|

A techie, GenX retirement

|

|

September 19, 2000: 5:56 a.m. ET

Silicon Valley couple should diversify their portfolio to weather market downturns

By Staff Writer Jennifer Karchmer

|

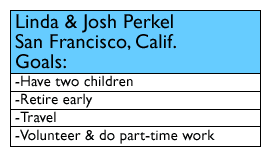

NEW YORK (CNNfn) - Linda and Josh Perkel seem like the quintessential Generation-X techie couple. In their early 30s, working for a high-tech company in Silicon Valley, they own a house in the San Francisco Bay area, have employee stock options and hold a variety of tech names, including Sun Microsystems, Nokia, and Cisco. Oh yeah, and they're expecting their first child in January.

And like many young tech workers, they have questions about saving for retirement. They think they're doing the right thing with a portfolio full of tech stocks. But with the Nasdaq off almost 3 percent this week, tech holders may rethink their strategy.

"I know we're tech heavy," said Linda, 33. "But we're trying to be more on the risky side so we can have the payoff down the road."

Financial planners say while scooping up high-flying tech stocks is appealing for a young person's retirement account, a portfolio too weighted in any one sector is doomed.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

"You live and die by those stocks because you're not diversified," said certified financial planner (CFP) Doug Flynn. "They need to look at different sectors."

Tech overload?

Working in Silicon Valley has its rewards, said Linda, and she's not just talking about the warm, breezy climate.

Linda grew up shivering through long, cold winters in Syracuse, N.Y. Her parents moved to the West Coast her last year of high school and she's lived there ever since. Working in the tech-laden area in California lends itself to being surrounded by news about technology companies and dot.coms.

"We're in the high-tech industry and all these companies are doing well so we're always looking at stock prices," said Linda, who checks her company's stock price several times during the day.

Did you miss CNNfn.com's retirement special? Click here to get it all

Both Linda and her husband Josh, 31, put 10 percent of their salary into their company's employee stock purchase plan (ESPP). In addition, they invest in a variety of tech names for retirement and plan to increase their stakes in Cisco and Nokia after receiving their year-end bonuses.

They're maxing out their 401(k) plans, each contributing the maximum $10,500 allowed per year. They also hold a variety of Vanguard funds in a traditional IRA.

As far as expenses go, they have car payments totaling $1,000 a month, and a mortgage with $360,000 owed. Their home is worth about $600,000.

With a combined salary of $200,000, the Perkels are making ends meet but they'd like to know if they're putting their savings in the right place to retire comfortably and send their son -- who's expected to enter the world in January 2001 -- to college.

Diversify the portfolio

Retirement for the Perkels means traveling, playing golf and not having to worry about bringing home a paycheck every week.

"Our goal is to retire as early as possible but we don't have a set time," Linda said. "Once we have kids it would be nice to work just part time or not at all, even."

Linda is also interested in volunteering or working as a teacher. "High tech pays very well and I enjoy my job but it would be nice if I could do something that was more fulfilling," she said.

The Perkels are not the only investors holding big tech names like Nokia (NOK: Research, Estimates), Cisco (CSCO: Research, Estimates), and Sun Microsystems (SUNW: Research, Estimates), but financial planners say it's a risky bet to buy only a handful of tech names.

Click here to read last week's Portfolio Rx on CNNfn.com!

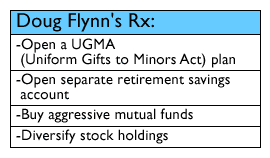

CFP Flynn says the couple should be patted on the back for maxing out their 401(k)s since that company-sponsored retirement account with matching funds is a great way to save for retirement.

First, while the payoff from holding tech stocks could be great, it's important to temper that account with either a mix of aggressive mutual funds or other types of stocks. Flynn suggests the couple buy international and small- and mid-cap names to round out their savings plan.

"Look at the S&P 500: it's got financials, utilities, retail, energy, and other good things out there," Flynn said. "Depending on the market, everything goes in cycles. They really need to diversify."

In addition, the Perkels need to set a clear goal on when they want to retire because that will determine how much they should be saving now.

For example, Flynn says if the Perkels wish to retire at age 50, that is 17 more years of maxing out their 401(k) plans which he estimates will net them $1.2 million. That may sound like a lot, but at age 50, they may still have 30-to-40 more years to live, which would require more savings.

However, if they decide to retire closer to age 60 and continue on the same savings plan of maxing their 401(k)s, they will have $3 million, which is a more doable amount, since their life expectancies will be shorter then, and they'll be closer to receiving Social Security benefits to supplement their savings.

"Most people just try to save up with no clear direction," Flynn said. "But with their great incomes, they can save money and they're doing the right things with the 401(k)."

The long haul

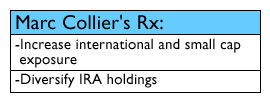

On the other hand, some planners say the Perkels may be better positioned to take advantage of the tech sector if they're in it for the long haul.

"I'm a believer of investing in something you understand," said CFP Marc Collier in Wellesley, Mass. "They do work at (a technology company) so I think it's something that is suitable for them because they understand the industry."

But Collier notes the tech sector is vulnerable to downturns that can really hurt a portfolio. For example, Nokia stock has taken a nose-dive in the last three months. The stock closed at $43.13 as of Sept. 18, down from its 52-week high of $62.50. "Are they OK with that kind of volatility?" he said.

So while the couple is saving for retirement how do they put away pennies for their child's education?

There are a few different avenues for saving for education, Flynn says.

Firstly, they can open a Uniform Gift for Minors Account known as UGMA, and put the money in the child's name. The advantages are that the money is taxed at the child's rate, which presumably would be lower than the parents' tax rate.

However, when the child is no longer a minor, little Johnnie owns the money and can use it for whatever he pleases, either college, a new motorcycle or a backpacking trip across Europe.

"If you're willing to put the money in the child's name, you're giving up the rights to the money," Flynn explained. "However, it's tax advantaged because it's taxed at the kid's rate. It's an emotional thing. Some people say, 'I don't want a dime in my kid's name, because I want to control the money.'"

Flynn suggests the Perkels open a long-term mutual fund account to accumulate savings specifically for education. If they save $400 a month beginning the day their child is born, with a 10.5 percent return, in 18 years they'll have $250,000. According to College Board statistics, that's about how much a 4-year private school will cost in 2018.

Learn how to manage your money!

Read CNNfn.com's Checks & Balances every Monday

So the Perkels have some diversifying and some saving to do, if they follow the experts' advice.

Eventually, they want to travel especially since neither of them has been out of the United States.

"We'd like to do it leisurely and explore and travel and not have to do it on a major budget, go to the East Coast and visit relatives."

-- Staff Writer Jennifer Karchmer covers news about retirement for CNNfn.com. Click here to send her e-mail.

* Disclaimer

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name and photo in an upcoming story. Please include a daytime phone number so we may reach you.

|

|

|

|

|

|

|