|

Stock picks by the pros

|

|

September 22, 2000: 4:43 p.m. ET

Cardinal Health, Sysco, Occidental, UnitedHealth, Kohl's, Sun Micro, EMC

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed the health, financial, retail and oil sectors Friday, recommending such stocks as Federated Department Stores, Pfizer, Amgen and Conoco. One analyst also noted some technology stocks that suffered unfairly in the wake of Intel's revenue warning Thursday.

While the markets fell in midday trading, recent guests on CNNfn commented on the stocks they are buying and why.

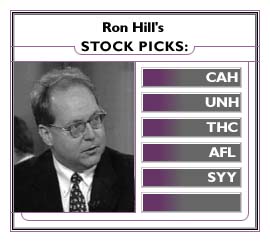

"A lot of people are spooked about the euro. If you don't want to do Johnson & Johnson, those big pharmaceuticals, look at your things which are the domestic U.S. plays: Cardinal Health (CAH: Research, Estimates), the largest distributor of medical products throughout the United States. Take a look at an HMO like UnitedHealth (UNH: Research, Estimates) or a hospital management company like Tenet Healthcare (THC: Research, Estimates). All three of these companies do most of their business in the United States in dollars so they're not subject to the euro and higher energy prices don't really affect them one way or the other," said Ron Hill, Brown Brothers Harriman. "A lot of people are spooked about the euro. If you don't want to do Johnson & Johnson, those big pharmaceuticals, look at your things which are the domestic U.S. plays: Cardinal Health (CAH: Research, Estimates), the largest distributor of medical products throughout the United States. Take a look at an HMO like UnitedHealth (UNH: Research, Estimates) or a hospital management company like Tenet Healthcare (THC: Research, Estimates). All three of these companies do most of their business in the United States in dollars so they're not subject to the euro and higher energy prices don't really affect them one way or the other," said Ron Hill, Brown Brothers Harriman.

"AFLAC (AFL: Research, Estimates) has great growth upon prospects. Japan is about to deregulate its market. AFLAC is a big player there. Should take nice share there, build more growth there. It's been a nice company for us. That will be a good one to play in," Hill said. "If you're looking for steady growth, another company I like in here is Sysco (SYY: Research, Estimates), America's largest food service company, not that other components company. But the food service company, because people still go out for dinner. And in the slowing economy one of the last things to go down is meals away from home, as they're called. They may go up because people try to work more jobs."

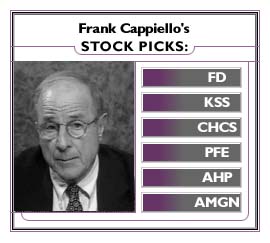

"  The Nasdaq goes up and down. But if you look at stocks like EMC, Oracle, Sun Microsystems, Juniper -- which is a little weaker today. But in the first three I've mentioned, all have rising earnings. So to make my point, the things you look for in this kind of really scary market is the stocks that have held up the best, or the stocks that continue to go up. These are the stocks you want to buy. If you want to buy some busted stocks, you've got to have a very good story. For example, retail has been over-discounted. Retailing stocks were killed very early in the summer and now they're beginning to move back gradually. As a matter of fact, if you looked at the stocks yesterday you'd see that retail stocks held or did very well," said Frank Cappiello, president of McCullough Andrews & Cappiello. The Nasdaq goes up and down. But if you look at stocks like EMC, Oracle, Sun Microsystems, Juniper -- which is a little weaker today. But in the first three I've mentioned, all have rising earnings. So to make my point, the things you look for in this kind of really scary market is the stocks that have held up the best, or the stocks that continue to go up. These are the stocks you want to buy. If you want to buy some busted stocks, you've got to have a very good story. For example, retail has been over-discounted. Retailing stocks were killed very early in the summer and now they're beginning to move back gradually. As a matter of fact, if you looked at the stocks yesterday you'd see that retail stocks held or did very well," said Frank Cappiello, president of McCullough Andrews & Cappiello.

"The favorite picks that I would have would be in the retail area, basically: Federated Department Stores (FD: Research, Estimates), which has been battered, Bloomingdale's and Macy's; Kohl's (KSS: Research, Estimates), which is a high-price retailer, but they've got the best performance, and they have room for growth; and a little company called Chico's F-A-S (CHCS: Research, Estimates), which is a specialty company which is doing very well. This is the kind of group that you want to pick over at the present time because we're going into the good season for retailing. And the retailer multiples have never been as low as they have in a long time," Cappiello said.

