NEW YORK (CNNfn) - U.S. stocks tumbled Wednesday as the impasse over the presidential election appeared no closer to ending 15 days after the nation went to the polls.

Technology stocks sold off for a fifth day, sending the Nasdaq composite index to its lowest level in more than a year. And losses to drug and tobacco stocks weighed on the Dow Jones industrial average as investors handicapping the fast-changing White House impasse sold stocks considered helped by a George W. Bush presidency.

In a legal victory for Vice President Al Gore, the Florida Supreme Court ruled that hand recounting in three heavily Democratic counties be used in the final tally. But hours later, officials in one of those counties, Miami-Dade, ended their manual recount of ballots, a possible setback for Gore's bid. Stocks, which came well off their lows on this latest news, fell sharply by day's end.

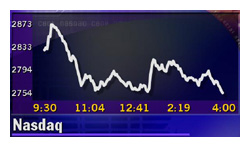

Whatever happens, this much is clear: The protracted battle for the presidency has not helped stocks. The Nasdaq is down 19 percent since Election Day.

"It's a very loud distraction for the markets," Eric Wiegand, equity strategist at Credit Suisse Asset Management, told CNNfn's market coverage.

Still, Wiegand said the problems of cooling corporate profits are independent of any political questions and could continue to hurt stocks.

"The economy is slowing, and a slowing economy has repercussions on earnings," he said.

The Nasdaq fell 116.11 points, or 4 percent, to 2,755.34. The loss marks the Nasdaq's lowest close since Oct. 19, 1999, when it finished at 2,688.18.

The Dow industrials shed 95.18 to 10,399.32, while the S&P 500 lost 25.99 to 1,322.36.

Investors seeking safety from the sell-off snapped up fixed-income securities, sending Treasurys higher.

But at least one market watcher forecasts an end to the damage.

"Once we get through the uncertainty, we could have a real powerful move on the upside," Linda Jay, floor trader at RPM Specialists, told CNNfn's Market Call.

More stocks fell than rose. Declining issues on the New York Stock Exchange beat advancing ones 1,838 to 940. More than 965 million shares traded. Nasdaq losers topped winners 2,887 to 1,063 as nearly 1.87 billion shares changed hands.

Wednesday marked the last full trading session of the week. U.S. markets are to close Thursday for Thanksgiving. Trading on Friday wraps up at 1 p.m., ET.

In currency markets, the dollar held steady against the euro but rose versus the yen.

The wait for the White House

Miami-Dade's decision to end its hand recount means that Gore needs two other counties, Broward and Palm Beach, to erase Bush's lead.

The tallies in those counties, where recounts are continuing, became more significant late Tuesday after the Florida Supreme Court said hand recounting there should be used to determine the presidency.

Texas Gov. Bush criticized the decision, without elaborating on what action his campaign would take, casting more doubt on the outcome. Texas Gov. Bush criticized the decision, without elaborating on what action his campaign would take, casting more doubt on the outcome.

Drug and tobacco companies, which could face looser regulation under a Bush administration, sold off. Merck (MRK: Research, Estimates) fell $1.56 to $90.69, while Philip Morris (MO: Research, Estimates) lost $1.63 to $35.81.

But Microsoft (MSFT: Research, Estimates), whose antitrust problems might lessen with a Bush Justice Department, recovered from earlier losses, to rise 50 cents to $68.24.

The losses in drug and tobacco stocks dragged the Dow down even as Coca-Cola (KO: Research, Estimates) rallied.

Shares of the soft drink maker jumped $4.31 to $59.56 after saying it was no longer interested in acquiring Quaker Oats (OAT: Research, Estimates) in a multibillion dollar deal. Hours later, France's Groupe Danone said it is interested in buying the maker of breakfast cereals and Gatorade sports drinks.

Quaker, which rallied Tuesday, shed $7.44 to $87.

Among other decliners, Intuit (INTU: Research, Estimates) fell $4.31 to $43.88 even as the maker of Quicken software posted a narrower-than-expected quarterly loss of $21.4 million, or 10 cents per diluted share. That's better than the loss of $25.3 million, or 13 cents per share, for the same period last year. Concern about revenue caused at least one firm, ABN Amro, to downgrade Intuit and lower its stock price target.

Click here for a detailed look at the tech stock sell-off.

Stocks have been falling since Labor Day as evidence mounts that profits will slow as the U.S. economy cools.

In the latest piece in the economic puzzle, the number of Americans filing new claims for unemployment benefits climbed to 336,000 last week.

Economists are watching the still-tight job market for indications that companies are shedding jobs and letting up on hiring -- all signs that a record expansion may be nearing an end.

Still, the Federal Reserve, which raised interest rates six times from June 1999 to May of this year, has given few signs that rates could anytime soon.

"We are all waiting for some indications from the Fed that says, 'Okay enough pain,'" Greg Smith, chief strategist at Prudential Securities told CNNfn's In the Money.

For stock investors, the pain has been significant. The Nasdaq composite index is off 45 percent from it March high of 5,048. For stock investors, the pain has been significant. The Nasdaq composite index is off 45 percent from it March high of 5,048.

Alan Skrainka, chief market strategist for Edward Jones, told CNNfn's Market Call that Wall Street needs some catalyst to bring investors back into stocks. (319K WAV) (319K AIFF)

|