|

Tech earnings preview

|

|

October 15, 2000: 6:10 p.m. ET

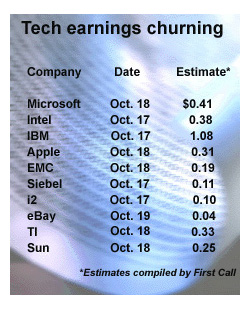

Reports due from Microsoft, IBM, Intel, EMC and other giants

By Staff Writers David Kleinbard and Richard Richtmyer

|

NEW YORK (CNNfn) - This week is the peak of earnings season, with reports from more than two dozen of the best-known names in technology scheduled, along with a raft from lesser-known but emerging firms.

The big stars of the week's earnings show will be IBM, Intel, Siebel, EMC, Microsoft, Texas Instruments, SAP AG, and Sun Microsystems. Those eight companies represent a combined $1.4 trillion in market value.

The previous week's earnings period proved to be like a cheese grater for several major tech names; companies selling at high price-earnings ratios that posted results even slightly short of analyst expectations were shredded.

The most notable example of the cheese-grater effect was Yahoo! (YHOO: Research, Estimates), the world's most heavily trafficked Web site. The Web portal last week exceeded analyst earnings estimates and reported that its third-quarter revenue rose 90 percent to $295.5 million from $155.9 million in the same period last year. While most companies would be thrilled with that revenue growth rate, the company's outlook wasn't good enough to satisfy investors, who drove the stock down 21 percent the day after the earnings report was issued.

Yahoo!'s price-earnings ratio went from an astronomical 170 times estimated 2000 earnings to a still not bargain-priced 136 times as a result of the one-day drop.

Technology investors have proven to be momentum-obsessed, willing to pay 200 times earnings or more for rapidly growing companies that meet their estimates, but trashing them when they miss by even a penny. The Street's obsession with momentum has resulted in some rather curious disparities in valuation. The storage giant EMC (EMC: Research, Estimates), for example, which was little-known just three years ago, now has a market value 29 times higher than that of Apple Computer (AAPL: Research, Estimates) and four times higher than that of Ford Motor Co.

Several of the companies scheduled to report in the week of Oct. 16-20 already have been decimated because they issued an earnings warning or because investors have lost their love for their industry sector. But others, such as EMC and Sun Microsystems (SUNW: Research, Estimates), still have momentum behind them and remain at price-earnings multiples well into the stratosphere.

Click here for a full list of upcoming earnings reports

Here are some highlights of some of the companies due to report between Oct. 16 and 20:

Microsoft - Microsoft is going to provide investors with more detail on its revenue breakdown than it has in the past when it reports its fiscal first-quarter earnings on Oct. 18. The Redmond, Wash. software giant will break out revenue segments for Desktop Software (71 percent of sales in fiscal 2000), Enterprise Software (18 percent of sales), and Consumer Software (7 percent of sales). Microsoft has suffered from sluggish sales of its Windows operating systems and desktop applications, such as Office.

Merrill Lynch analyst Christopher Shilakes recently said that he didn't think Microsoft's (MSFT: Research, Estimates) latest results would benefit from a material acceleration in revenue from its new Windows 2000 operating system. Shilakes is forecasting revenue for the quarter of $5.7 billion, which would be just 5 percent above the same period last year. The mean analyst earnings estimate is 41 cents per share, versus 38 cents in the same period last year, according to First Call.

Intel - Investors have had more than three weeks to recover from the bombshell Intel dropped on the market when, blaming weak sales in Europe, it warned that its third-quarter results would disappoint. Intel, the world's largest supplier of PC microprocessors, had been expected to post revenue growth between 6 and 8 percent and earnings per share of 41 cents per share during the third quarter, according to First Call. However, after the warning, those expectations were taken down to 3 to 5 percent revenue growth and a profit of 38 cents per share.

The Santa Clara, Calif.-based company is set to report its latest results Oct. 17. At the close of trading Friday, Intel shares stood at $40.38, more than 46 percent below their 12-month high of $75.81 which they reached just weeks before the earnings warning.

IBM - Technology bellwether IBM is set to report its third-quarter results Oct. 17, with analysts expecting Big Blue to show a profit of $1.08 per share. That compares with 90 cents per share during the same period last year. When the Armonk, N.Y.-based company reported its second-quarter results, executives promised a strong second half and said they were on track to meet analysts' expectations for the third quarter as well as the full year.

Last month, Goldman Sachs analyst Laura Conigliaro raised a red flag on IBM, warning that the weakening of the euro against the dollar and the British pound could reduce IBM's third-quarter revenue growth by 3.5-to-4 percentage points and its fourth-quarter revenue growth by as much as 5.5 percentage points. The company also reported in its second quarter that the rise in the dollar had reduced sales overseas by 1 percent in dollar terms. At $5.9 billion, IBM's second-quarter revenue from Europe, the Middle East and Africa represented 27 percent of its total.

Apple Computer - Since the return of its dynamic chief executive Steve Jobs, Apple has recovered from the brink, with its popular, low-cost and colorful "iMac" computers leading the way. But the company late last month warned that it hit a "speed bump" which cost it about $55 million in profit during the September quarter. Executives at Apple blamed lower-than-expected education-related sales, which normally peak during September, as well as weak sales of its new "Power Mac G4 Cube" system for the shortfall.

