|

U.S. job creation slows

|

|

November 3, 2000: 12:19 p.m. ET

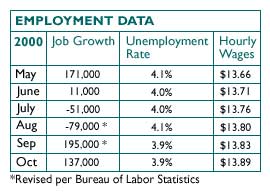

137,000 jobs created in October; wages rise 6 cents; jobless rate at 3.9 percent

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The U.S. economy generated new jobs at a slower pace in October, while average hourly wages crept higher and the jobless rate held steady at a 30-year low, the government reported Friday -- more mixed signals for analysts and investors about whether the U.S. economy is slowing down.

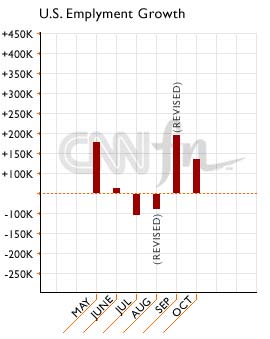

Some 137,000 new jobs were added to the economy last month, the Labor Department said, far fewer than the 190,000 forecast by Briefing.com and the revised 195,000 positions created a month before. Average hourly earnings -- a harbinger of inflation -- rose 6 cents, or 0.4 percent, to $13.89, higher than analysts' forecasts of a 0.3 percent increase. The jobless rate held steady at 3.9 percent. Some 137,000 new jobs were added to the economy last month, the Labor Department said, far fewer than the 190,000 forecast by Briefing.com and the revised 195,000 positions created a month before. Average hourly earnings -- a harbinger of inflation -- rose 6 cents, or 0.4 percent, to $13.89, higher than analysts' forecasts of a 0.3 percent increase. The jobless rate held steady at 3.9 percent.

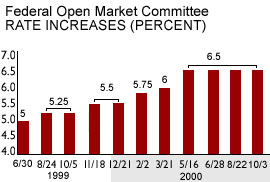

The report offered yet another fuzzy snapshot of the U.S. economy. While the slower pace of job creation suggests the Federal Reserve's series of interest rate increases is damping hiring intentions, the increase in hourly wages indicates companies are paying their workers more -- something that could spark faster inflation as firms lift prices to offset their rising labor costs, and as workers spend their fatter paychecks.

"In the light of the big increase in compensation costs reported in the productivity data, we think the risk now that wages will genuinely accelerate over the next few months is very real," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. "Accordingly, while the markets might like the sign of slower growth evident in the payroll numbers, there is little to make us think Fed easings are near."

Wage inflation woes

Indeed, the Labor Department reported Thursday that labor costs for U.S. companies jumped in the third quarter, an indication that workers are beginning to demand more for their contributions on the job in an economy where demand for the goods and services they produce is beginning to wane.

Financial markets registered a somewhat negative reaction to the report as investors reasoned that the jump in hourly wages could portend faster inflation as companies pay their workers more and those workers spend their additional wages. Stocks took divergent paths in midmorning trade, while bonds retreated. Financial markets registered a somewhat negative reaction to the report as investors reasoned that the jump in hourly wages could portend faster inflation as companies pay their workers more and those workers spend their additional wages. Stocks took divergent paths in midmorning trade, while bonds retreated.

The report offered few indications that the tight labor market is easing, even as a host of other indicators shows the economy has begun to react to the Fed's series of rate increases. The Fed raised rates six times between June 1999 and May 2000 but has held rates steady at three meetings since. It is expected to do so again when it next meets Nov. 15.

"It confirms that as we started the fourth quarter the economy continues to slow," said Hugh Johnson, chief investment strategist with First Albany Corp. in Albany, N.Y. "At the same time that the economy is slowing, there is ongoing tightness in the labor markets and ongoing upward pressure on wages."

Politics of economics

The report was the last major indicator to be released before next Tuesday's presidential elections. According to the daily tracking poll released by CNN/USA Today/Gallup, Texas Gov. George W. Bush maintains a narrow lead over Vice President Al Gore in the presidential race. Bush has the support of 47 percent of those surveyed while Gore draws 43 percent. The poll has a margin of error of plus or minus two percentage points.

Labor Secretary Alexis Herman, appointed by President Bill Clinton on May 1, 1997, told CNNfn.com that Bush's proposed plan to cut taxes would harm the fiscal discipline that has allowed the current U.S. administration to turn the record deficit into a record surplus, fueling economic growth and creating more new jobs than ever before.

"I believe that the proposal by the governor to not use the surplus to continue to pay off the debt could be harmful," she said. "We have to make sure we are going to continue to make the right investments in education to continue promoting jobs, and so far we have not had any evidence that those things will happen under Gov. Bush's plan."

As for the report itself, Herman said the numbers painted a picture of moderating job creation, but that the overall job market remains robust. "I think overall this a report that shows the economy is in balance," she said. "It think we are seeing signs of moderation, but overall it shows that the economy remains strong after a lengthy period of expansion."

Record-low unemployment

October marked the 13th consecutive month that the nation's jobless rate has rested at or below 4.1 percent; when the Democrats took the White House in 1992, the unemployment rate averaged 7.5 percent.

Employment in service-related industries rose by 99,000 last month after increasing 229,000 the month before. Retail employment rose 4,000 after falling by 21,000. Manufacturing employment showed no change after losing 69,000 jobs a month earlier. Construction jobs rose by 34,000 in October, as seasonal layoffs were lighter than usual, Labor said.

Meantime, the pool of available workers -- which combines the number of unemployed job seekers and those not looking for work in the last 12 months who said they would take a job -- rose to 9.9 million in October from 9.8 million in September, indicating the number of available workers willing and able to fill jobs is on the rise. Meantime, the pool of available workers -- which combines the number of unemployed job seekers and those not looking for work in the last 12 months who said they would take a job -- rose to 9.9 million in October from 9.8 million in September, indicating the number of available workers willing and able to fill jobs is on the rise.

"I always say we don't have a worker shortage in this country, we have a skill shortage," Herman said. "This is an economy that needs skilled workers and what we're trying to do is manage the change that is taking place and help provide those skills so that more positions can be filled."

As for the Fed, Anthony Chan, chief economist with Banc One Investment Advisors, told CNNfn that October's employment report will likely prompt Fed officials to keep a more watchful eye on any inflation pressures, but that it won't sway Fed Chairman Alan Greenspan or anyone else on the Federal Open Market Committee to raise rates. (261KB WAV) (261KB AIFF)

Separately, the Commerce Department reported that orders at U.S. factories gained 1.6 percent in September after gaining a revised 2 percent in August. Orders for durable goods, meantime, advanced at a revised 3 percent pace on the month compared to a 2.9 percent advance in August.

|

|

|

|

|

|

|