|

Euro stumbles yet again

|

|

September 11, 2000: 6:47 a.m. ET

Currency drops to new low against dollar as U.S. economy outshines Europe

|

LONDON (CNNfn) - The euro touched another record low against the U.S. dollar Monday, stumbling below the 86-cent mark as the strong growth and low inflation that characterize the United States economy drew ever more investors to put funds into dollar-denominated securities.

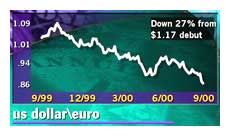

The euro slipped as low as 85.70 cents in mid-morning London trade before recovering slightly to 85.90 cents. The common currency of the 11-member Euro zone is now down more than 27 percent from its value of $1.17 at its launch in January 1999.

Analysts attributed the latest setback to a number of factors, including the OPEC's weekend decision to boost oil output, which pushed the price of oil slightly lower. The euro also fell to new lows against the Japanese yen and the Swiss Franc.

"What we're seeing today is a very long-term trend asserting itself - people abandoning the euro and buying the U.S. economic miracle," said Adam Cole, an international economist with HSBC Securities. "OPEC's decision is not helping the euro much today either" "What we're seeing today is a very long-term trend asserting itself - people abandoning the euro and buying the U.S. economic miracle," said Adam Cole, an international economist with HSBC Securities. "OPEC's decision is not helping the euro much today either"

An environment of stable economic growth and persistently low inflation has helped bolster confidence in U.S. equity markets, encouraging investors around the globe to hold U.S. dollar-denominated investments such as shares in high-tech companies. Investors switching their funds out of non-dollar-traded assets in order to buy U.S. securities must buy dollars, pushing up the currencies value relative to others, such as the euro.

Some currency experts have suggested that the European Central Bank take a more aggressive stand at defending the euro from declines in currency markets, something that other central banks have done when their currencies have come under pressure.

The British pound on Monday hit a seven-year low against the U.S. dollar, falling as low as $1.4093 before recovering to $1.4117. It was the first time the pound has fallen below $1.41 since February 1993.

|

|

|

|

|

|

|