|

G7 to OPEC: cut oil prices

|

|

September 23, 2000: 4:59 p.m. ET

Ministers pledge to protect global economies amid oil, euro woes

By Staff Writer M. Corey Goldman, with Heather Bourbeau

|

PRAGUE, Czech Republic (CNNfn) - The high price of oil and the low value of the euro dominated discussions between finance ministers and central bankers of the Group of Seven industrialized countries on Saturday, with leaders pledging to prevent either from deterring an otherwise rosy global economic outlook.

Meeting at the German Embassy in Prague, the G7 -- Canada, France, Germany, Great Britain, Italy, Japan and the United States - called on oil producers to return prices to a "level consistent with lasting global economic prosperity and stability" for both rich and developing countries.

They also noted in their statement Friday's unprecedented effort among several of the G7 central banks to boost the sagging euro, suggesting the action was taken "because of the shared concern of Finance Ministers and Governors about the potential implications of recent movements in the euro for the world economy." They also noted in their statement Friday's unprecedented effort among several of the G7 central banks to boost the sagging euro, suggesting the action was taken "because of the shared concern of Finance Ministers and Governors about the potential implications of recent movements in the euro for the world economy."

"In light of recent developments, we will continue to monitor developments closely and to cooperate in exchange markets where appropriate," the G7 said. The European Central Bank, the U.S. Federal Reserve, the Bank of England and the Bank of Canada all sold U.S. dollars for euros Friday in an effort to reduce the amount of the currency outstanding and boost its value.

Summers mum on euro

Ministers from the G7 meet once a year during the annual meetings of the International Monetary Fund and World Bank. They typically discuss the progress of their respective economies with the IMF and issue a communiqué to the public with their views on global growth and other issues.

Speaking at the residence of the U.S. ambassador to the Czech Republic following the G7 meeting, U.S. Treasury Secretary Lawrence Summers declined to answer reporters' questions about Friday's intervention or the euro.

"I think the G7 statement speaks for itself and I don't want to add to what it says," Summers said several times in response to persistent questions about the level of the euro and whether further intervention might happen to prop up its value. "I don't want to go beyond the language in the communiqué." "I think the G7 statement speaks for itself and I don't want to add to what it says," Summers said several times in response to persistent questions about the level of the euro and whether further intervention might happen to prop up its value. "I don't want to go beyond the language in the communiqué."

The euro closed Friday at 89.92 U.S. cents, up about 3 percent from its all-time low of 84.42 U.S. cents on Wednesday though still about 25 percent below its inaugural price of $1.17 U.S.

The sinking euro and surging oil prices, cited this week by the IMF as two of the principal risks facing the otherwise rosy global economy, focused worldwide attention on the G7 meeting in the Czech Republic's capital.

Summers was also somewhat elusive on the subject of oil prices, less than a day after President Clinton authorized the release of 30 million barrels of crude oil from the Strategic Petroleum Reserve, the first time the U.S. has dipped into its reserves in nine years.

Oil release a "welcome" move

The U.S. and the rest of the G7 "welcomed" the U.S. move, though noted in their statement that they were "concerned" about the adverse effect of high oil prices, indicating that "it is important for world oil prices to return to a level consistent with lasting global economic prosperity and stability for both oil producing and consuming countries."

"With respect to the action that was taken, it was certainly a constructive step reflecting a careful attempt to respond to pressures that had gathered in the oil sector over time," Summers said, indicating that the G7 was also concerned about actual scarcity of the commodity.

Organization of Petroleum Exporting Countries' (OPEC) President Ali Rodriguez said Saturday that the oil cartel was not seeking a confrontation with the developed world by restricting supply as prices simmer at their highest level in a decade. Organization of Petroleum Exporting Countries' (OPEC) President Ali Rodriguez said Saturday that the oil cartel was not seeking a confrontation with the developed world by restricting supply as prices simmer at their highest level in a decade.

Rodriguez, who is also Venezuela's energy and mines minister, said there was no oil supply shortage in world markets as consumers in the Northern Hemisphere prepare for winter, and he welcomed an invitation for talks among OPEC, the European Union and the G7.

"We are not great military or economic powers, but developing countries seeking to defend our rights over our natural resources," he told journalists ahead of next week's OPEC summit in Caracas. "It would be grotesque to try to confront the big world powers. On the contrary, they are our customers."

Upbeat economic outlook

Oil prices fell ended the day Friday at $32.68 per barrel on the New York Mercantile Exchange, down from their near $35 per barrel level reached earlier in the week.

As for the world economic outlook, the G7 statement was fairly upbeat, noting that "prospects for continued expansion in industrialized countries and the world economy more generally have further improved in recent months as underlying fundamentals have strengthened." As for the world economic outlook, the G7 statement was fairly upbeat, noting that "prospects for continued expansion in industrialized countries and the world economy more generally have further improved in recent months as underlying fundamentals have strengthened."

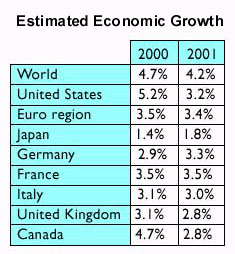

The IMF on Tuesday unveiled its forecast for global economic growth, predicting that the world economy will expand by 4.2 percent in 2001. It warned, however, that high oil prices could dim its predictions.

For the U.S. and Canada, the G7 issued a solid report card, noting that growth remained strong, inflation contained and unemployment low. However, the group cautioned that "fiscal and monetary policies should continue to be prudent" and pointed out that the U.S. savings should be higher.

For the euro region, the G7 were a little more cautious, stating that Europe must intensify structural reforms in order to keep growth strong and inflation contained. Structural reforms refer to the difficulty many of the countries within the European Union have when it comes to boosting productivity.

Russia: Combat money laundering

Turning to former and current IMF-client countries, the G7 asked Russia to push through more structural reforms of its own, including improving corporate governance, enforcement of the rule of law, combating money laundering and creating an efficient financial sector.

While the seven ministers did not name countries specifically, they underscored the need for more corporate and financial restructuring in "many Asian countries" and "policies aimed at reducing vulnerabilities in many Latin American countries."

While the richest nations were debating oil and euros, the world's poorer nations -- including some from Latin America and Asia -- were putting the G7 economies under scrutiny. Finance ministers from developing countries issued a strongly worded statement aimed at the world's most developed nations. While the richest nations were debating oil and euros, the world's poorer nations -- including some from Latin America and Asia -- were putting the G7 economies under scrutiny. Finance ministers from developing countries issued a strongly worded statement aimed at the world's most developed nations.

The Group of 24 said the world's major economies need to become less protectionist to ensure global employment growth and poverty reduction.

All the finance ministers, central bank officials and other delegates managed to meet Saturday with little disruption from protesters. All but one protest materialized Saturday in Wenceslav's Square in downtown Prague, though the crowd quickly dispersed.

|

|

|

|

|

|

|