|

Inheriting a windfall

|

|

September 18, 2000: 7:01 a.m. ET

Don't make rash decisions; park cash in a liquid account and weigh alternatives

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - So maybe you didn't inherit millions of dollars from Aunt Betty last year when she passed on, but your parents left you $50,000 after their deaths and you're just not sure what to do with the dough.

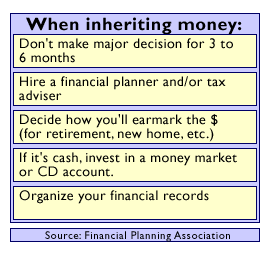

Financial planners say the best advice is to stay put and not make any big decisions after receiving a large sum of money.

"It really changes your entire perspective when you go through an inheritance," said Barbara Steinmetz, a certified financial planner (CFP) in Burlingame, Calif. The emotional burdens of losing a loved one often cloud your best judgment, so experts suggest you sit tight for three-to-six months after losing a loved who has left you either a sum of cash, securities, or even the family business.

Boomers gaining wealth

With the baby boom generation and their parents accumulating wealth in the bull stock market, many people stand to gain a sizable chunk of money in inheritance in coming years, the Financial Planning Association reports.

Unfortunately, many people just don't know what to do when they receive stocks, real estate or the family farm. A recent survey by Oppenheimer Funds, in fact, showed that 40 percent of baby boomers who have already received at least a $50,000 inheritance made a financial decision on that money in less than a week. Unfortunately, many people just don't know what to do when they receive stocks, real estate or the family farm. A recent survey by Oppenheimer Funds, in fact, showed that 40 percent of baby boomers who have already received at least a $50,000 inheritance made a financial decision on that money in less than a week.

So planners say take it slow. First, if the inheritance is in cash, you should park it into a low-risk money market or certificate of deposit account. That way your inheritance is making some money but it can be easily retrieved. Then use the time to shop for a reputable financial or tax adviser -- and maybe even a therapist.

"Whenever there is a rapid change in life -- a death, a divorce, whatever -- put the money in a something that is liquid paying a decent return while you're deciding what to do," Steinmetz said.

Next, map out your own financial goals and expectations over the next years and decide how to earmark the inheritance. Will you put it toward your own retirement, into that account for the new house, or save it for your child's education?

Maybe when your father passed away he left you stocks and bonds he held for several years. Planners say if you choose to sell them, you'll need to determine their cost basis - which is the original price of the securities plus any dividends. However, inherited securities typically enjoy a step up in basis, so check with your adviser.

Inheritances don't always come in the form of cash or stocks or bonds. A family business can be passed down through the generations and deciding how it will live on - or be sold -- is another important decision.

Depending on how close you've been to the business will help you decide how to proceed. Also, you're more likely to have known about such an inheritance, although an unexpectedly early death may put it into your hands sooner than planned.

Did you help run the company or do you live miles away having nothing to do with it? Decide how important your family legacy is and if you want to run the company or sell it.

If you do decide to sell the business, "don't take the first appraisal on it," Steinmetz advised. "There are people who are out there who may try to take advantage of you at this point." Again, let some time pass before making any major decisions.

Clear your mind

So while you're making plans to meet with your tax adviser and other members of the family to discuss the inheritance, take time to understand the loss of the loved one who passed the inheritance along to you.

Unfortunately, some people feel guilty when they receive an inheritance because it's money they haven't earned. Also, they may feel isolated if they didn't grow up with wealth and have now come into a sizable chunk of cash.

Above all, Steinmetz said, "Take a deep breath and don't react too quickly."

-- Staff Writer Jennifer Karchmer covers news about estate planning for CNNfn.com. Click here to send her e-mail.

|

|

|

|

|

|

|