|

Telekom bids for Powertel

|

|

August 28, 2000: 4:49 p.m. ET

Deutsche Telekom offers $6B; move would complement VoiceStream buyout

|

NEW YORK (CNNfn) - Ignoring looming regulatory concerns, Germany's Deutsche Telekom AG moved to buy its second U.S. wireless carrier in a month late Sunday, striking a $6 billion all-stock buyout of Powertel Inc., a fast-growing mobile operator based in the Southeast.

The agreement, which is contingent on Deutsche Telekom closing its $42.1 billion acquisition of VoiceStream Wireless Corp. announced last month, aims to fill a gap in the German company's growing U.S. holdings, which now will include cellular coverage in 24 of the top 25 U.S. markets.

Deutsche Telekom's buyout binge has drawn the fire of U.S. politicians, who are wary of the large stake the German government holds in the company, and the Powertel acquisition is likely to run into the same issue. VoiceStream itself agreed Sunday to take control of Powertel at a much lower price, but only if Deutsche Telekom's U.S. acquisition push falls through.

"The deal is fairly simple in concept, but the execution is a little complicated," VoiceStream President and CEO John Stanton told CNNfn. "The structure of the deal is either an either/or. We believe that the Deutsche Telekom deal will be closed and as a consequence, they both will be closed simultaneously."

Like VoiceStream and Telekom's domestic mobile phone unit T-Mobil, Powertel relies on the GSM standard, the most popular digital cellular standard in the world. The four-year-old West Point, Ga.-based company has roughly 727,000 customers in 12 Southeastern states stretching from Kentucky to Florida, areas where VoiceStream currently offers no wireless service.

"Powertel is complementary to the VoiceStream footprint, and it looks as though [Deutsche Telekom] paid less for the Powertel subscribers than for VoiceStream subscribers," said Francois Travaille, telecom analyst at BNP Paribas in Paris, who has a "neutral" rating and a 35-euro per-share price target on Deutsche Telekom.

Combined, the three companies will have roughly 20.5 million customers worldwide, including roughly 2.5 million in the United States.

VoiceStream has the broadest reach of any GSM provider in the United States, reaching 2.3 million customers throughout the nation. Combined with Powertel, the two companies will give Deutsch Telekom access to roughly 90 percent of the country's licensed cellular users, Stanton said. (328K WAV) (328K AIF)

Based on the total value of the deal, the German telecommunications firm is paying about $9,700 per Powertel customer, far less than the $17,500 per subscriber in the VoiceStream deal, according to Deutsche Telekom spokesman Hans Ehnert.

Terms of the agreement call for Deutsche Telekom to swap 2.6353 shares of its stock for each Powertel share. The company also will assume roughly $1.2 billion of Powertel debt.

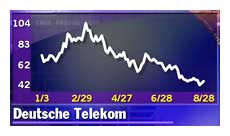

Shares of Deutsche Telekom (FDTE) rose 0.69 of a euro, or 1.5 percent, to 45.28 euros in Frankfurt trading Monday. Deutsche Telekom, which said in July its first-half profit would be down about 26 percent from the previous year, is expected to provide further details of its first-half earnings Tuesday. The company blamed competition and the cost of building out its networks.

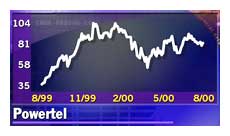

Based on Deutsche Telekom's closing price in Frankfurt Monday, the buyout values each Powertel (PTEL: Research, Estimates) share at 107.39, a 24-percent premium over its closing price Friday of 86.62. Powertel shares tumbled 5.56, or more than 6 percent, to 81.06 on the Nasdaq Monday.

Same political issue as VoiceStream?

The Deutsche Telekom buyout of VoiceStream first valued the U.S. company at about $174 a share  , but based on current stock prices the agreement values VoiceStream at $158.99 a piece. , but based on current stock prices the agreement values VoiceStream at $158.99 a piece.

Shareholders, fearing opposition by U.S. politicians and regulators, have kept the VoiceStream shares far below that level. VoiceStream (VSTR: Research, Estimates) shares lost 1.13 to close at 117.06 Monday.

Sen. Ernest Hollings, D-S.C., has introduced legislation now pending in Congress that would prohibit the Federal Communications Commission from permitting the transfer of American wireless licenses to Deutsche Telekom or any other German firm for at least a year.

Hollings, the ranking Democrat on the Senate Commerce Committee, has cited national security concerns for his proposal, noting that Deutsche Telekom is 57 percent owned by the German government.

The legislation would require that Germany cut its holding to 25 percent before a deal could be approved. As it now stands, the government would own roughly 45 percent of the enlarged company once the deal is completed.

Hearings scheduled

The U.S. House of Representatives has scheduled hearings on the companion legislation to Hollings' bill for Sept. 7. Hollings is expected to testify at that hearing.

Analysts said the Powertel transaction likely would receive the same scrutiny, a factor likely to make shareholders wary for some time. The fate of the Deutsche Telekom/VoiceStream deal is not expected to be decided for at least another eight months.

"That's the tricky thing," said Harvey Liu, an analyst with CIBC World Markets. "The premium is obviously much higher with the Deutsche Telekom deal, but the risk is greater."

Still, Stanton said he remained confident both mergers would gain approval.

"I don't think it really has any effect on the discussions that are going on in Congress," he said. "The substance of this transaction is that it makes us a more competitive company."

The key, analysts said, will be for VoiceStream to show how it is at a competitive disadvantage if the Deutsche Telekom isn't approved.

"If you look at wireless right now, we have six major players," said Cynthia Motz, an analyst with Credit Suisse First Boston. "The problem is that VoiceStream doesn't have deep pockets or a sponsor like Deutsche Telekom. They really are going to be in a very difficult position against companies like Verizon (VZ: Research, Estimates) and SBC [Communications]/Bell South."

VoiceStream waiting in the wings

In a separate agreement, VoiceStream, the No. 8 U.S. mobile phone company, agreed to buy Powertel for about $4.7 billion, but the acquisition will become effective only if the Deutsche Telekom/VoiceStream deal falls apart.

That agreement calls for Powertel shareholders to receive VoiceStream common shares at a predetermined conversion ratio. If VoiceStream's shares close at $130.77 or above during the 20-day period ending five trading days prior to the closing of the deal, Powertel shareholders will receive 0.65 of a VoiceStream share. But if the Bellevue, Wash.-based company's shares close at $113.33 or below, they will receive 0.75 of a share.

Based on closing prices Friday, the VoiceStream deal values each Powertel share at $85, a slight discount to its closing price Friday.

Goldman Sachs & Co. advised VoiceStream during the negotiations, while Powertel was advised by Morgan Stanley Dean Witter. Donaldson Lufkin & Jenrette represented Deutsche Telekom.

|

|

|

|

|

|

|