|

CS First Boston to bid for DLJ

|

|

August 29, 2000: 9:14 p.m. ET

Investment bank to pay $11.6B, or $90 a share, in cash-stock deal for DLJ

By Luisa Beltran and Tom Johnson

|

NEW YORK (CNNfn) - Credit Suisse First Boston will bid $11.6 billion, or $90 a share, for U.S. investment bank Donaldson, Lufkin & Jenrette, a source close to the deal told CNNfn.com Tuesday.

Credit Suisse, a Zurich-based global investment bank, will announce the cash and stock deal on Wednesday, the source said. AXA Financial, a subsidiary of France's AXA (AXA: Research, Estimates), the world's No. 1 insurance company, which owns 71 percent of DLJ, would receive Credit Suisse stock for its stake while U.S. investors would receive cash. The title of the combined firm will remain Credit Suisse First Boston, the source said.

Such a deal would prolong the industry's recent consolidation wave, which included Swiss bank UBS (UBS: Research, Estimates) purchasing securities firm PaineWebber (PWJ: Research, Estimates) last month. Bear Stearns chief executive has also reportedly told analysts that his company would entertain an acquisition proposal, but only at an extremely high multiple.

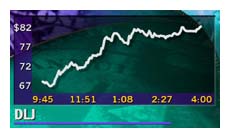

The proposed deal represents a modest premium - just under 10 percent - to DLJ's current stock price, which rose $16.06, or nearly 25 percent, to close Tuesday at $81.88.

Rumors of the deal were first reported by Dow Jones news service on Tuesday while the Financial Times reported terms in a report on CNN's Moneyline Tuesday night. Rumors of the deal were first reported by Dow Jones news service on Tuesday while the Financial Times reported terms in a report on CNN's Moneyline Tuesday night.

Joe Roby, DLJ's chief executive, would become chairman of the combined companies while CSFB's current chief executive, Allen Wheat, would remain as CEO, the source said.

DLJ was not available for comment while CSFB declined to comment. AXA Financial also could not be reached for comment.

Rumors of the deal caused shares of both DLJ and its online brokerage, DLJdirect Inc., to climb Tuesday. DLJ (DLJ: Research, Estimates) set a new 52-week high with volume on the stock, which typically averages less than 464,000 shares traded per day, eclipsing 6.1 million shares. DLJDirect (DIR: Research, Estimates) followed suit, climbing $2.25 to $10.19. AXA's American depository receipts (ADRs) climbed $1.56 to $79 per share.

At one point, the New York Stock Exchange asked DLJ (DLJ: Research, Estimates) and DLJ Direct, the company's online brokerage subsidiary, to comment on its unusual trading activity, but the companies said they did not comment on stock activity as a matter of policy.

Entering trading Tuesday, the New York-based brokerage had a market capitalization of about $9.6 billion, but finished the day with at nearly $12 billion. The most recent brokerage merger, UBS' $12 billion bid for PaineWebber, brought the acquired company a 47 percent premium on its stock price.

Analysts mixed on possible deal

Analysts said such a deal would make sense for Credit Suisse, one of the world's largest investment banks, particularly as top industry players scramble to stay ahead of the sector's consolidation wave. One analyst, Steve Eisman, of CIBC World Markets, questioned the deal in an interview with CNN's Moneyline. [13KB WAV][13KB AIFF] Analysts said such a deal would make sense for Credit Suisse, one of the world's largest investment banks, particularly as top industry players scramble to stay ahead of the sector's consolidation wave. One analyst, Steve Eisman, of CIBC World Markets, questioned the deal in an interview with CNN's Moneyline. [13KB WAV][13KB AIFF]

DLJ's strengths lie in the United States, where it provides a full-range of brokerage services including offering online investment options through DLJ Direct (DIR: Research, Estimates). But the company has gradually been expanding its European footprint as well.

DLJ generated nearly $7.1 billion in revenue last year, roughly half of which was generated by its investment banking and financial services divisions.

"This is just a continued consolidation in the industry on a global basis," said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum. "You're seeing Credit Suisse take a bigger stake in the research end of things -- it's good for Credit Suisse because it gives them better asset management and greater size."

But others weren't convinced AXA would want to sell the brokerage.

"(AXA) is accustomed to the high returns and nice earnings streams that come out of DLJ," said Al Capra, an analyst with Putnam Lovell Securities. "AXA would have to get a great deal, an off-the-charts price. It would have to be a large global financial services entity with deep pockets."

One possible attraction to such a deal for investors would be the cost savings that Credit Suisse could wring from the transaction, analysts said. The two companies have several overlapping operations, meaning large layoffs are likely if a merger agreement is struck.

"We are all just sitting here waiting to hear something," one DLJ official said. "It's a scary thought. Basically everyone has a counterpart over there."

Analysts said mid-sized brokerage houses have come under increasing pressure to build market share and profits in recent years to keep pace with industry leaders and fend off a host of online brokerages.

Merger speculation drove the stocks of several DLJ rivals up Tuesday as well. A.G. Edwards (AGE: Research, Estimates) shares rose $2.75 to $54.44, Bear Stearns (BSC: Research, Estimates) climbed $3.31 to $63.12 and Lehman Brothers (LEH: Research, Estimates) jumped $3.56 to $140.62.

|

|

|

|

|

|

|