"Another area, drugs, you know, we talked about some of the worries that Wall Street has. The euro, the oil problem, interest rates, but there's another and that's political. There is a good possibility now, Wall Street thinks, anyway, that Gore could not only get into the presidency, but carry Congress with him. And that's hurt drug stocks because that's one of his targets. And here, the drug stocks we like are Pfizer (PFE: Research, Estimates), American Home (AHP: Research, Estimates), and Amgen (AMGN: Research, Estimates)," he said.

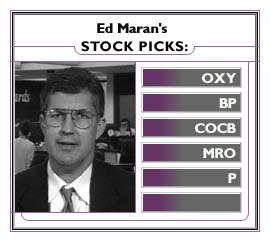

We're seeing civil unrest in Europe. We're having great concern over what the price will be for heating during the winter, and for certain poor people or people of limited means. That could be a very serious issue. And there is a general issue of people being worried about their energy bills. So it may not be a crisis, but I think that $35 oil is serious enough that it's something that is reasonable for the president to be looking at," said oil analyst Ed Maran of A.G. Edwards. We're seeing civil unrest in Europe. We're having great concern over what the price will be for heating during the winter, and for certain poor people or people of limited means. That could be a very serious issue. And there is a general issue of people being worried about their energy bills. So it may not be a crisis, but I think that $35 oil is serious enough that it's something that is reasonable for the president to be looking at," said oil analyst Ed Maran of A.G. Edwards.

"Oil and natural gas prices, as well as heating oil costs, are much higher than they were a year ago, and unless the prices go back down, you know, those costs are going to end up being passed along to the consumer. We don't know what the price of the commodity will do between now and when the winter arrives; but if it stays high, then consumers might see price increases of that magnitude," Maran said.

"We think that the economy is relatively resilient; inflation is low so we don't think the Fed will have to respond in any fashion, you know, in order to counter inflation. And with strong economic growth and less sensitivity of the price of oil than the economy used to have, we're fairly confident that the economy is not going to be greatly impacted by this," he said.

"One of our top picks is Occidental (OXY: Research, Estimates). It has a very high sensitivity of the price of oil and natural gas. And they've done some restructuring that has lowered their cost. And the market has not really caught on to how much value there is in this stock. So I would take a look at Occidental. We like BP Amoco (BP: Research, Estimates). Great company, diversified worldwide, and good long-term-growth prospects. We also like Conoco (COCB: Research, Estimates), Marathon (MRO: Research, Estimates) and Phillips (P: Research, Estimates) -- all mid-sized oil companies that are integrated and have, you know, great profit margins, growing production, very low P/E multiples -- trading at under 12 times what we expect them to earn in the year 2001," Maran said.

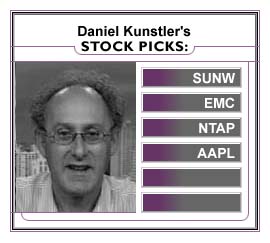

The [stocks] I point to are those that have little Intel (INTC: Research, Estimates) exposure. Sun Microsystems (SUNW: Research, Estimates) and EMC (EMC: Research, Estimates) are doing better [Friday] than [they were Thursday] night, but [they were] caught up in [the general technology selloff following a revenue warning by Intel]. Network Appliance (NTAP: Research, Estimates) is also recovering, but it also [was] down [Thursday] night. But that's collateral damage. We're throwing up our hands. This doesn't make  sense, particularly Sun Micro," Daniel Kunstler, an analyst with J.P. Morgan Securities, said. sense, particularly Sun Micro," Daniel Kunstler, an analyst with J.P. Morgan Securities, said.

"You're not going to hear [revenue warnings] from Sun or EMC. You're not going to hear them from Network Appliance. We've already heard from Compaq (CPQ: Research, Estimates) -- which straddles the enterprise space -- that the third quarter is not in jeopardy. Europe is not in jeopardy. So you look at this and say, 'Wait a minute.'

"I would be buying Sun Micro. It is off again this morning. It was off yesterday. They'll have a bang-up quarter. Demand looks good going into next year, going into new production introduction.

"I'm buying Apple (AAPL: Research, Estimates). They got hammered yesterday five bucks... and again another five bucks on this Intel news. [It's a] cheap stock in the low 20s."

"I like EMC. They came out saying Europe [is] not a problem for [them], demand's great, virtually signaling the quarter is in good shape."

-- compiled by Staff Writers Lucy Banduci and Mark Gongloff

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|