|

Air earnings to stay aloft

|

|

October 16, 2000: 2:45 p.m. ET

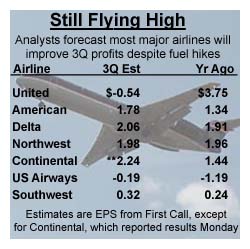

Most airlines are expected to report better 3Q results despite rising fuel costs

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Rising fuel prices apparently won't ground airline profitability this quarter.

Continental Airlines, the nation's No. 5 carrier, reported a better-than-expected gain in profit Monday, and the other major carriers are mostly expected to follow suit.

The exception is UAL Corp. (UAL: Research, Estimates), owner of United Airlines, the world's largest carrier. UAL has already warned it will lose money in the quarter, due partly to the cost of a new labor agreement, and also to schedule disruptions and lost business which occurred during labor negotiations with its pilots union.

But even with fuel prices significantly higher than a year ago, most carriers are coping through a combination of higher fares, strong passenger traffic and long-term fuel purchase contracts known as hedges. But even with fuel prices significantly higher than a year ago, most carriers are coping through a combination of higher fares, strong passenger traffic and long-term fuel purchase contracts known as hedges.

"Demand for air travel has very strong and airlines successfully raised fares four times this year," said Julius Maldutis, analyst with CIBC World Markets, on CNNfn's Ahead of the Curve program Monday. "When you look at airline fares, you'll know why airlines are doing so well."

Some of the more troubled, second-tier carriers, such as Trans World Airlines (TWA: Research, Estimates), America West Holdings (AWA: Research, Estimates) or Alaska Air Group Inc. (ALK: Research, Estimates), are forecast to see earnings fall or even post a loss. US Airways Group (U: Research, Estimates), which is awaiting approval of its purchase by UAL, is also expected to post a loss, but one much smaller than a year earlier when labor trouble and Hurricane Floyd affected its results.

But the other major carriers such as No. 2 American Airlines, which is owned by AMR Corp. (AMR: Research, Estimates), and No. 3 Delta Air Lines (DAL: Research, Estimates), are expected to post much stronger results later this week.

"Air travel is usually one of the first big hits of a slowing economy, but these guys don't believe the economy is slowing," said Ray Neidl, analyst with ING Barings. "It's only going to be a good quarter."

While some of the second-tier major carriers are expected to have company-specific problems, a number of upstart carriers are expected to improve results. AirTran Holdings Inc. (AAI: Research, Estimates), which bought the former ValuJet a number of years ago, Monday posted earnings of $8.9 million, or 13 cents a diluted share, 1 cent a share better than First Call's forecast and up more than double the $3.9 million, or 6 cents a diluted share, it posted a year earlier.

Denver-based Frontier Airlines Inc. (FRNT: Research, Estimates) and Utah-based Skywest Inc. (SKYW: Research, Estimates) are also forecast to post better-than-expected results.

Many airlines are using long-term fuel purchase contracts, known as hedges, to limit the impact of rising fuel. But even with fuel prices remaining high and more and more signs of a slowing economy elsewhere, analysts believe that profits can continue to climb in the fourth quarter.

"I think there's a risk we're going through a period that profits will get squeezed relative to expectations," said Jim Higgins, analyst with Credit Suisse First Boston. "If economy slows dramatically, there could be real downside risk to numbers. But having said that, if we have a soft landing (for economic growth) and fuel prices coming down just a bit, then things could actually improve."

Labor costs also expected to rise

One dark cloud on the earnings horizon is increasing labor costs. Much of the loss at United is due to the cost of a new labor pact with pilots reached in late August. Delta pilots are also seeking a new contract, demanding to be paid even more than the United pilots.

"I think that's the major problem the industry faces today, as result of the United settlement now, you're going to see labor at other airlines make similar demand," said Maldutis. "It's going to spread across the board. Airlines are vulnerable to labor demands. It'll be passed onto you and me." (333KB WAV) (333KB AIFF)

Higgins said that given relatively low valuation of most airline stocks in the face of current oil prices, there's a lot of upside to the stocks that could still be realized.

One thing that scared investors out of the sector was a belief that more mergers were on the horizon, and that AMR and Delta would have to follow UAL's lead to make a major purchase. With the UAL-US Airways deal making relatively little progress towards winning approval lately, the market is starting to believe there won't be a new round of mergers, analysts said.

Despite beating forecasts, shares of Continental (CAL: Research, Estimates) slipped 6 cents to $42.44 in trading Monday. Other carriers' stocks were little changed as well.

-- Click here to send e-mail to Chris Isidore

|

|

|

|

|

|

|