|

Blodget upbeat on AOL-Time

|

|

October 16, 2000: 1:55 p.m. ET

Influential analyst says regulatory talks are heated, but expects U.S. approval

|

NEW YORK (CNNfn) - Regulatory talks surrounding America Online and Time Warner's proposed merger appear to be heating up, but one influential Wall Street analyst on Monday stood firm in his belief that the deal will close by the end of the year, with no major concessions.

Merrill Lynch analyst Henry Blodget, who gained prominence in the analyst community for his surprising predictions about Internet stocks, said that talks between AOL, the leading Internet Service Provider (ISP), and Time Warner, a media conglomerate and cable TV operator that is also the parent of CNNfn.com, are more intense that expected. As such, he said the deal might close later in the year than the November timeframe he last predicted.

Blodget's comments come on the heels of a report in Saturday's Washington Post, which, citing unnamed sources, said that U.S. government and company negotiators have been unable to reach a deal over how the merged company would ensure that rival ISPs would have access to its high-speed cable network. Blodget's comments come on the heels of a report in Saturday's Washington Post, which, citing unnamed sources, said that U.S. government and company negotiators have been unable to reach a deal over how the merged company would ensure that rival ISPs would have access to its high-speed cable network.

The newspaper said that Federal Trade Commission attorneys are preparing litigation to block the merger. An FTC spokesman contacted by CNNfn.com on Monday was not immediately available for comment.

After discussing the article with AOL executives, Blodget said he believes that the sides are closer than the article suggested, and that it would close with no surprise concessions.

"The FTC negotiations are more intense than expected, especially with regard to cable access by other ISPs," he said. "AOL/TWX may have to sign consent decrees, but we believe these would simply formalize policies that the company would have pursued anyway."

Time Warner and AOL representatives on Monday said they continue to have "constructive conversations," which are nearing an end. The companies have long maintained that the deal would close "in the fall." Time Warner and AOL representatives on Monday said they continue to have "constructive conversations," which are nearing an end. The companies have long maintained that the deal would close "in the fall."

Last week, European regulators gave the merger the green light on the condition that AOL (AOL: Research, Estimates) dissolve all of its "structural links" with the German media firm Bertelsmann AG, one of Time Warner's (TWX: Research, Estimates) top competitors.

Weeks before they approved the deal, the European Commission's antitrust regulators reportedly circulated a preliminary recommendation to block the deal.

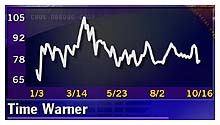

In early afternoon trading on Monday, shares of Time Warner fell $1.04 to $76.96, while AOL shares fell $1 to $52.

|

|

|

|

|

|

AOL

Time Warner

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|