|

Jobs, manufacturing drop

|

|

September 1, 2000: 11:03 a.m. ET

U.S. lost 105,000 jobs in August; NAPM index shows manufacturing retreat

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - The U.S. economy shed 105,000 jobs in August - the biggest drop in nine years - while manufacturing ended 18 straight months of growth by shifting into reverse, reports said Friday, the latest signs of a slowdown in the world's largest economy.

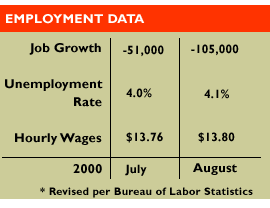

The unemployment rate edged up to 4.1 percent last month from 4.0 percent in July, the Labor Department said in its report. The report said the job losses came because 158,000 census jobs ended and 87,000 workers at Verizon Communications (VZ: Research, Estimates), the nation's largest local telephone company, were on strike. But even without those factors, the gains in employment were weaker than forecasts.

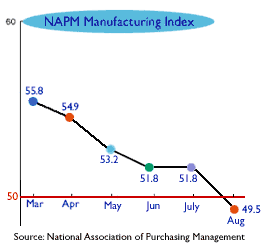

Separately, the nation's purchasing managers said manufacturing contracted for the first time in 18 months in August. The National Association of Purchasing Management index of manufacturing fell to 49.5 percent last month, weaker than Wall Street forecasts that expected it to climb from the 51.8 percent figure posted in July. A figure above 50 points to growth in manufacturing while one below that indicates contraction.

In addition, a separate Commerce Department report showed that spending on new construction fell 1.6 percent in July, the fourth straight month of decline in the sector.

Economists said the jobs report pointed to slower economic growth in the United States - exactly what the Federal Reserve has been trying to achieve with six interest rate increases since last June. Economists said the jobs report pointed to slower economic growth in the United States - exactly what the Federal Reserve has been trying to achieve with six interest rate increases since last June.

"These numbers are as close to perfect as you can get from a Fed point of view," said David Orr, chief economist with First Union.

"These kinds of numbers are wonderful," Charles Lieberman, chief economist at First Institutional Securities, told CNNfn's Before Hours program. They (the Fed) can sit back and twiddle their thumbs 'til the cows come home. This is about as good as it gets from their perspective." (239KB WAV) (239KB AIFF)

Census workers, strikers cause job drop

The number of jobs lost last month was higher than Wall Street had expected. Analysts polled by Briefing.com had forecast a drop of 20,000 jobs in August, following the revised drop of 51,000 jobs reported in July.

Excluding the strike at Verizon and the Census workers who were cut, total payrolls would have risen by 138,000 last month.

Hourly earnings, closely watched as an inflation indicator, rose 0.3 percent, or 4 cents an hour, to $13.80 in August, the Labor Department said, in line with estimates. The rise was below the 0.4 percent gain in July. Overall hourly wages have risen 3.8 percent in the last year.

U.S. stock markets opened higher after jobs reports, and stayed higher after the 10 a.m. reports from NAPM and Commerce. Investors bet the data would be enough to stop the Fed, the nation's central bank, from raising rates again soon.

The employment report showed a 79,000-job drop in the manufacturing sector in August, more than offsetting a large increase in July. It said construction-related industries, such as lumber, furniture and stone, clay, and glass products were among the hardest hits, along with a motor vehicles and rubber and plastics.

The construction spending report, from the Commerce Department's Census Bureau, shows a nearly 5 percent drop in spending between March and July this year. Most of that decline came from a drop in residential construction, which accounts for about half of building. Non-residential private construction was relative flat, slipping 0.8 percent, while public construction declined at a 3.5 percent rate. The construction spending report, from the Commerce Department's Census Bureau, shows a nearly 5 percent drop in spending between March and July this year. Most of that decline came from a drop in residential construction, which accounts for about half of building. Non-residential private construction was relative flat, slipping 0.8 percent, while public construction declined at a 3.5 percent rate.

Numerous components of the NAPM index all echoed other signs of a slow-down in manufacturing, as production, new orders, order backlogs and employment all fell during the period.

"The No. 1 reason new orders and production are falling is that inventories have risen in recent months as consumer spending has slowed," said Mark Vitner, another First Union economist. "Such a buildup was acceptable when economic growth was accelerating. Now that growth is cooling off, businesses will need to curb stockpiles."

Vitner agreed with his colleague Orr that the economy has not yet slowed enough to lead to a interest rate cut by the Fed.

"Some folks will be quick to jump on this morning's data as a sure sign that the next move by the Fed will be to cut interest rates," said Vitner. "Such talk is still way too premature."

|

|

|

|

|

|

|