|

Avaya spinoff terms set

|

|

August 31, 2000: 4:50 p.m. ET

Lucent shareholders to receive one new share for every 12 shares they own

|

NEW YORK (CNNfn) - Lucent Technologies declared a special one-for-12 stock dividend for its shareholders Thursday that will complete the widely anticipated spinoff of its $8 billion enterprise networking group, Avaya Inc.

The Murray Hill, N.J.-based telecommunications company said it will pay shareholders one share of newly created Avaya stock for every 12 Lucent shares they own. Lucent expects to distribute the dividend on Sept. 30.

The total number of shares distributed will depend on the number of Lucent (LU: Research, Estimates) shares on the day of record, Sept. 20. As of Wednesday, the company had approximately 3.3 billion shares outstanding.

Separately, Lucent announced it is selling its system integration and fulfillment operations business to Sanmina Corp., a global electronics contract manufacturing services company, for an undisclosed amount.

Lucent's factory, which employs 141 people, builds telecommunications messaging systems for Lucent and Avaya. The deal is expected to close by September 30 and once complete, all 141 people will be employed by San Jose, Calif.-based Sanmina Corp (SANM: Research, Estimates).

The Avaya spinoff

Lucent announced plans to spin off Avaya in March, aiming to free the company to focus on its high-growth Internet infrastructure and wireless operations. The company has also announced it will spin off its microelectronics unit as well, and float up to 20 percent of that company's shares in what some predict could be the largest initial public offering in history.

Avaya is a compilation of three Lucent subsidiaries: its switchboard, or PBX, operations; Systimax, its corporate cabling division; and its local-area network, or LAN, business. From its first day, it will rank as a worldwide leader in messaging and structured cabling solutions and a U.S. leader in call center and voice communications systems. Avaya is a compilation of three Lucent subsidiaries: its switchboard, or PBX, operations; Systimax, its corporate cabling division; and its local-area network, or LAN, business. From its first day, it will rank as a worldwide leader in messaging and structured cabling solutions and a U.S. leader in call center and voice communications systems.

The company boasts more than one million customers, including more than three-quarters of the Fortune 500, in more than 90 countries, and employs roughly 34,000 people worldwide.

Analysts have largely praised the decision to spin the operations off, noting it would allow Lucent to concentrate on its faster-growing business lines, such as optical networking, Internet infrastructure, wireless and semiconductors.

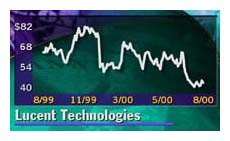

But investors have not shown the same enthusiasm. After jumping nearly 15 percent the day the spinoff was announced, Lucent shares have fallen more than 37 percent. Lucent dropped $1.19 to close at $41.81 Thursday, while Sanmina rose $13.75 to $118.

|

|

|

|

|

|

Lucent

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|