|

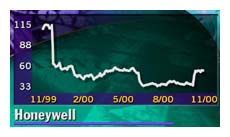

Honeywell delays unit sales

|

|

November 10, 2000: 11:06 a.m. ET

Company pulls four businesses off the block pending takeover by GE

|

NEW YORK (CNNfn) - Honeywell International Inc. cancelled plans Friday to divest four ancillary business units already earmarked for sale until it finalizes its multi-billion takeover by General Electric Co., signed last month.

The Morristown, N.J.-based aerospace and transportation products company said it is discontinuing plans to sell its Friction Materials, Automotive Consumer Products Group, U.S. Security Monitoring and Pharmaceutical Fine Chemicals businesses in light of the merger.

Company spokesman Tom Crane said the decision was made to help expedite its purchase by General Electric, which agreed last month to acquire Honeywell for $45 billion, but did not preclude selling the units at a future date.

"We felt the prudent thing to do at this point was to discontinue to divestiture process," he said.

Still, while Honeywell was accepting bids for its consumer products and pharmaceutical chemicals operations, it already had struck a deal in early September to sell the Friction Materials unit, which primarily produces automotive brake products, to Questor Partners Fund II LP., a Southfield, Mich.-based investment fund. Still, while Honeywell was accepting bids for its consumer products and pharmaceutical chemicals operations, it already had struck a deal in early September to sell the Friction Materials unit, which primarily produces automotive brake products, to Questor Partners Fund II LP., a Southfield, Mich.-based investment fund.

Crane said Honeywell had reached an undisclosed agreement with Questor to discontinue that transaction.

It is unclear which, if any, of the four units General Electric would be interested in retaining following the transaction. All four were put on the block to help shore up the company's bottom line and revive its sagging stock price prior to Honeywell's takeover discussions, first with United Technologies Inc. and then with General Electric.

The company has been forced to trim its earnings expectations twice this year leading up to the merger and faced accusations from investors and analysts that it had become too bloated following the union of Honeywell and the former Allied Signal last year.

The consumer products unit, which includes such well-known brands as Prestone, the leading automotive antifreeze/coolant in the United States, and Autolite, a producer of spark plugs, generates more than $1.1 billion in annual revenue. The Friction Materials unit has a similar revenue stream and several well-known product names, including Bendix.

Analysts expected the company could garner up to $3 billion by selling the four operations by the first quarter of next year.

Honeywell shares lost 75 cents to $52.94 in mid-morning trading Friday.

|

|

|

|

|

|

Honeywell

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|