|

Tax veto stings small biz

|

|

September 1, 2000: 1:03 p.m. ET

Small-business owners not yet freed of estate tax planning costs

|

NEW YORK (CNNfn) - Small business owners will not be free of the burden of estate tax planning this year. They had hoped, after a bill eliminating the tax was passed by Congress earlier this year, they might finally be able to give up time-consuming and costly estate-planning measures designed to ease the pain of paying the hefty tax.

President Clinton has called the measure, which would cost $100 billion over 10 years, fiscally irresponsible because it would consume too much of the budget surplus, and has promised to veto it since it passed Congress in July.

"I believe that this latest bill, this estate tax bill, is part of a series of actions and commitments that when you add it all up would take us back to the bad old days of deficits, high interest rates and having no money to invest in our common future," said Clinton today at the White House.

House override vote next week

Small-business groups have vowed not to give up the fight against what they call the "death tax." The coalition of business groups that has led the lobbying effort to repeal the tax, called the Family Business Estate Tax Coalition, massed its troops shortly after Clinton's announcement, to plot a strategy for the week ahead.

The House of Representatives has scheduled an override vote on Sept. 7. Before then, the Family Business coalition is planning a massive lobbying and grass-roots effort to keep the votes of the 65 Democrats who broke ranks to vote in favor of eliminating the tax back in June. The House of Representatives has scheduled an override vote on Sept. 7. Before then, the Family Business coalition is planning a massive lobbying and grass-roots effort to keep the votes of the 65 Democrats who broke ranks to vote in favor of eliminating the tax back in June.

They are going to be courted by small-business lobbyists; they will receive letters and phone calls from small-business owners in their district and there may be an editorial or two in their hometown papers.

At this point, however, the fate of the estate tax is sealed. Senate Democrats did not vote elimination in enough numbers to override a veto by President Clinton. Now, it's a political issue.

The coalition hopes, with a strong vote in the House of Representatives, to demonstrate the president is out of step with nearly all the Republicans in Congress and many Democrats and, by extension, with much of the American public.

Political posturing lost on small-biz owners

The politics of the estate tax issue simply baffle people like Vern Albert, a Colorado rancher who wants it eliminated so that his family can hang onto its land. Land values in eastern Colorado, resulting from recent rampant resort development, have increased dramatically in the last decade.

His own ranch has grown incrementally from the time his grandfather homesteaded a 640-acre plot more than a century ago. The land is probably  worth about $1,000 an acre, he said, based on recent land sales in the area. At that rate, his descendents will not escape the estate tax, which is levied at a rate of between 38 percent and 55 percent on estates valued at more than $675,000. worth about $1,000 an acre, he said, based on recent land sales in the area. At that rate, his descendents will not escape the estate tax, which is levied at a rate of between 38 percent and 55 percent on estates valued at more than $675,000.

They won't be able to pay it. Though the land he ranches is worth a lot of money, Albert said he earns only about a one percent return on investment in most years. To supplement his income and help pay off a loan he took out a few years ago to buy cattle, he now lets hunters of elk and deer roam his property for a fee.

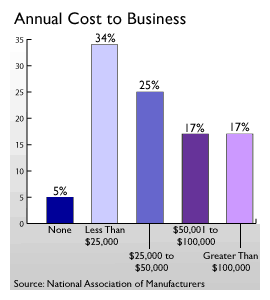

To Albert and other small farmers and business owners, the estate tax issue is not political; it's a matter of money. Recent member surveys conducted by the National Federation of Independent Business and the National Association of Manufacturers reveal their members pay anywhere from $2,000 a year to upward of $100,000 a year in preparation for the inevitable estate tax.

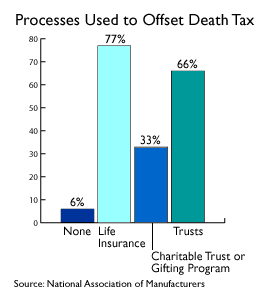

The majority of small-business owners prepare by buying life insurance on the principal in the company. The rest cushion the blow of estate tax bills through a combination of charitable trusts and gifting programs.

At his press conference on Tuesday, however, President Clinton said the Republicans who have supported the estate tax bill have mischaracterized who will benefit from its elimination. The people who will get the biggest tax break, he said, are the 3,000 wealthiest families, who will receive about half the total of the repeal. Clinton added the repeal of the estate tax would create disincentives for wealthy people to make charitable contributions.

The response from the National Federation of Independent Business, a small-business advocacy group, was vicious. "That is complete garbage," said NFIB spokesman Jim Hirni. "The President talks and talks about the cost of this bill. He never talks about the effect on small business or how much it penalizes every small-business owner in the country to keep it in place."

|

|

|

|

|

|

|