|

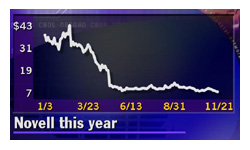

Novell meets Street

|

|

November 21, 2000: 5:18 p.m. ET

Network software vendor meets expectations; posts break-even results

|

NEW YORK (CNNfn) - Computer networking software vendor Novell Inc. on Tuesday reported fiscal fourth-quarter financial results that were in line with Wall Street's expectations but down sharply from the corresponding period a year earlier.

And executives at the Provo, Utah-based company said it will be several quarters before the measures that have been taken to step up sales begin to show real results.

After the close of trading, Novell (NOVL: Research, Estimates) posted break-even results, excluding the impact of restructuring charges, for the three-month period ended Oct. 31. However, including restructuring charges of $48 million, Novell reported a net loss of 11 cents per share during the fourth quarter.

In the year-ago quarter, the company had net income of $74 million or 21 cents per share.

At $273 million, Novell's most recent quarterly revenue fell 20.8 percent from the $345 million in revenue the company logged in the fourth quarter of fiscal 1999.

Analysts polled by earnings tracker First Call had expected Novell to post break-even results during the quarter on sales of about $270 million.

For the full fiscal year, Novell's financial results also came in below the year earlier. At $1.16 billion, the company's total sales for the year were 8.7 percent below the $1.27 billion logged in fiscal 1999. Meanwhile, net income fell more than 74 percent to $49 million, or 15 cents per share, from $191 million, or 55 cents per share in 1999.

After slipping 9 cents to $7.44 in Nasdaq trade ahead of the earnings announcement, Novell (NOVL: Research, Estimates) shares fell another 62 cents, or 8.4 percent, to $6.81 in after-hours trade Tuesday.

Novell has been struggling for more than a year as its mainstay product, called Netware, has faced increasing competition from Microsoft's Windows products as well as the growing popularity of the freely distributed Linux operating system.

The company has taken a number of steps in an effort to realign its business to adapt to the changing environment. Last year, Novell shifted its focus on to more specialized segments within the software industry, specifically the market for "directory-enabled" network applications and services, which are used to unify and manage disparate directories residing on a common network infrastructure.

In September, Novell laid off 900 employees, or about 16 percent of its total work force, in an effort to reduce its operating expenses in the wake of a similarly dismal third quarter.

Executives at Novell acknowledged that the company has had a difficult year and said the measures they have taken to turn things around will take several quarters before they become fully effective. Executives at Novell acknowledged that the company has had a difficult year and said the measures they have taken to turn things around will take several quarters before they become fully effective.

"Fiscal 2000 has been a very difficult year for Novell following dramatic declines in traditional packaged software sales," said Eric Schmidt, Novell's chairman and chief executive.

He said growth in the company's new areas of focus did not accelerate fast enough to offset a sharp decline in packaged-product sales.

During the full fiscal year, Novell said its packaged software sales declined by $243 million, or 47 percent, to account for 23 percent of total revenue. Meanwhile, large network site licenses and sales to computer equipment manufacturers rose only 12 percent, the company said.

The company is currently rebuilding its distribution channel around partners it says can deliver and support its new products. It began to implement these new programs in October, and expects to complete that task by the end of the first fiscal quarter.

However, it will take several quarters before the new distribution system becomes fully effective, according to Dennis Raney, Novell's chief financial officer.

"We expect overall Novell revenue performance to continue to be soft until we gain the combined benefit of new e-business deployments and complete a shift in channel programs to include a new group of partners from the ranks of consulting systems integrators and other service providers," Raney said.

Looking ahead, the company said it expects fiscal first-quarter revenue to decline from the most recent quarter, followed by sequential increases in revenue through the remainder of the year. Novell expects the fourth quarter of fiscal 2001 to be its strongest of the year, which is in line with the seasonal patterns it has seen historically.

|

|

|

|

|

|

|