The consensus estimate of 16 analysts polled by First Call is for Apple to earn 31 cents per share during the quarter. That's down from expectations of 45 cents per share prior to Apple's earnings warning. At the end of trading Friday, Apple's shares stood at $22.06, more than 70 percent below their 12-month high of $75.18 and just above a low of $19.12. Apple is set to report its results Oct. 18.

EMC - EMC is the leading supplier of data-storage hardware and software. The explosion of data created by the Internet and data warehousing has caused demand for EMC's products to mushroom. The company's revenue has grown from $2.9 billion in 1997 to $6.7 billion last year and an estimated $8.44 billion this year. The company has a revenue goal of $12 billion in 2001. A $1,000 investment in EMC 10 years ago would be worth more than $806,000 at the end of last year.

EMC (EMC: Research, Estimates) has roughly 23 percent of the market for server-attached storage, and the market for more sophisticated forms of storage, namely storage area networks and network-attached storage, is accelerating. Analysts expect EMC to earn 19 cents per share on revenue of about $2.13 billion when it reports its third-quarter earnings before the opening bell on Oct. 18.

Siebel - Siebel is the leading player in the rapidly-expanding area of customer relationship management, or CRM, software, which is used to collect and analyze information about customers, enabling companies to better target their marketing campaigns and improve customer service call centers. In the second quarter, Siebel's revenue rose 119 percent to $387.4 million from $176.7 million. Net income rose to $54.8 million, or 11 cents per share, from $24.2 million, or 6 cents. The mean analyst earnings estimate when Siebel (SEBL: Research, Estimates) reports its third quarter net income on Oct. 17 is 11 cents.

i2 Technologies - i2 is a leading business-to-business software company best known for its TradeMatrix platform of B2B solutions. TradeMatrix allows companies to set up marketplaces that enable customers and suppliers to do business together in real time. The company's Rhythm product suite does supply chain management, customer management, and product lifecycle management. Its main competitors are Ariba (ARBA: Research, Estimates), Commerce One (CMRC: Research, Estimates), and Manugistics (MANU: Research, Estimates).

The expanding use of the Internet for supply-chain management and inter-company marketplaces resulted in second-quarter revenue for i2 that rose 84 percent to $242.6 million. Net income excluding amortization of intangibles and acquisition-related charges grew to $19.1 million, or 10 cents share, from $4.2 million, or 3 cents, in the second quarter of 1999. When i2 reports its third-quarter results on Oct. 17, analysts expect it to earn 10 cents per share on revenue of roughly $285 million.

eBay - eBay is the world's garage sale. The well-known Web site enables people to sell objects they own and buy just about everything except for firearms, illegal drugs, and human body parts. Analysts like eBay's (EBAY: Research, Estimates) business model because it's based on taking a cut of each sale made on its site, rather than on advertising revenue. Last month, eBay's management announced a revenue goal of $3 billion in 2005, implying revenue growth rates approaching 50 percent per year until that date. Merrill Lynch estimates that the company's revenue will grow to $403 million this year from about $225 million last year.

For the quarter ended June 30, eBay reported revenue of $97.4 million, a 97 percent increase over the $49.5 million reported for the same period last year. Consolidated net income for the quarter was $11.6 million, or 4 cents per share. eBay users sold $1.3 billion of goods through the site that quarter. When eBay reports its third quarter financial results on Oct. 19, analysts expect it to earn 4 cents per share on revenue of $107 million.

Texas Instruments - As the world's leading supplier of digital signal processors, or DSPs, and analog semiconductors, Texas Instruments has positioned itself in one of the fastest-growing segments of the electronics industry. When the company reports its third-quarter results on Oct. 18, analysts are expecting the company to turn in a profit of 33 cents per share, which would be a 50 percent increase over last year's third-quarter earnings.

TI's main products, DSPs and analog chips, are some of the most important components used in consumer electronics such as digital cellular phones and high-speed Internet access devices. Some market watchers estimate that TI supplies about 65 percent of the chips in mobile phones worldwide. However, there has been a split body of opinion developing on Wall Street recently about global demand for wireless handsets. Some believe that it is slowing, while others are expecting it to continue strongly throughout the remainder of the year. Last week, Motorola, the world's No. 2 supplier of wireless handsets, reported a quarterly profit that was in line with expectations, but revenue that fell short of what some analysts had been looking for, which it blamed on slower sales of mobile phones.

Sun Microsystems - Sun Microsystems is the world's leading supplier of Web servers, which are the powerful computers that make up the backbone of the Internet, as well as a top supplier of computer storage-systems and high-end workstations. The company has seen its stock price more than double during the past year as it has aggressively gone after dot.com companies and Internet service providers as they expand their network infrastructures.

When Sun reported its fiscal fourth-quarter results, in July, executives bumped up their revenue and earnings targets for 2001 based on soaring demand for the company's products. The company set a revenue growth target of roughly 30 percent and said earnings should grow at a rate equal to or slightly below the revenue growth rate in the coming year, with particular strength in the first half. Sun is set to post its fiscal first-quarter results on Oct. 18, with analysts expecting to see a profit of 25 cents per share, compared with 17 cents per share during last year's fiscal first-quarter.

|

|

|

|

|

|

|