|

Venture capital still flowing

|

|

November 13, 2000: 7:30 a.m. ET

Funding dipped only slightly in the third quarter despite jittery market

|

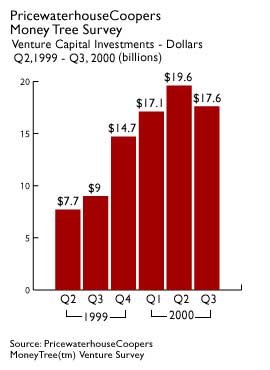

NEW YORK (CNNfn) - A Wall Street wary of technology stocks has not had a major effect on venture capital. In the third quarter of 2000, according to a survey released Monday by PricewaterhouseCoopers, venture capital funds raised $17.6 billion.

That figure represents a slight dip the record $19.8 billion raised in the  second quarter, but is still nearly double the $8.9 billion recorded in the third quarter of 1999. second quarter, but is still nearly double the $8.9 billion recorded in the third quarter of 1999.

Despite the third-quarter drop, PricewaterhouseCoopers is still projecting that venture capital investments for 2000 will hit a total of $70 billion, twice the $35 billion collected over the course of 1999.

"Turmoil in the Nasdaq has had just a minor ripple effect in the venture capital market," said Tracy Lefteroff, managing partner of PricewaterhouseCoopers' venture capital practice. Lefteroff added that as the market has cooled, venture capitalists tailor their investing strategies to the changing conditions.

Shying away from e-commerce

At least one of those changes to their investing strategies was evident in the third quarter report. Venture capitalists poured less, though still substantial, sums into Internet companies in the third quarter for the first time in recent quarters following a major shakeout among dot.coms. In the third quarter, a total of $10 billion went into Internet companies, down from a high of $11.9 billion in the second quarter of 2000.

Lefteroff noted that venture capitalists, while they continue to write checks to Internet businesses, have shied away from the e-commerce sites following many high profile failures this year. Instead, the majority of venture money, nearly $6 billion, backed Internet tools and applications, including companies providing Web site security and Internet service providers. Both business-to-business e-commerce and business-to-consumers Internet companies took in less than $1 billion during the third quarter.

The single largest deal of the quarter, according to PricewaterhouseCoopers, was landed by Denver-based Relera, an Internet service company, which raised $207 million.

The VCs also turned their attention to new sectors of technology including optical networking companies, which clocked the biggest investment increase of any category of business. Among the optical networking companies that received funds were Sunnyvale, Calif.-based Novalux, which raised $109 million and Colorado-based Network Photonics, which received $70 million.

The number of deals dropped during the quarter, while the size of deals increased, also expected following a downturn in the stock market. Rather than spread their money among many companies, most venture capitalists invest more in those companies they think have the highest chance of success.

The number of deals dropped 11 percent to 1,283 from 1,432 during the second quarter. The average amount invested increased only slightly, to $13.74 million from $13.67 in the previous quarter. That figure, however, is a huge jump from the average deal size in the third quarter of 1999, which was $8.9 million.

The billion-dollar club

Another indication that venture capital investing is weathering the market downturn is the fact that at least a dozen funds worth more than $1 billion, a sum unheard of just a few years back, closed in the first nine months of 2000.

"It is truly unprecedented," said Lefteroff.

The billion-plus club is comprised mostly of major venture capitalists with long track records of solid investing including several Silicon Valley stalwarts like Accel Partners, New Enterprise Associates, Benchmark Capital, the Mayfield Fund and Oak Investment Partners. But in the last quarter, it became apparent that it's not only the old guard of San Hill Road that can raise that kind of money.

Relative newcomers to the venture capital world scored big in the third quarter. Redpoint Ventures of Palo Alto, Calif., just a year old, closed its second fund in August with $1.25 billion. VantagePoint Venture Partners of San Bruno, Calif., a relatively unknown firm, closed a $1.6 billion fund in October. St. Paul Venture Capital, based in Minneapolis, also announced it raised $1.3 billion last month.

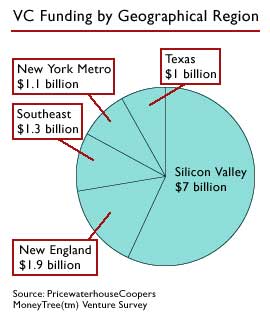

Silicon Valley still reigns

As usual, the vast wealth of venture capital is far from being evenly spread  across the nation. The major bulk of it again was sunk into companies headquartered in that skinny peninsula south of San Francisco called Silicon Valley. Nearly $7 billion in venture money invested in Silicon Valley companies. What was left over, after Silicon Valley took its share, went to companies in New England, the Southeast, the New York City metropolitan area and Texas. New England took in $1.9 billion, the Southeast raised $1.3 billion, the New York area received $1.1 billion, and Texas companies garnered just about $1 billion. across the nation. The major bulk of it again was sunk into companies headquartered in that skinny peninsula south of San Francisco called Silicon Valley. Nearly $7 billion in venture money invested in Silicon Valley companies. What was left over, after Silicon Valley took its share, went to companies in New England, the Southeast, the New York City metropolitan area and Texas. New England took in $1.9 billion, the Southeast raised $1.3 billion, the New York area received $1.1 billion, and Texas companies garnered just about $1 billion.

|

|

|

|

|

|

PricewaterhouseCoopers

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|