|

GE deal is classic Welch

|

|

October 23, 2000: 3:57 p.m. ET

Jack Welch's twilight acquisition tops off a history of bold moves

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Just months before he was scheduled to retire, General Electric Co. Chairman Jack Welch surprised everyone with a last-minute deal that marks his biggest acquisition ever. It's a swan song that observers say is also a classic Jack Welch maneuver -- fast, decisive and unexpected.

Over the past 20 years, Welch has burnished a reputation as one of the most successful and admired chief executives in history, reaping enormous riches for his shareholders as GE has grown from a light-bulb maker to the world's biggest company with a portfolio that includes aircraft engines, medical systems, financial services and the NBC television network.

And during that time, Welch has developed a cult of personality virtually unmatched in corporate America. It was his decision to delay retirement and stay on as chairman and CEO until the end of 2001 that helped seal GE's $45 billion deal to acquire avionics maker Honeywell International. Honeywell Chief Executive Michael Bonsignore said Monday that having Welch on board through the integration period was "critical" in his company's decision to accept the GE bid instead of an earlier offer by United Technologies Corp.

Observers say the GE-Honeywell deal -- which came just three days after reports surfaced of the proposed United Technologies-Honeywell union -- shows as much about Welch's heft within the business world as it does about General Electric's financial prowess.

As Welch recounted Monday, he was visiting the floor of the New York Stock Exchange on Thursday when he saw Honeywell's stock surge about $10 for no apparent reason. "I damn near dropped -- I didn't know what the hell happened," he said. But after a reporter told him that Honeywell and United Technologies were on the verge of a deal, he mobilized his forces and had a counteroffer ready the next day.

Not many CEOs have the nimbleness -- or the confidence from their boards of directors and the cash reserves -- to act that quickly.

"I think that one of the things about Jack Welch is that over his career he has been able to reexamine the business models and make changes when necessary," said B. Ram Baliga, a professor at the Babcock Graduate School of Management at Wake Forest University. "The other thing is that he makes sure that he and his team are always prepared. The Honeywell acquisition is a real indicator -- there was really no talk of GE being in the picture until this weekend. He is able to act very opportunistically."

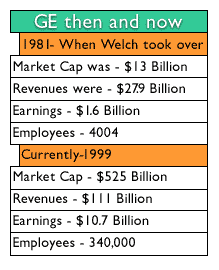

Welch, 64, joined GE in 1960 and became chairman and chief executive officer in April 1981. When the feisty Massachusetts native took control of the company, GE's annual profits stood at about $1.6 billion. Last year, earnings rose to $10.72 billion. During the same period, GE's market capitalization has surged from about $14 billion to nearly $500 billion. Welch, 64, joined GE in 1960 and became chairman and chief executive officer in April 1981. When the feisty Massachusetts native took control of the company, GE's annual profits stood at about $1.6 billion. Last year, earnings rose to $10.72 billion. During the same period, GE's market capitalization has surged from about $14 billion to nearly $500 billion.

Welch has accumulated a track record of financial performance at GE that few other CEOs can match, said Lawrence Horan, an analyst at Parker/Hunter Inc. who follows the company.

"Jack has run GE for approximately 20 years and in that time GE's stock price has risen about 25 percent per year on average," Horan said. "That makes a lot of people who bought the stock 20 years ago millionaires for a very small initial investment. There's not many companies that can do that."

Last year, Fortune magazine named Welch its "Manager of the Century." But Welch's methods aren't universally popular. His aggressive cost-cutting efforts early in his tenure resulted in the disposal of underperforming divisions, including the company's housewares, air conditioning and semiconductor units, as well as the elimination of about 100,000 jobs. The cuts earned him the moniker "Neutron Jack," a reference to a bomb that kills people but leaves buildings standing.

But Welch did not cut costs indiscriminately, instead supporting his subordinates to build units he thought had potential, said Bruce Erickson, a business and government professor at the Carlson School of Management at the University of Minnesota.

"He had a reputation to start out of being a ruthless cost cutter, and he sort of lived that down. The memories of that at GE aren't as bad as they used to be," he said. Welch "seems to have a knack of picking the right industries to get into." "He had a reputation to start out of being a ruthless cost cutter, and he sort of lived that down. The memories of that at GE aren't as bad as they used to be," he said. Welch "seems to have a knack of picking the right industries to get into."

Welch's legacy

Welch's decision to take on a big acquisition as he closes out his career also isn't without risk, observers say. If the Honeywell acquisition is not handled well, it will hurt his legacy. Already, GE stock is down more than 11 percent since the Honeywell takeover talk began last week.

"If it's done successfully, it will be the quote 'crowning glory' of his 21 years," Horan said. But "there's a lot of risk for him personally, because if it's mishandled it goes down as something maybe he shouldn't have done. Staying on is something that's probably required on all fronts. Jack wants to make sure that his legacy is not marred by an acquisition that when handed off was not handled that well."

Welch himself said he has a lot riding on the deal.

"I'm putting 20 years on the line," he said at Monday's news conference announcing the acquisition, adding that his own bank account depended on the deal's outcome. "The guy who owns the most GE stock is me," he said. "I don't own anything else."

But does Welch's decision to stay on for another year reflect a successful executive's reluctance to retire?

Observers say that while Welch may be struggling to find a successor who is as good as he is, they doubt that he will hang on longer than the end of next year. Baliga said the company needs to appoint a successor soon, otherwise potential candidates for the job may get restless and depart for opportunities elsewhere.

Baliga drew an analogy to President Clinton, another leader who he said is also approaching the twilight of his tenure with gusto.

"Clinton clearly enjoys the job, and he has said that if he could he wouldn't mind sticking around," he said. "I think Jack probably enjoys the challenges, and probably would not mind staying on. But if this is seen as a signal to the potential successors, it's possible that you can lose some talent."

|

|

|

|

|

|

General Electric

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|