NEW YORK (CNNfn) - If you want job options -- and a three-car garage to boot -- you want a business degree.

So says Khalil Matta, director of the Management Information Systems (MIS) program at University of Notre Dame's Mendoza College of Business.

According to him, a bachelor's degree in business administration knows no bounds. It's the kind of educational background that's in demand by virtually every company in the nation, from multinational conglomerates to start-ups.

It's also a major that yields big dividends.

"You'll find that our graduates are being paid probably higher than anyone else in the college, and that's just a simple matter of supply and demand," Matta said, noting business majors who specialize in finance and Management Information Systems, or MIS, are in the greatest demand these days.

"The explosion of electronic commerce in the marketplace, by both start-up companies and traditional firms trying to supplement their business lines, has generated a lot of need for those who understand the technology and how the technology fits into business," he said.

What they do

Business administration majors study a little of everything, a well-rounded mix of management, marketing, information technology and finance. They are groomed for leadership.

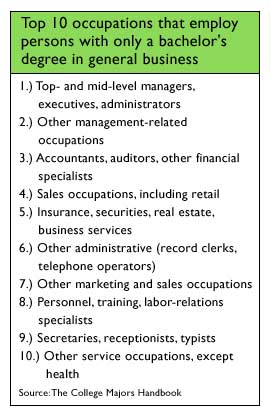

More than two-thirds (68 percent) of general business graduates work for private corporations, The College Majors Handbook, published by JIST Works Inc., reports. About 15 percent are self-employed, 10 percent work for the government or military, and the remaining 7 percent are employed in the education or nonprofit sectors.

The Handbook also notes nearly 75 percent of general business students are male.

Most colleges and universities, in fact, break their programs down into these concentrations: finance, accounting, management, Management Information Systems (MIS), and marketing.

(Click here for a previous "WYD" column on career opportunities for accounting majors.)

MIS majors, one of the fastest growing concentrations, learn how to design, develop, and implement information systems, including computer networks, which support an organization's decision-making processes.

The Bureau of Labor Statistics notes that information systems managers, an occupation projected to grow 36 percent or more through 2008, also oversee the work of computer analysts, programmers and other computer-related workers, who are often more technically skilled.

Many end up working for business consulting firms, including Arthur Andersen, KPMG and Deloitte & Touche. And many others, including Sheila  Okninsky, 21, a current-year graduate from Notre Dame's program, become systems analysts and other information technology specialists. Okninsky, 21, a current-year graduate from Notre Dame's program, become systems analysts and other information technology specialists.

"I always knew that I liked math but I don't really like science so that limited my choices (of a major)," she said. "This just seemed the perfect mix of competitive educe and changing technology. I do work as a programming, applications developer and database administrator -- anything with a computer that you can imagine."

Financial managers, on the other hand, which include the positions of controllers, cash managers, and chief financial officers and branch managers of banking institutions, oversee the preparation of financial reports, direct investment activities and implement cash management strategies, the BLS states in its latest Occupational Outlook report.

That sector is projected to grow 10 percent-to-20 percent -- about as fast as the average for all occupations - through 2008, the government reports, noting rapid consolidation in the banking industry will shrink the number of available positions for branch managers in particular.

Those with strong interpersonal and computer skills, a higher degree and knowledge of international business, will have the best luck in the job market.

And finally, marketing research analysts gather and interpret past sales data to predict future sales. They also gather and analyze data on competitors and study prices, sales and the effects of marketing techniques, in some cases using surveys. That occupation also is expected to grow 10 percent-to-20 percent over the next eight years, according to government data.

Visit CNNfn's Career page regularly to read "Working Your Degree," a new

column that highlights job opportunities for a different college major each week. Click here for a list of previous profiles of these professions: accounting, physical education, biology, political science, English engineering, economics, computer science, physical therapy, history and teaching.

Continuing education

As with most upper-level managerial posts, a bachelor's degree in business administration only gets you so far.

Continuing education is crucial for financial managers, in particular, the BLS notes, "reflecting the growing complexity of global trade, shifting Federal and State laws and regulations, and a proliferation of new, complex financial instruments."

To advance to a truly top post in any of the business concentrations, however, most employers require a master's degree.

Insiders, however, including Milton Blood, managing director of accreditation for the AACSB in St. Louis, formerly the American Assembly of Collegiate Schools of Business, said undergraduate business students these days are putting higher education on hold.

In fact, he notes, MIS students in particular are so heavily recruited that many don't even finish their undergraduate degrees.

"That is certainly our hottest area right now," Blood said. "We just can't train enough people for information systems to meet the needs of corporate America. There's a real concern lately that students are getting lured out of school before they complete their undergraduate degree. That's been the difficulty in that field."

Matta adds: "We are in a special time and there are a lot of exciting things happening. Students face new challenges. A lot of them are afraid that if they leave for grad school and come back they will have missed the train."

Still, Blood and Matta agree that most business students looking to climb the corporate ladder do return for an MBA. Still, Blood and Matta agree that most business students looking to climb the corporate ladder do return for an MBA.

"Many undergrad biz majors will get an MBA at some point along their career and that's why you see so many of our students enrolled in part-time MBA programs," Blood said, noting that way students don't have to derail their careers and they generally get a large percentage of tuition costs paid for by the boss.

Paycheck check-up

According to the latest survey by the National Association of Colleges and Employers, starting offers for business administration grads grew substantially this year, with average salaries climbing to $36,400, or 9.1 percent over year-ago offers.

Management Information Systems (MIS) graduates, NACE found, enjoyed the highest offers among the business disciplines, averaging salaries of $43,953 per year. That's up 5.2 percent over starting offers last fall.

"These grads were sought by many employers, but most aggressively by consulting services companies, computer systems design firms, and computer and electronic products manufacturers," the organization wrote in its 2000 Salary Survey report.

RHI Consulting data cited by the BLS, however, paint an even rosier picture for MIS grads, showing average starting salaries ranging from $51,000 to $100,000 depending upon the area of specialization.

Grads in business systems networking and telecommunications also did well this year, posting average offers of $40,641, NACE reports. Nearly 25 percent of their offers, however, were for $47,500 and more.

"Like MIS grads, these students offer a mix of business and technical skills, a combination that is obviously valuable to many employers," NACE finds.

Those who specialize in a business finance degree also will do well.

Citing the same 1999 survey by Robert Half International, a staffing services firm that specializes in accounting and finance, the BLS reports that salaries of assistant controllers and treasurers varied from $42,700 in the smallest firms to $84,000 in the largest firms; corporate controllers earned between $47,500 and $141,000; and chief financial officers and treasurers earned from $65,000 to $319,200.

Salaries, it notes, are generally 10 percent higher for those with a graduate degree or Certified Public Accountant or Certified Management Accountant designation.

And finally marketing research analysts, the BLS reports, earned a median annual salary of $48,000 in 1998, the most recent year for which data are available. The highest 10 percent earned nearly $95,000 a year.

If you're still wondering how hot the job market is for general business grads right now, just ask a few graduating students. Tim Riely, another current-year Notre Dame grad, for example, went on close to 30 interviews after college and ended up with five solid offers, before choosing to work for Deloitte Consulting in Chicago.

"I knew I was interested in something with a technical nature but I didn't want to get so deep technically that I couldn't see the larger picture," he said of his decision to major in business.

But he does offer one word of warning.

"Some people complain about the business curriculum because you have to take a lot of business classes, not necessarily in your sequence, that you may not like," he said. "There's marketing, management, finance and accounting to take when you might want to take a foreign language."

-- Click here to send e-mail to Shelly K. Schwartz

|