|

Lucent dull: Altabef

|

|

August 29, 2000: 4:39 p.m. ET

Matrix Asset Advisors director also tells investors to avoid the metals sector

|

NEW YORK (CNNfn) - Douglas Altabef, managing director of Matrix Asset Advisors, said on Tuesday he thinks Lucent won't increase appreciably in the next year, Applied Materials and Novellus are the best buys in the semiconductor sector, Office Depot could have another  earnings disappointment around the corner, and investors should avoid the metals sector. earnings disappointment around the corner, and investors should avoid the metals sector.

Every day at 1 p.m. ET, CNNfn viewers are invited to call in to the "Talking Stocks" segment and ask equity-related questions of the guest expert. The toll-free number is: 800-304-FNET.

Click here to send your stock questions to the next guest.

Name: Norm, New York

Question: Lucent (LU: Research, Estimates). Do you think Lucent represents an opportunity for appreciation over the coming 12 months?

Answer: The whole telecom area is vulnerable because of strong run-ups over the past few years. Although Lucent has lagged most recently, they too have seen huge appreciation. I don't think the next 12 months will bring a major increase in Lucent's stock price.

Name: Tom, California

Question: What would be your best pick from the semiconductor sector?

Answer: I would focus on the semiconductor equipment companies such as Applied Materials (AMAT: Research, Estimates) and Novellus (NVLS: Research, Estimates).

Name: Jo, Missouri

Question: Office Depot (ODP: Research, Estimates). What's your take on Office Depot, and where do you expect it to be by year-end?

Answer: I like Office Depot for the next 12-to-24 months, but I believe there could be another earnings disappointment in the near term. The stock is likely to be in the $7-to-$9 range by year-end.

Name: John (location unknown)

Question Alcan (AL: Research, Estimates), Inco (N: Research, Estimates). What is your opinion on cyclical metal stocks at this time, and Alcan and Inco in particular?

Answer: Any activity in the metal sector should be trading rather than investing. I would focus on other sectors because I believe you have to be very right on the timing with cyclical metals in order to do well.

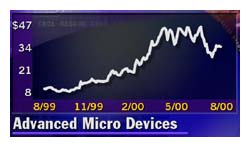

Name: James (location unknown)

Question: Advanced Micro Devices (AMD: Research, Estimates). I was wondering what you thought of Advanced Micro Devices (AMD). It has  dropped from the $90s after they announced a split and beat earnings. After the split it traded around $34.50. Do you think this is a good time to buy? dropped from the $90s after they announced a split and beat earnings. After the split it traded around $34.50. Do you think this is a good time to buy?

Answer: I don't think it's a bad time to buy, but I don't think it's a screaming buy either. I would take a smaller position in AMD and also focus on the semiconductor equipment stocks such as Novellus and Applied Materials or Kemet (KEM: Research, Estimates) and Vishay (VSH: Research, Estimates).

CNNfn welcomes your e-mail questions for our "Talking Stocks" guest. Please include your first name, state and one stock question per e-mail. Please keep in mind: "Talking Stocks" is for specific stock questions only.

If you do not see an answer to your e-mail here, it is because our guest does not cover the company.

-- compiled by Staff Writer Mark Gongloff

* Disclaimer

|

|

|

|

|

|

|