan. Our mission is to discover, to design and to delight our consumer. And we're doing that every day now. We're getting closer to doing it better and better. We're maybe I would say 50-or-60 percent of the way there, but the consumer's only seeing 10 or 20 percent of it because it's yet to really reach market."

Shanley believes it's important for Reebok, which has traditionally held a strong position in women's athletic shoes to maintain that lead, particularly in light of rival Nike (NKE: Research, Estimates)'s announcement last week that it would create a separate women's unit. Shanley believes it's important for Reebok, which has traditionally held a strong position in women's athletic shoes to maintain that lead, particularly in light of rival Nike (NKE: Research, Estimates)'s announcement last week that it would create a separate women's unit.

"They (Reebok) got a wake-up call in terms of Nike's announcement in terms of recognizing the need to improve the fashion content of their apparel business," Shanley said.

The company has revealed little about specific shoe designs, preferring to wait until September, when it will officially launch its new line at corporate headquarters before the industry and the media.

Slowing economy a challenge

One of the challenges facing Fireman, Reebok and other footwear manufacturers is a softening retail environment driven by higher interest rates, consumer debt and rising oil prices. Although analysts look favorably on the retail sector going forward, many have said growth will continue, but not at the torrid pace of the last two or three years.

Apparel retailers in particular have been having a tough time, with many issuing earnings warnings for their second quarters and remainder of 2000. A fashion malaise, specifically in women's apparel combined with designers struggling to keep up with swift changes in an increasingly casual work place, has taken a bite out of sales.

Nevertheless, footwear and casual footwear makers and retailers have actually begun to see a little more traction in the last two years.

Athletic footwear sales in the U.S. between February and June 2000 increased 4 percent from the comparable year-ago period, the NPD Group's Hylan said. Year-to-date sales stand at about $5.8 billion. If the pace continues, sales will remain relatively flat at about $13.9 billion for the full year.

But that's an improvement from prior years in which footwear sales actually lagged. People, particularly teenagers, have more to spend on footwear, and are more willing to buy a new pair of sneakers these days because of the innovative styles that are beginning to appear. But that's an improvement from prior years in which footwear sales actually lagged. People, particularly teenagers, have more to spend on footwear, and are more willing to buy a new pair of sneakers these days because of the innovative styles that are beginning to appear.

"The retail environment in general has been soft, but for this industry, it's actually better than it was a year ago," Watchmaker said. "And those retailers that are primarily athletic specialty are doing much better this year."

The 'Survivor' factor

In the hours before the popular game show's finale last week, many plied Reebok executives for the name of the winner. After all, the company had signed a one-year endorsement contract with the winner six months before.

But officials insist they found out the name of the winner when everyone else did. The company is still working on a specific marketing plan to use with Hatch, the corporate trainer from Rhode Island who attracted attention by walking around the island naked on his birthday.

Although the financial gain from the agreement will undoubtedly help boost sales, it's the top-of-mind association with the show Fireman believes will continually benefit the company.

"Obviously it was a fabulous marketing coup," Fireman said. "Our people in marketing brought the program to us six months ago. We took a chance, they took a chance, we supported them, and that's what it was -- was a chance," Fireman said. "It's worked out fabulously. And I think the credit goes to the whole team. They didn't stop at just getting the program. They actually took a full chance and created ads that were related to the program itself, which was a unique experience on television. And it's paying off vastly."

Reebok has also signed up a number of athletes participating in the 2000 Summer Olympics beginning next month in Sydney, Australia.

"We feel these guys have really got an opportunity," Shanley said.

|

|

|

|

|

|

|