|

To tap or not to tap

|

|

September 21, 2000: 6:23 p.m. ET

Clinton considers tapping oil reserve; Bush opposes move; Gore supports idea

|

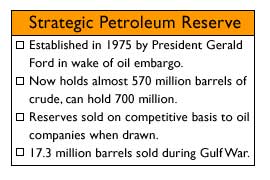

NEW YORK (CNNfn) - President Clinton is considering tapping into the country's Strategic Petroleum Reserve to tame heating oil and gasoline prices, but has yet to reach a decision and senior advisers are split on the course of action, according to senior officials familiar with the deliberations.

World oil prices fell on news the reserve may be tapped. U.S. light sweet crude for November delivery fell $1.24 to $34 a barrel while Brent crude in London fell $1.01 cents to $32.73.

The issue has divided Clinton's top policymakers. Energy Secretary Bill Richardson, several informed sources told CNN, has advocated drawing down perhaps as much as 60 million barrels, although he conceded in his memo to the president that even that approach would likely have only a modest impact on prices.

Top Clinton economic adviser Gene Sperling, who has presented the president with a list of options that includes the so-called "test sales" approach - selling 5 million barrels at a time -- advocated Thursday by Vice President Al Gore, the Democratic presidential nominee.

Treasury Secretary Lawrence Summers has forcefully argued against any major draw down of the 571-million barrel stockpile and in a memo to the president said Federal Reserve Chairman Alan Greenspan concurs. But Summers said Thursday he was not opposed to Gore's more modest plan. Treasury Secretary Lawrence Summers has forcefully argued against any major draw down of the 571-million barrel stockpile and in a memo to the president said Federal Reserve Chairman Alan Greenspan concurs. But Summers said Thursday he was not opposed to Gore's more modest plan.

Republican presidential candidate George W. Bush's campaign criticized Gore's proposal, calling it an "election year political ploy" that could threaten national security.

Bush's communications director Karen Hughes told reporters in New York: "That reserve is intended for strategic and national security purposes, not for election year political purposes."

The American Petroleum Institute also came out against the proposal.

"The Strategic Petroleum Reserve was established by Congress to address supply disruptions," the Institute said in a statement. "It was not intended, and should never by used, to manipulate prices. History has shown time and again that government interference in the marketplace will lead to negative consequences such as the long gas lines of the 1970s."

Goldman Sachs Vice Chairman Robert Hormats told CNNfn tapping into the strategic reserve is a good way to increase crude supply, but consumers may have to wait to see the effect because most big oil refineries are operating at full capacity.

"The refineries are going flat out and additional crude is not going to be able to go through those refineries right away," Hormats said. "It's a good thing to show to the OPEC countries that we're doing something ourselves to increase supply, but it may not achieve much in the near term."

Senior administration officials said Clinton's decision was likely to come Friday, but could be delayed a few days. They said it was possible he would make his decision Thursday, but several said political advisers believed it best to wait so that the vice president's ideas would get media attention.

Would tapping the reserve lower prices?

If the administration decided to sell a large portion of crude or have several smaller sales, it is still uncertain what effect that would have on the market.

The reserve has only been tapped once before, during the Gulf War, but according to Dennis O'Brien, director of the Institute for Energy Economics and Policy at the University of Oklahoma and a former senior official at the Department of Energy, the effect to tap the reserve was purely psychological.

"Ahead of the Gulf War the price of crude oil jumped up to about $40 a barrel, but when it was announced they would use the reserve the price immediately plunged back," O'Brien told CNNfn. "After that not much was done. The intended objective was accomplished."

Only 17.3 million barrels were eventually sold during the Gulf War.

He said a psychological jolt to the market might be the administration's desired goal.

"This sends a message, but it doesn't really alleviate driving factors," O'Brien said, which are very low product stocks - such as heating oil, diesel and jet fuel - and bottlenecks at the refineries.

O'Brien also warned tapping the reserve could have an undesired effect. Since the oil is sold on bidding basis, the price could rise.

"It's one of those things we really don't know what will happen," he said. "If you really did it in an environment of rising prices, my fear is that it would be like throwing gasoline instead of water on a fire."

From the well to your home

If the White Houses decides to use some of the 571 million barrels stored in the strategic reserve, the oil is sold to oil companies who submit bids. Once bids are accepted, companies provide financial assurances and arrange transportation from one of five major sites along the Gulf of Mexico.

The process usually takes about 15 days from the decision to sell to the transportation of the oil, but varies on the instructions given to the Reserve's administration.

John D. Shages, Strategic Petroleum Reserve finance and policy director, told CNNfn a great deal would depend on the amount needed. John D. Shages, Strategic Petroleum Reserve finance and policy director, told CNNfn a great deal would depend on the amount needed.

"People are talking about varying amounts (being requested) and larger amounts take longer," Shages said.

The type of oil sold also affects the timing.

The reserve is comprised of two-thirds sour crude and one-third sweet crude. Sour crude contains more sulfur, which must be removed before refining, lengthening the process.

"If we have a very small deal we would use all sweet crude, but with a big draw offer we'd use a combination of sour and sweet," Shages said.

O'Brien said the strong demand right now is for lighter, sweeter crudes to replenish product stocks.

The strategic reserve was created for emergency use after the 1973-74 oil embargo.

The Gore plan

Rising fuel prices could threaten a central platform to the Gore campaign -- the strong economy.

In a speech in Hollywood, Md., Gore called for several oil releases of five million barrels each from the strategic reserve and further releases in the future to help stabilize prices. (220K WAV or 220K AIFF)

Gore also recommended instituting a permanent home heating oil reserve in the Northeast to be tapped when oil prices rise, $400 million in emergency funds to help low-income families, and a temporary $600 million tax credit for home heating oil companies to encourage them to increase their supplies.

"We have to take action because American people are being taken advantage of in an unfair way," Gore said in prepared remarks. "OPEC needs to keep its promise, raise production and bring prices down on the world market."

The Energy Department predicts heating costs will be a third higher on average this winter than last, and could go even higher if there is severe weather.

The vice president also took another swipe at the oil companies, claiming they were "profiteering" at the expense of American consumers saddled with $2-a-gallon gasoline during the summer and faced with an expected price shock in the winter heating season.

"You should never have to rely on the good will of the big oil companies to heat your home or drive down the highway," Gore said.

According to Gore's plan, the companies who buy from the reserve should replenish the reserve when prices are cheaper.

-- CNN Senior White House Correspondent John King, The Associated Press and Reuters contributed to this report

|

|

|

|

|

|

|