|

Robust growth ahead: IMF

|

|

September 19, 2000: 10:47 a.m. ET

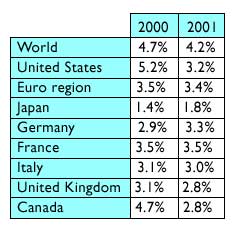

World economy seen growing 4.2% in 2001; U.S. tipped for soft landing

|

LONDON (CNNfn) - The world's developed economies are poised for strong growth and little inflation through 2001 as growth in Asia and Latin America continues at a robust pace and the U.S. economy experiences a moderate slowdown, the International Monetary Fund forecast Tuesday.

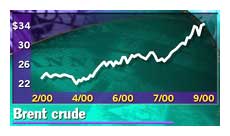

However, historically high oil prices could act to slow growth, the agency said, warning it might trim its forecasts if the cost of crude stays at current 10-year-high levels or rises even further. Brent crude for November delivery recently traded at $34.35, well above the $26.53 a barrel that the IMF used to arrive at its estimates. However, historically high oil prices could act to slow growth, the agency said, warning it might trim its forecasts if the cost of crude stays at current 10-year-high levels or rises even further. Brent crude for November delivery recently traded at $34.35, well above the $26.53 a barrel that the IMF used to arrive at its estimates.

In its semi-annual World Economic Outlook, the Washington-based agency's flagship report, the IMF said the global economy should grow by 4.2 percent in 2001, an increase from its April estimate of 3.9 percent. It expects economic activity to expand 4.7 percent for the whole of this year.

"The U.S. economy is maintaining its momentum, the recovery in European nations is picking up, the Japanese economy is showing signs of recovery and Asian economies are in solid recovery," the report said.

Some words of caution

Michael Mussa, the IMF's economic counselor and director of research, reiterated that view to reporters in a press conference marking the start of the IMF-World Bank annual meetings in Prague, saying the world economy was enjoying its strongest period of growth in more than a decade, despite global oil prices that remain obstinately near 10-year highs.

But he also cautioned that several risks are attached to the rosy economic scenario, particularly the state of the crude oil market. Unless prices fall, he said, the agency might lower its forecasts as much as 0.5 percent from current levels. Rising prices for crude tend to slow economic growth by raising the cost of everything from manufacturing tires to heating a home. But he also cautioned that several risks are attached to the rosy economic scenario, particularly the state of the crude oil market. Unless prices fall, he said, the agency might lower its forecasts as much as 0.5 percent from current levels. Rising prices for crude tend to slow economic growth by raising the cost of everything from manufacturing tires to heating a home.

"If oil prices were to stay at $35 a barrel throughout 2001 or if they were to escalate to $40 a barrel or over, then the impact on inflation and world growth would be more significant," Mussa said, adding that current oil prices, which have risen by between $6 and $7 since the IMF completed its forecasts in August, would add some $200 billion to the world's annual energy bill.

This could ultimately depress global demand for goods and services and damp the pace of growth in economic activity, he said.

The ailing euro

Also of concern to the IMF are "apparent misalignments" between the value of the U.S. dollar and the ailing euro, which is trading near all-time lows against the dollar.

The European Central Bank last week announced that it would use some $2.3 billion in interest accrued from its currency reserves to purchase euros in the market - a move that it said doesn't amount to currency market intervention, but which comes close.

Intervention is the term that describes how central banks enter currency markets, making large purchases of their own currency to bolster its value.

Mussa on Tuesday indicated that the ECB "will need to take majored actions" to help lift the value of the euro, either through direct intervention or by raising interest rates for the 11-member euro zone in the months ahead. Mussa on Tuesday indicated that the ECB "will need to take majored actions" to help lift the value of the euro, either through direct intervention or by raising interest rates for the 11-member euro zone in the months ahead.

The time could be right for concerted intervention to support the euro, Mussa said. "Circumstances for intervention are relatively rare, but they do arise," he said, adding that the collapse of Europe's sagging single currency could hurt economies in Europe and beyond. "One has to ask, 'If not now, when?'"

"I used to say (the euro) was more an embarrassment than a problem, but now I would say it's a problem," he added.

The twenty-month-old euro fell as low as 84.91 U.S. cents Tuesday, the seventh in the past 10 trading days that it has set a new record low. It recovered to 85.23 U.S. cents at midday London time.

U.S. economy poised for slowdown

Among other concerns, the IMF urged the European Union to set a credible timetable to bring in new members from central and eastern Europe, but said the newcomers might face problems if they adopted the euro too quickly.

"Full economic convergence with the income levels of western Europe will take years -- probably decades in most cases - to accomplish, well beyond any prospective timetable for the adoption of the euro," the report said. "As a result, the importance of microeconomic flexibility must be emphasized."

The IMF raised its forecast for U.S. economic growth in 2001 to 3.2 percent from 3 percent in its April report. It said the U.S. economy will likely grow 5.2 percent this year, up from its previous forecast of 4.4 percent in April. The economy expanded 4.2 percent in 1999.

For the euro region, the IMF forecast that the economy would grow 3.5 percent in 2000, up from its initial estimate of 3.2 percent made in April. For 2001, euro region growth was estimated at 3.4 percent versus the April forecast of 3.2 percent.

The German economy was expected to grow by 2.9 percent this year, up slightly from a forecast of 2.8 percent in April, while the projection for growth in 2001 was unchanged at 3.3 percent. The IMF forecast for 2000 French economic growth was unchanged from April at 3.5 percent. But its estimate for 2001 was raised to 3.5 percent from 3.1 percent.

Japan's economy was forecast to grow by 1.4 percent this year, up from the April estimate of 0.9 percent. The 2001 growth forecast was unchanged at 1.8 percent. Japan's economy is still technically in recession since it has not posted two consecutive quarters of growth in more than 10 years.

|

|

|

|

|

|

|