|

Giving a portfolio more juice

|

|

September 26, 2000: 7:08 a.m. ET

Programmer wants to make better use of every free dollar that she makes

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - In a spendthrift world, Laura Lee Cummings is a definite exception.

A resident of Raleigh, N.C., the 30-year-old computer programmer lives well within the means of her $65,000 annual salary and carries no debt. Her monthly expenses, including rent and car insurance, total $1,800.

She maximizes her 401(k) contributions and puts 36 percent of her take-home pay -- or $1,000 a month -- into savings. From that she contributes $166 a month into a Roth IRA, and $700 a month into a Vanguard 500 Index account intended for a $40,000 down payment on a house. Plus, she has set aside $5,000 for emergency purposes.

"I'm a big-time saver," said Cummings, who would like to buy a home before she's 35 and retire at least partially in her mid-50s. Nevertheless, she's frustrated that her investment portfolio, which now totals nearly $66,000, hasn't grown faster. "I just don't want the money sitting in low-risk funds," she said.

Juice up the investments

Certified financial planners who reviewed Cummings' portfolio applauded her savings efforts. "She is absolutely a rare breed of saver in this country," said CFP Rick Applegate, president of Strategic Capital Concepts in Allison Park, Pa. Still, he added, "She needs more juice for her goals."

Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

They suggested she move into some more aggressive plays for her retirement money and ask her employer to provide greater fund choice in her 401(k) plan, particularly since the company does not offer a matching contribution. Currently, the plan only offers funds run by Principal.

At the same time, the planners suggested, she should shelter some of her down payment money from the market's whims.

Diversify abroad

Currently, her portfolio -- which consists of a $13,500 401(k) account at work, a $34,200 401(k) account from a former job, a $5,500 Roth IRA and a $12,500 taxable mutual fund account -- is overweight in U.S. large-cap stocks, with only 10 percent in international stocks, 5 percent in small-cap equities and 5 percent in fixed income investments.

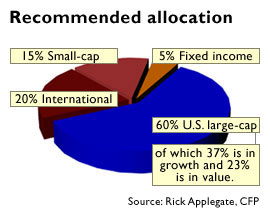

Both Applegate and CFP James Braziel of National Planning Corp. in Chico, Calif., recommend she reduce her large-cap exposure to between 60 percent and 70 percent, inclusive of some mid-cap growth holdings. At the same time, they said she should boost her international investments to at least 20 percent; or even as high as 25 percent, Braziel said. They also thought she should have at least 10 percent of her money in small-cap stocks; although Applegate suggested 15 percent.

Moreover, Cummings should opt for some funds with a more aggressive growth strategy, Applegate said, particularly since more than half her money in her former 401(k) is tied up in two conservative and very similar funds -- T. Rowe Price Equity Income and T. Rowe Price Growth and Income. Moreover, Cummings should opt for some funds with a more aggressive growth strategy, Applegate said, particularly since more than half her money in her former 401(k) is tied up in two conservative and very similar funds -- T. Rowe Price Equity Income and T. Rowe Price Growth and Income.

The easiest way for her to adjust her portfolio is to roll over the old 401(k) money into an IRA, the planners suggested. (An IRA rollover is not always recommended, since in some states such accounts may be more vulnerable to claims made against the investor in a lawsuit or bankruptcy proceedings; but IRAs do receive some protection from creditors in the state of North Carolina.)

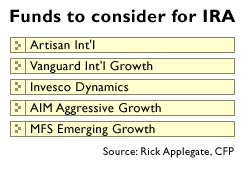

Once Cummings has set up an IRA account, Applegate recommended that she consider investing in Artisan International or Vanguard International Growth for her international exposure; and Invesco Dynamics, AIM Aggressive Growth, or MFS Emerging Growth for small-cap and aggressive growth exposure.

Exercising her options

In terms of sectors, her money is well allocated for the most part, although she is somewhat underweight in technology, the planners said. This, however, is likely to be rectified by the 1,000 stock options her employer -- a technology company -- has given her.

The options, which she may purchase for $6 each, will mature over the next four years, and the first 250 will be available to her this November. Since the stock is now trading around $20, she might make a $14 capital gain on each share should she sell them. The options, which she may purchase for $6 each, will mature over the next four years, and the first 250 will be available to her this November. Since the stock is now trading around $20, she might make a $14 capital gain on each share should she sell them.

Selling is something she might consider doing with 500 of her options, Braziel said, and then add the proceeds to her down payment savings. (He strongly recommended she consult a financial planner about the regulations and tax consequences governing the specific type of options she has before taking action.)

Don't bet the house on Wall Street

Braziel also suggested Cummings keep at least half of the proceeds from the sale of her option in cash or a money market account.

That's because both he and Applegate are concerned that all the money earmarked for her home is in the stock market, which could serve her poorly in the event of a prolonged downturn.

While the Vanguard 500 Index is a very good fund, it would serve her better if she didn't need the money for at least six years, instead of three, Applegate said. "She's expecting too much."

At the very least, he said, Cummings should invest that money in a growth and income fund such as one from T. Rowe Price, which is more conservative.

Early retirement? 'Doable, but ...'

Cummings' desire to retire in her mid-50s is possible given her savings habits, but her circumstances would be much better if she opted for retirement closer to 60 or 65, the planners said.

Click here to read this week's Checks and Balances Column.

Click here to read last week's Portfolio Rx.

That's in large part because the advantages of compounding are magnified when an already large nest egg is allowed to grow, accruing interest and dividends, for a longer period of time.

In any case, Cummings should not assume her expenses will go down in retirement because she plans to be very active and likely will still be paying off the mortgage if she buys a house.

Assuming she continues to max out her 401(k) and gets an 8 percent average annual return on her retirement investments, factoring in 3 percent for inflation, Applegate figures she will have about $30,000 a year to live on if she retires at 55 and lives to age 90.

That may work for her, he said, if she doesn't have a very high standard of living. But if she wants to retire at 55 and live on 70 percent of her current income - or $45,500 - then she will need to save another $1,500 per month. "The problem is she wants to retire so young," Applegate said.

"If she waited just five more years, it would be a piece of cake," Braziel added, noting that he assumes she will continue to contribute not only to her 401(k) but roughly $1,000 monthly to her taxable mutual fund account and her Roth long after she buys her house.

Like everyone planning for retirement and other financial goals, Cummings should monitor her portfolio's asset allocation periodically to make sure the balance of investments is best serving her needs at the time and that the spade she owns is really a spade. This is particularly critical when investing in small-cap funds, for instance, where style shift is possible given how quickly small companies can become mid-caps or large-caps.

And given that a host of unknown factors - marriage, children, career change, and/or illness, not to mention tax law changes - can affect one's financial outlook over the years, it pays to remember that no single projection tells the whole tale and no one plan fits every circumstance. Or, as Braziel noted, financial planning is more art than science.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so that we may reach you.

* Disclaimer

|

|

|

|

|

|

|