|

Spending rise tops income

|

|

September 29, 2000: 8:42 a.m. ET

August income and spending exceed expectations; savings hit record low

|

NEW YORK (CNNfn) - Personal income rose faster than expected in August but not as fast as consumer spending, resulting in the lowest savings rate on record, according to government data Friday.

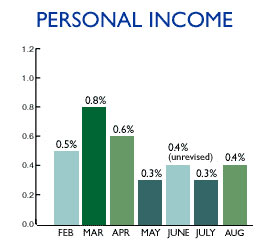

Personal income, which includes wages, interest and government benefits, rose 0.4 percent last month, according to a Commerce Department report. That was a slightly faster pace than the 0.3 percent rate predicted by analysts surveyed by Briefing.com. Personal income rose 0.3 percent in July.

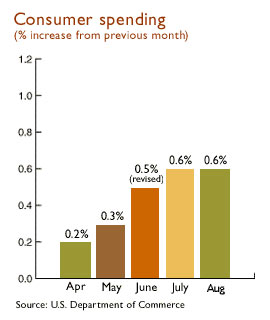

Personal consumption, a measure of spending by individuals, rose 0.6 percent in August, matching the July rate. Analysts had forecast August spending would rise 0.5 percent. Consumer spending fuels an estimated two-thirds of the U.S. economy.

The continued strong spending caused the personal savings rate to plummet. Personal savings, which reflect disposable personal income less personal spending, fell to a negative $25.4 billion in August, compared with a negative $2.8 billion in July. That put the savings rate at negative 0.4 percent, the lowest reading since economists began calculating the figure in 1959. July's savings rate was revised upward from a negative 0.2 percent to zero. The continued strong spending caused the personal savings rate to plummet. Personal savings, which reflect disposable personal income less personal spending, fell to a negative $25.4 billion in August, compared with a negative $2.8 billion in July. That put the savings rate at negative 0.4 percent, the lowest reading since economists began calculating the figure in 1959. July's savings rate was revised upward from a negative 0.2 percent to zero.

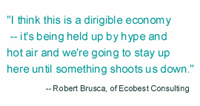

The personal income and consumption data follow a report earlier this week indicating that consumer confidence continues to be strong. That upbeat attitude of U.S. consumers has the power to keep the economy growing despite reports that suggest a cooling, said Robert Brusca, chief economist of Ecobest Consulting.

"I think the consumer is still spending, and I think this is the story," he told CNNfn's Before Hours. "I think the economy is strong. I don't think we're having a soft landing. I don't think we're landing at all. I think this is a dirigible economy -- it's being held up by hype and hot air and we're going to stay up here until something shoots us down." (196KB WAV) (196KB AIFF)

The Federal Reserve meets Tuesday to consider short-term interest rates. It has raised rates six times since June 1999 in order to cool down the economy and reduce the risk of inflation. But it has left rates unchanged at the last two meetings, and few analysts expect a change this time.

Recent economic numbers, such as corporate earnings warnings and retail sales reports, have suggested a slowdown in the economy and consumer spending in recent months. Recent economic numbers, such as corporate earnings warnings and retail sales reports, have suggested a slowdown in the economy and consumer spending in recent months.

Some economists say that while the latest personal spending numbers signal robust consumer confidence, continued growth prospects are questionable in light of the stock market's lackluster performance this year.

"The rapid rise in equity prices sufficed to fill the gap between spending growth and income growth in 1999," Jay H. Bryson, global economist at First Union, wrote in a report. "However, equity prices largely have been flat this year, and year-to-year growth in real consumer spending appears to have topped out." "The rapid rise in equity prices sufficed to fill the gap between spending growth and income growth in 1999," Jay H. Bryson, global economist at First Union, wrote in a report. "However, equity prices largely have been flat this year, and year-to-year growth in real consumer spending appears to have topped out."

One encouraging number in the report for investors is that the price index for personal expenditures was unchanged in August when compared with July data. The index actually fell for both durable and nondurable goods and rose for services, suggesting inflation is under control.

|

|

|

|

|

|

|