|

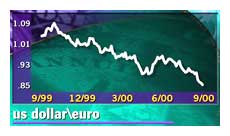

Euro slides to another low

|

|

September 19, 2000: 7:04 a.m. ET

Japan hints at help for euro; currency needs central bank support, IMF says

|

LONDON (CNNfn) - The struggling euro hit record lows against the dollar and the yen on Tuesday, prompting financial chiefs outside the euro zone to suggest ways to prop up the currency, with Japan indicating it might help the European nations in moves to strengthen the euro.

"I want to hear what the other ministers have to say, but fundamentally, Japan will cooperate to achieve overall foreign exchange stability," said Finance Minister Kiichi Miyazawa, referring to a meeting this weekend of finance ministers and central bankers from the Group of Seven industrial nations in Prague.  "We will respond flexibly," Miyazawa said. "We will respond flexibly," Miyazawa said.

The twenty-month old euro fell as low as 84.91 U.S. cents, setting a new record for the seventh day in the past 10 sessions. The euro recently traded at 85.23 U.S. cents.

Against the yen it also reached a new low, trading at ¥90.73.

The International Monetary Fund also spoke of central bank intervention as a possible means of bolstering the currency, which IMF Chief Economist Michael Mussa said had fallen too far.

"The ECB will need to take majored actions" to help lift the euro, said Mussa, speaking in Prague. "If not now, one would have to ask, when."

"I used to say it was more an embarrassment than a problem, but now I would say it's a problem," Mussa added.

The latest slide came despite supportive remarks from Ernst Welteke, president of Germany's central bank the Bundesbank, who said the euro's low level was not justified by economic fundamentals.

"We hold the same view," Japan's Miyazawa said.

Analysts said that such talk, reiterating remarks made earlier by European finance ministers, would not spark a rally in the euro.

"No one can find a good reason to buy the euro at the moment," said Niels Christensen, currency strategist at Société Générale in Paris. "The only thing that could turn the tide is intervention, possibly accompanied by soft U.S. data."

Another factor weakening the euro is European investors' healthy appetite for U.S. stocks and bonds. Europeans bought $34.64 billion worth of U.S. shares in the second quarter, the Wall Street Journal reported, saying this was down from $58.67 billion in the first three months of 2000 but higher than in any other previous quarter. New purchases of U.S. stocks by investors in the euro zone typically mean buyers must sell euros and buy dollars.

--from staff and wire reports

|

|

|

|

|

|

|