|

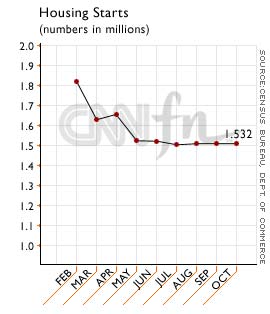

Housing starts edge up

|

|

November 17, 2000: 11:20 a.m. ET

New homes under construction in October score 0.1% gain in month

|

NEW YORK (CNNfn) - The number of new homes under construction edged up slightly in October, but grew at a much slower rate than expected, the U.S. Commerce Department reported Friday.

Still, the figure points to a surprisingly strong housing market sparked by consumer confidence and stabilizing mortgage rates, analysts said.

The number of new houses and apartments under construction in October edged up 0.1 percent to a 1.532 million annual rate from the 1.530 million rate reported in September.

The number fell short of the estimates of analysts polled by Briefing.com, who had expected a 1.550 million unit rate, or an increase of 1.3 percent.

Housing starts, or the beginning of construction on residential units, are an important predictor of consumer purchasing, due to the need to furnish new houses with appliances and furniture.

Shopping for a house? Click here for home buying tools

"Basically, that's saying that it's unchanged. We were doing well, not as well as last year, but we're doing well, and this says we're still doing well," Michael Carliner, an economist with the National Association of Homebuilders, told CNNfn's "Before Hours" program Friday. "But we haven't slowed down any further. We slowed down quite a bit between the middle of the year and summer, but from here on through, and I think next year as well, it will be pretty flat."

He added that lower mortage rates also should help keep the sector alive. [WAV 229KB] [AIFF 229KB]

During the first 10 months of the year, new units under construction were at a 1.372 million rate, down 4 percent from the 1.422 million in the year-earlier period.

New building permits issued in October rose to 1.537 million, or 1 percent above the revised September rate of 1.518 million.

James Annable, chief economist at WingspanBank.com, said consumer confidence remains strong despite six interest rate hikes and recent market volatility, and that is what has shored up the housing sector, preventing it from slipping further than it did in October.

"There is nothing that looks at the future capacity to have income as much as the housing sector, and the fact that this sector has held together as well as it has ... is indicative to me that consumers are feeling very good about their economic prospects and that they are going to continue to spend," Annable said. "Households are enormously confident and their wages are going up, and they've got income to spend. That's going to make it hard to slow down spending."

|

|

|

|

|

|

|