|

Iraqi threat spooks oil price

|

|

October 26, 2000: 8:59 a.m. ET

Iraq wants payment in euros or will stop pumping oil from Nov. 1

|

LONDON (CNNfn) - Threats from Iraq to halt its crude output sent oil prices sharply higher Thursday on concerns a lack of available oil could cause a winter fuel crisis in the Northern hemisphere.

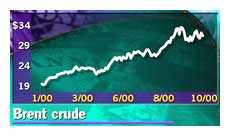

Brent crude for December delivery jumped 76 cents to $32.12 a barrel on London's International Petroleum Exchange. Iraqi sources said the country would suspend oil exports if the United States objects to Baghdad's demand to be paid in euros instead of dollars.

Iraq is refusing to accept dollars as payment for its oil, claiming the United States is conspiring to destabilize the country.

"Iraq is certainly throwing a spanner in the works," J.J. Traynor, head of oil and gas research at Deutsche Bank, told CNNfn.com. "Iraq has carried out its threat three times since 1997. Iraq wants to be paid in euros, but this needs to be discussed at the United Nations."

The United Nations sanctions committee will meet on Oct. 30 to discuss a proposal from Iraqi oil marketing body SOMO that from Nov. 1 all letters of credit for crude oil payment must be opened in euros rather than dollars. The United Nations sanctions committee will meet on Oct. 30 to discuss a proposal from Iraqi oil marketing body SOMO that from Nov. 1 all letters of credit for crude oil payment must be opened in euros rather than dollars.

Iraq pumps about 2.5 million barrels a day, keeping about half a million for its own consumption and exporting between 1.8 million and 2 million barrels. The Organization of the Petroleum Exporting Counties exports 29 million barrels a day, nearly 40 percent of the world's daily demand of 76 million barrels.

Any attempt by Iraq, the U.S.'s sixth biggest oil supplier, to halt exports would reverse 70 percent of the combined 3.2 million barrel-a-day increase in production this year from OPEC nations.

"If Iraq goes through with this it could push prices back to $35-$37 for Brent in which case the U.S. might have to step in and release more of their strategic reserves," said Leo Drollas at the Center for Global Energy Studies.

Saudi Arabia and other producers plan to fill the void left by any suspension of Iraqi oil sales, a senior OPEC delegate claimed on Thursday, although whether they have enough capacity to replace Iraq's oil is not clear.

Oil prices have bumped along close to 10-year highs in the past few months, and OPEC's attempts to lower prices by boosting production have had little impact so far. In attempt to take the steam out of the market President Clinton has so far ordered the sale of 30 million barrels of oil from the U.S.'s strategic reserves.

Escalating tension in the Middle East following violent clashes between Israel and the Palestinians has further unsettled the oil price.

In addition, the market will be watching to see whether OPEC increases output by 500,000 barrels per day if prices remain high enough Friday to trigger its price stability mechanism. The cartel's members agreed to increase output by that amount if their benchmark price for a basket of different crude oils stays above $28 for 20 consecutive working days, which it has done since Oct. 2.

Any order to release the extra oil would probably not come until Monday, because of a one-day delay in calculating the basket price at OPEC's Vienna headquarters.

"Our feeling is that OPEC will agree to the increase, but that the net impact on global supplies will be negligible," analyst Lawrence Eagles at GNI Research wrote in his daily note to investors.

The price of crude oil in the U.S. market declined for a second straight day on Wednesday on the prospect that more oil will be released from the country's national petroleum reserves as well as from OPEC. December crude oil on the New York Mercantile Exchange slipped 41 cents to $32.96 per barrel.

Both the American Petroleum Institute and the Department of Energy reported small increases in U.S. crude oil stocks this week.

The DOE report "suggests that more product (such as heating oil) may be available in the week ahead," Eagles said. "Adding to this, the U.S. 6-to-10 day forecast calls for above-normal temperatures in much of the U.S. northeast."

--from staff and wire reports

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|