|

Maxing a military portfolio

|

|

October 18, 2000: 11:58 a.m. ET

Colorado couple put nest egg in one basket and seek to make most of pension

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - If you're in your mid-40s and have put in at least 20 years of military service, you walk away with a monthly pension for life and a lot of financial options.

The chance to earn even more money in the private sector is the biggest one.

That way, you can live off your new salary, invest your military pension for your later years, and start accruing assets in a 401(k).

That's Duane Gunn's game plan. A captain in the U.S. Air Force who currently earns about $48,000 per year, Gunn, 34, will be eligible to receive a gross income of about $3,000 a month if he retires at 43, more if he makes lieutenant colonel and retires at 49.

His wife, Julie, also 34, works part-time for a human resources office and grosses about $8,640 a year.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

The Gunns, who are currently stationed in Colorado, hope to be able to retire in 20 years with a nest egg of between $1.2 million and $1.5 million, not including Duane's military pension. They may continue to work past their mid-50s, but ideally because they want to, not because they have to, Duane explained.

So far, they have built up a $105,000 portfolio by investing regularly since their mid-20s in their Roth IRAs and a taxable mutual fund account. But, Duane said, "We still feel we're behind the power curve."

Financial planners, however, say they're off to a good start and very well may reach their goals if they can do the following: diversify their holdings, maintain their current level of savings -- which equals about 14 percent of their combined gross income; quickly eliminate their credit card debt and get a better grip on their spending, which they believe the Gunns, like most people, underestimate.

Take aim with more than AIM

The planners are very concerned that the couple have committed nearly all their money to just one fund -- AIM Summit 1 -- a growth-oriented vehicle with a large-cap bias that has more than half its assets in technology and until recently carried a punishing heavy load.

They agree that the AIM fund is a good one in that it has beaten the S&P 500 long-term and provides some diversification in mid-cap and small-cap stocks. They agree that the AIM fund is a good one in that it has beaten the S&P 500 long-term and provides some diversification in mid-cap and small-cap stocks.

But they strongly urge the Gunns to broaden their holdings much more to counteract any downturns that a given asset class, market sector or single fund may suffer over time.

More than half of the Gunns' nest egg -- $60,000 -- is invested in the fund in their taxable account, which means it would be too costly tax-wise to liquidate if they wanted to invest elsewhere.

That's why the planners recommend the Gunns first move the $39,000 they have in their Roths into other funds, which would be a tax-free event presuming they don't make any early withdrawals from the Roth accounts. They also recommend some of the Gunns' future contributions to their taxable account be made to funds other than the AIM Summit 1 to help balance out their portfolio's asset allocation.

Stocks 24/7

Given the couple's goals for early retirement and their relatively young age, two certified financial planners (CFP) -- Mark A. Cecil of The Acacia Group in Bethesda, Md., and Andy Keeler of the Everhart Group in Columbus, Ohio -- suggest their portfolio be fully invested in stock funds, preferably no-loads in most cases.

While early retirement in some sense means a shortened time horizon, in truth the Gunns should consider their investment horizon a long one, Keeler said. "At minimum these accounts will have to last them into their eighties." While early retirement in some sense means a shortened time horizon, in truth the Gunns should consider their investment horizon a long one, Keeler said. "At minimum these accounts will have to last them into their eighties."

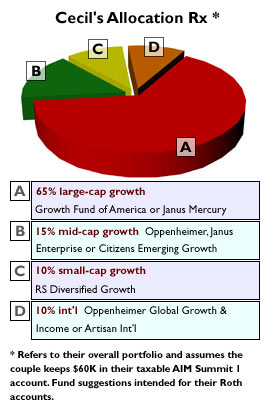

Cecil's model portfolio for the couple was the most aggressive with 90 percent of holdings in domestic growth stocks and 10 percent in international stocks.

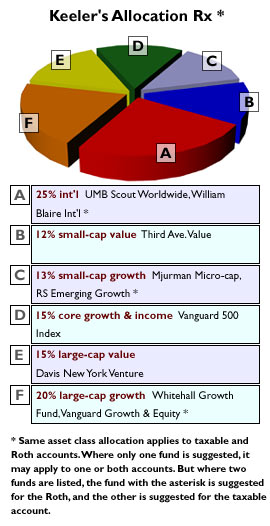

Keeler's was somewhat less aggressive. He suggested 33 percent in U.S. growth stocks, 27 percent in U.S. value stocks, 25 percent in international, and 15 percent in a growth and income stock blend.

