|

Storage sell-off

|

|

November 17, 2000: 2:49 p.m. ET

All bets are off for storage stocks in the short-term, but the long view is good

By J.P. Vicente

|

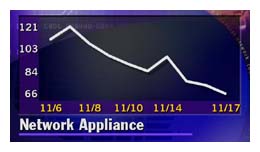

SAN FRANCISCO (www.redherring.com) - When storage company Network Appliance reported on Tuesday that it expects revenue growth to slow slightly in the coming quarters, the news sent the company's stock into a tailspin, adding momentum to a sell-off that was speeding up over the past month. Although Network Appliance competitor EMC rallied slightly on Tuesday, it too is down sharply in the last month on concerns that demand for storage is slowing.

All bets are off for network-storage stocks in the short term, but if you're in the market for the long run, and you happen to own Network Appliance or EMC, here's a piece of advice: forget about recent price drops and stick to your holdings.

And if you don't already own any network-storage stocks, here's some advice for you: get them while they're cheap! And if you don't already own any network-storage stocks, here's some advice for you: get them while they're cheap!

Why? Storage is currently the fastest-growing segment in the technology world. The main players in this market are solid companies with near-flawless balance sheets and steady streams of earnings and revenues. And forecasts for the sector, no matter how you slice the numbers, show that demand for storage products will continue to grow at a brisk pace -- at least 20 percent a year -- over the next decade.

Don't leap before you look

So why, you may ask, have stocks such as EMC, Network Appliance, Veritas Software (Nasdaq :VRTS), and Brocade Communications Systems (Nasdaq :BRCD) all tanked in the past 30 days?

Analysts attribute the price drop mostly to an adjustment in the multiples of those stocks. Storage companies have been among the best-performing tech stocks this year, and as a result, they've traded at very high valuations.

So even though Network Appliance reported that sales in its fiscal second quarter grew 109 percent on a year-over-year basis while net earnings jumped 120 percent, the indication of slower revenue growth ahead was all the justification momentum investors needed to head for the exits.

"One can argue that the market might've gotten ahead of itself, and might have pushed up prices of some of these companies a bit too high. But the recent drop is an overreaction," says Mark Kelleher, an analyst at FAC/Equities, a division of First Albany Corporation. "I see this as a buying opportunity. Prospects for the sector are still extremely positive."

Indeed, they are. That's because the drivers of growth in the storage arena remain mostly intact, despite the fact that some other segments of the technology sector -- such as PCs and consumer software -- appear to be slowing down.

A recent survey of information technology (IT) officials, conducted by the research firm Dataquest, showed that spending on storage devices is expected to grow by 22.4 percent annually through 2004. That compares to 11.3 percent growth in overall IT spending, 6.2 percent growth in server spending, and 5.9 percent growth in PC purchases. Meanwhile, the U.S. gross domestic product (GDP) is seen expanding by an annual 3.6 percent in the period.

Honey, we need more bookshelves again

There's more. The number of Internet users -- currently around 170 million worldwide -- is expected to continue to double over the next few years. Although a slowdown of sorts is expected, it's widely accepted that some 50 million new users will be added every year over the next ten years. All those people will surf the Web, write emails, create Word documents and Excel spreadsheets -- you name it. And all that data will have to be stored somewhere.

As if those arguments weren't compelling enough, two more forces are driving the sector's long-term growth. As broadband access to the Internet (DSL, cable modems) becomes mainstream over the next few years, users will start creating and exchanging larger files -- such as pixel-intensive digital pictures, even larger MP3 files, and all those homemade digital videos. Needless to say, users will require bigger "boxes" to store those files.

And let's not forget about backup and redundancy systems at both corporations and Internet service providers. The larger the live network, the larger the space needed for backing everything up. "The key growth drivers are all in place," says Tom Kraemer, an analyst at Merrill Lynch.

But that's not to say storage companies, as B.B. King would sing, "can't do no wrong." Such growing markets tend to attract competition, which, in turn, creates price wars, which send revenues dropping. Although the barriers to entry are high -- mostly because of high research-and-development spending demands -- analysts say competition will only get stiffer.

Everbody wants to store the world

Old dogs in the tech world, such as IBM (NYSE :IBM), Compaq (NYSE :CPQ), Hewlett-Packard (NYSE :HWP), and Sun Microsystems (Nasdaq :SUNW), have all been scrambling to beef up their storage units in order to compete against EMC and Network Appliance. IBM, for instance, has already instructed its PR machine to start touting its new storage software, Storage Tank, even though the actual product won't be delivered until late next year.

Competition between the two storage leaders is fierce, as well. EMC is expected to launch a new product in early December to compete more aggressively with Network Appliance in the highly lucrative and fast-growing network attached storage (NAS) market, where Network Appliance is currently the undisputed leader.

Ashok Kumar, an analyst at U.S. Bancorp Piper Jaffray, wrote recently that short-term upside for Network Appliance is capped by jitters about the possible inroads EMC's new product might make into Network Appliance's market share.

Also, analysts say, growth rates of more than 100 percent a year -- like Network Appliance's, for instance -- are not sustainable in the long run. "While we are very confident about the firm's underlying fundamentals ... Network Appliance's rich multiples require continued strong upside surprises and estimate increases, both of which are unlikely to happen near-term as the law of large numbers catches up with the company," says Andrew Neff, an analyst at Bear Stearns.

Mr. Neff was one of the few analysts who downgraded Network Appliance earlier this week after the company announced its fiscal second-quarter results, and he does have a point. Storage stocks are indeed expensive. Despite a 49 percent drop over the last 30 days, Network Appliance still trades at 172 times estimated fiscal 2002 earnings as of Thursday's close. EMC trades at 84 times fiscal 2002 earnings, while Brocade trades at 208 times forecast profits for fiscal 2002.

Yet we believe that, at $73 a share, this is a good time to buy Network Appliance. At this level, Network Appliance's trailing price-to-sales ratio is 32, only 19 percent higher than EMC's price-to-sales ratio of 26, even though Network Appliance's revenues are growing twice as fast. The truth is that long-term investors should remain unfazed by recent price swings, as strong growth rates combined with expanding Internet usage will continue to bolster the sector. Just think about it: what do you think is going to happen to the Net's overall storage-capacity needs after your next mouse click?

Discuss networking, communications, and optical technologies and trends in the Network Talk discussion forum, or check out forums, video, and events at the Discussions home page.

© 1997-2000 Red Herring Communications. All Rights Reserved.

|

|

|

|

|

|

|