|

Xerox warns yet again

|

|

October 2, 2000: 6:46 p.m. ET

Woes continue for copier maker, expects 3Q loss on weak sales

|

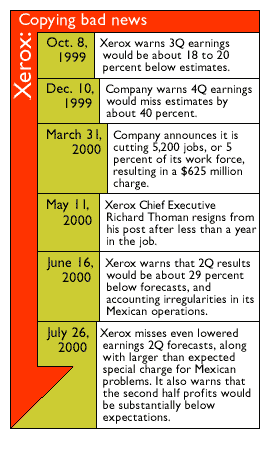

NEW YORK (CNNfn) - Xerox Corp. warned Monday it would badly miss Wall Street's third-quarter earnings expectations and instead post a loss -- the fourth earnings warning the copier giant has issued in the last five quarters.

The Stamford, Conn.-based company said it now expects to lose 15 cents to 20 cents per share during the quarter ended Sept. 30, a sharp reversal from the profit of 12 cents per share analysts polled by research firm First Call had expected.

In a statement released after the closing bell, the company blamed the shortfall on increased competitive pressures and weaker-than-anticipated revenue in North America and Europe, particularly during September, noting, "the expected improvement in high-end sales did not occur." In a statement released after the closing bell, the company blamed the shortfall on increased competitive pressures and weaker-than-anticipated revenue in North America and Europe, particularly during September, noting, "the expected improvement in high-end sales did not occur."

"These results are obviously disappointing and completely unacceptable," said Paul Allaire, Xerox's chairman and chief executive. "Clearly, actions beyond resolving our operational issues are required, including major cost reductions, asset dispositions and a review of the dividend level. Aggressive actions to improve profitability in 2001 are being pursued."

Company officials had already hinted in July when Xerox missed lowered second quarter expectations that its third-quarter earnings would be "modest." The company shifted its sales focus late last year to concentrate more on high-end printing and publishing equipment.

Xerox, whose name is synonymous in office culture with reproducing paper documents, continues to struggle as it tries to move beyond its copier legend.

Instead of being replicated and mailed or faxed, documents used in offices and homes around the world are now typically shared via electronic mail. Xerox has been hurt by this technology shift, and from too little of the company's revenue coming from growth areas such as color copiers or low-cost ink jet printers. Instead of being replicated and mailed or faxed, documents used in offices and homes around the world are now typically shared via electronic mail. Xerox has been hurt by this technology shift, and from too little of the company's revenue coming from growth areas such as color copiers or low-cost ink jet printers.

In addition, the company has also experienced more competition for its core, upper-end black-and-white copiers. Sales in that segment dropped 11 percent in the second quarter, prompting Allaire in July to suggest that improvements in Xerox's sales force and new products would help it stem the loss of business there.

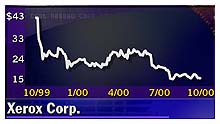

Xerox (XRX: Research, Estimates) shares closed up 31 cents to $15.31 in trading Monday ahead of the warning.

|

|

|

|

|

|

|