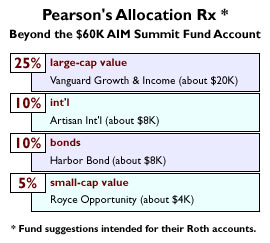

More moderately aggressive still, with only 90 percent in stocks, was the recommended portfolio of CFP Ron Pearson of Virginia Beach, Va., who himself retired from the military after 20 years. Beyond the growth diversification provided by the AIM Summit 1 Fund, Pearson said, the Gunns might consider investing 30 percent of their money in value stocks, 10 percent in international stocks, and 10 percent in bonds.

Financial experts agree, however, that an investor's risk tolerance should be a key consideration when making allocation choices.

Get out while the getting's good

The three planners applauded the Gunns on their savings rate. Every month they put $400 into their taxable mutual fund account as well as $166 into Duane's Roth. In addition, Julie contributes 15 percent of her salary to a newly opened 401(k) account.

In fact, with the military pension coming to them, they're accruing much more than that, Cecil said.

But he strongly recommends Duane retire at 43 rather than 49 because the longer he stays in the military the more he cuts his savings potential. Since he leaves the Air Force with highly marketable skills, staying until 49 means he loses out on six years of investing that $3,000-per-month pension, not to mention the opportunity to qualify for a 401(k), Cecil said. But he strongly recommends Duane retire at 43 rather than 49 because the longer he stays in the military the more he cuts his savings potential. Since he leaves the Air Force with highly marketable skills, staying until 49 means he loses out on six years of investing that $3,000-per-month pension, not to mention the opportunity to qualify for a 401(k), Cecil said.

Still, even without investing the pension, if they maintain their current savings rate and their investments yield an average return of 8 percent per year, they will be close to making $1.2 million by their early- to mid-50s, he said.

Build in wiggle room for pricey changes

But 20 years is a long time and a lot can happen between now and then -- a family for one thing. The Gunns are considering having one child. If they wish to pay for that child's college education they will need to save at least an additional $100-to-$200 a month, Keeler said.

Housing will be another concern. The Gunns live free in military housing and will probably continue to do so until Duane retires. But eventually they may want to buy a house, and that may alter their retirement picture further.

"Life has a way of veering us off our path," Cecil said.

That's partly why the planners suggest the Gunns get clearer about their spending habits, their near-term plans and assess their dollar-goals for retirement as realistically as possible.

For instance, Duane hopes their nest egg will produce 10 percent of income every year starting in their mid-50s. Historically, it's been very difficult to pull that much out of stock assets on an annualized basis, Cecil said, so he recommends they plan on drawing less than the total return they wish to get, such as 6 percent or 7 percent. Any more might strain their asset base, particularly when the market has a bad year.

"They really need to think about more clearly defining their retirement needs," Cecil said. And they can do that, he added, by first "understanding what life is like today to better set goals for the future."

Know thy spending habits

Duane estimated that the couple spend at least $1,600 a month, not including food and entertainment, which he had a hard time putting a price on: "We're bad on that," he said. "We eat out way too much and we entertain way too much."

The $1,600 includes a $477 payment for their new car, about $400 toward their credit card debt, $150 for insurance premiums and $566 in contributions to his Roth and their joint mutual fund account. At the end of the month, he estimated they have about $500 left over, which is spent on gifts and vacations.

Click here to see last week's Portfolio Rx. Click here to read this week's Checks and Balances.

In truth, Pearson said, after doing some after-tax math on their salaries and savings contributions, they probably spend closer to $3,500 a month, especially considering the couple only have about $2,500 in a savings account.

What's more, all the planners were eager for the couple to adopt a cash-only lifestyle and quickly dispense with their $8,000 of credit card debt. "They've got to get rid of that," Pearson said, recommending they do so in no more than 18 months.

With two raises expected next year -- one in January and one in August -- Duane and Julie plan to start contributing $166 a month to her Roth and begin investing in a second taxable mutual fund. But they might first consider devoting both those raises or at least one of them to paying off their debt first, the planners said.

They also should devote some of money to building up an emergency fund worth at least three months' expenses. "I'd like to see more cash on hand, so they don't have to go to credit cards," Cecil said.

Save more now

The money is there for them to achieve these near-term goals, the planners believe. It's just a question of re-channeling how it's allocated.

"If they clamped down on their spending, they could save more," Keeler said. And since "a lot can happen between now and retirement, if they can save it, they should save it."

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|

|

|

|

|

|

|