|

Worker productivity rises

|

|

September 6, 2000: 2:47 p.m. ET

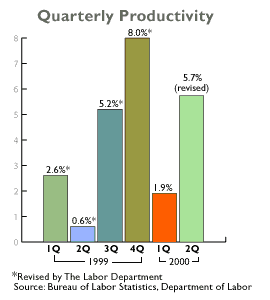

U.S. worker productivity in 2Q rises a revised 5.7%; wage costs drop

|

NEW YORK (CNNfn) - U.S. workers were even more productive in the second quarter while wage costs for companies declined more rapidly than previously thought, the government reported Wednesday -- more evidence that the world's largest economy is chugging along without much inflation.

The Labor Department said that worker productivity jumped 5.7 percent in the second quarter -- above the 5.5 percent increase anticipated by analysts polled by Briefing.com and the 5.3 percent rise initially reported. Labor costs -- a measure of what companies spend on worker output -- fell at a revised 0.4 percent annual rate, a bigger drop than the 0.1 percent drop initially reported and larger than Wall Street forecasts of a 0.2 percent decline. The Labor Department said that worker productivity jumped 5.7 percent in the second quarter -- above the 5.5 percent increase anticipated by analysts polled by Briefing.com and the 5.3 percent rise initially reported. Labor costs -- a measure of what companies spend on worker output -- fell at a revised 0.4 percent annual rate, a bigger drop than the 0.1 percent drop initially reported and larger than Wall Street forecasts of a 0.2 percent decline.

Such numbers provided more evidence for analysts and investors that massive strides in technology have boosted productivity, a measure of worker output per hour, and kept costs down for companies -- a combination that is expected to convince the Federal Reserve to hold interest rates steady when the central bank's policy-makers meet on Oct. 3.

"The economy continues to operate at a pace that is non-inflationary -- companies are able to keep their costs down, even with tight labor markets," Mickey Levy, chief economist with Banc of America, told CNNfn's Before Hours. "What it clearly indicates is that the Fed will probably remain on hold through the rest of the year."

A muted reaction

Financial markets registered little reaction to the numbers, with investors already looking ahead to more up-to-date figures on the economy and upcoming third-quarter earnings reports. The Dow Jones industrial average headed higher at the opening bell, while the Nasdaq composite index began the session lower. Bonds posted small losses.

Fueling the U.S. economy's blazing performance in recent years has been incredible advances in technology -- everything from smaller and faster computer chips to wireless telephones - helping to move information quickly from one end of the world to the other. The U.S. economy expanded at a 5.3 percent pace in the second quarter. Fueling the U.S. economy's blazing performance in recent years has been incredible advances in technology -- everything from smaller and faster computer chips to wireless telephones - helping to move information quickly from one end of the world to the other. The U.S. economy expanded at a 5.3 percent pace in the second quarter.

While the growth in productivity has helped the economy to grow at an impressive pace with little inflation, the gains are fueling expectations for corporate profitability, a theme that has spurred stocks to recover from sharp declines earlier this year. That has spawned renewed optimism on Wall Street and on Main Street, where consumer spending remains strong.

Levy told CNNfn that as the economy slows and as companies reduce the number of workers they have on the payroll, productivity gains should swell even more. (461KB WAV) (461KB AIFF)

A self-serve society?

What has triggered significant productivity gains and what has compelled Fed Chairman Alan Greenspan to publicly marvel are faster, better and cheaper ways for companies and people to conduct business with one another.

Online shopping for everything from books to boots, automated check-outs at grocery stores and gasoline stations, and paperless transactions involving e-mail and the World Wide Web have allowed companies to keep their costs in check, ensuring that prices for goods and services remains contained.

And that's on the consumer side. Analysts are increasingly optimistic that business-to-business ventures using the Internet as a mechanism to buy and sell -- B2B as they are known -- will become an increasingly prominent part of how companies operate.

On Tuesday, International Business Machines Corp. (IBM: Research, Estimates), Microsoft Corp. (MSFT: Research, Estimates), and Ariba Inc. (ARBA: Research, Estimates) said they will team up to create a directory which aims to become the standard way for businesses to find and connect with partners on the Web -- a B2B venture of their own.

Year over year, second-quarter productivity rose 5.2 percent, up from an originally reported 5.1 percent gain and the largest such rise since a 5.3 percent gain in the third quarter of 1983. The number of hours worked increased at a 0.4 percent rate, down slightly from the 0.5 percent pace initially reported and the 3.2 percent rate registered in the first quarter.

Non-manufacturing output up

The increase in hours worked was the smallest since the first quarter 1996, when hours fell 0.1 percent, Labor said.

Separately, the National Association of Purchasing Management said its index of non-manufacturing output expanded at a faster pace last month, while its gauge of prices paid for materials fell to the lowest level this year.

The NAPM said its non-manufacturing business index rose to 60 in August from 55.5 in July. The group's index of prices for supplies and materials paid fell to 59 last month from 61.5 a month earlier, indicating that prices for raw materials are not advancing.

|

|

|

|

|

|

|