NEW YORK (CNNfn) - Wall Street got into the Thanksgiving mood Wednesday by carving up shares of technology stocks, especially Internet and software names, some of which failed to provide the revenue growth investors had come to expect in the once high-flying sectors.

The Goldman Sachs Internet index ended the session 18.82 lower at 216.67, an 8 percent decline. Meanwhile, Goldman's computer software index fell 22.37, or 6.8 percent, to 304.54.

The Nasdaq composite index, which is weighed heavily with technology names, fell to a 13-month low, ending the session 115.69 points lower at 2,754.13, a 4 percent decline on the day.

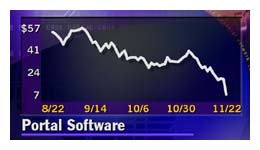

Portal Software leads the way lower

Shares of Portal Software (PRSF: Research, Estimates) were the biggest percentage losers on Nasdaq Wednesday, losing more than half their value after analysts downgraded the stock based on a forecast of a slower growth rate it released on Tuesday.

The e-commerce software company's shares fell more than 63 percent, dropping $11.84 to $6.78.

Portal reported third-quarter results on Tuesday that beat consensus analyst expectations, but the company said it expected a slowdown in its growth rate. Earnings were $7 million, or 4 cents per share, on revenue of $72 million. The consensus analyst estimate was 2 cents a share, according to earnings tracker First Call  . .

Banc of America Securities Analyst Kevin Trosian on Wednesday downgraded his rating on Portal Software to "buy" from "strong buy" and lowered his price target to $27 a share from $51.

"The quarter was more back-end loaded than usual, with roughly 60 percent of sales occurring in October," Trosian said in a research note. "We believe this was due to slower sales to second-tier providers as well as a somewhat delayed adoption of Portal's solution because of the murky outlook regarding telecommunications capital expenditures."

Analysts elsewhere followed suit. Prudential downgraded Portal to "accumulate" from "strong buy;" Goldman Sachs dropped the company from its "recommended list" and gave it a "market outperform" rating; and Merrill Lynch lowered it to a near-term "accumulate" from "buy."

Intuit, Novell falls after earnings reports

Intuit (INTU: Research, Estimates) plunged $4.31, or 9 percent, to $43.88, even though the personal-finance and tax software maker posted a first-quarter net loss of 10 cents per share versus the 16 cents per share Wall Street expected it to lose.

Despite the narrower-than-expected loss, ABN Amro analyst Glenn Greene downgraded Intuit's stock rating to an "add" from a "buy" and cut his 12-month price target to $55 from $60 a share.

Green said he is concerned about a $25 million-to-$30 million revenue shift in tax software from the second quarter to the third. He also said he was modestly disappointed by the Site Solutions activation rate as well as the end of certain QuickBooks/Gateway partner relationships.

By contrast, Credit Suisse First Boston analyst Jim Marks said Intuit is off to a strong start in its new fiscal year. He maintained his "buy" rating and price target of $72.

Computer network software vendor Novell (NOVL: Research, Estimates) fell $1.44, or 19.3 percent, to $6. After Tuesday's close, the company reported fourth-quarter earnings sharply below a year ago, as it suffered from a rapid decline in sales of its packaged software to small businesses.

In the fourth quarter, Novell broke even on a diluted per share basis, down from a profit of 17 cents per share last year. The results were in line with analyst expectations, according to First Call. Revenue fell 21 percent to $273 million from $344.5 million a year ago. In the fourth quarter, Novell broke even on a diluted per share basis, down from a profit of 17 cents per share last year. The results were in line with analyst expectations, according to First Call. Revenue fell 21 percent to $273 million from $344.5 million a year ago.

The Provo, Utah-based company, best-known for its NetWare network management software, said growth in its new Internet-based services could not offset the rapid sales decline elsewhere, and it warned that sales likely will be flat in the coming year.

"We've had a pretty difficult year," Chairman and CEO Eric Schmidt said in a conference call. "We are six months into a process of transforming from a relatively straight-forward software company into a solutions-based company."

Among other software stocks taking hits Wednesday: BEA Systems (BEAS: Research, Estimates) fell $9.94, or 16.3 percent, to $51.06; Veritas Software (VRTS: Research, Estimates) finished $3.94 lower at $93.38, a 4.1 percent decline; Verisign (VRSN: Research, Estimates) dropped $9, or 9.6 percent, to $85.06; and Siebel Systems (SEBL: Research, Estimates) shed $7.62, closing 8.9 percent lower at $77.81.

Cache Flow, Inktomi plunge

Shares of CacheFlow (CFLO: Research, Estimates), which makes hardware and software to speed up the transmission of data across the Internet, tumbled $39, or almost 51 percent, to $37.81, even though the network caching vendor beat Wall Street expectations in its fiscal second quarter.

CacheFlow's loss for the quarter narrowed to $3.1 million, or 9 cents a share, excluding charges, versus the analysts' expectations of a loss of 11 cents per share.

However, investors dumped the stock in response to concerns about its decline in sequential revenue growth and the company not boosting guidance for its second-half results for 2001.

Despite the investor sell-off, several analysts maintained their ratings for CacheFlow. Bear Stearns reiterated its rating of "attractive" and a price target of $74 a share, while Morgan Stanley analysts kept their "outperform" rating.

Inktomi (INKT: Research, Estimates), which also provides caching technology to speed the delivery of Internet content, fell in sympathy, plunged $7.88, or 21.7 percent, to $28.38.

Goldman defends Yahoo!

Shares of Yahoo! (YHOO: Research, Estimates) logged their third consecutive session of declines, falling $3.50 to $38.19, an 8.4 percent decline on the day.

The Internet portal was especially hurt by a research report Tuesday from Morgan Stanley analyst Mary Meeker, who said the company has a 30 percent chance of missing revenue expectations in the next several quarters.

On Wednesday, analysts at Thomas Weisel Partners downgraded Yahoo! shares to "buy" from "strong buy."

But Goldman Sachs analysts Michael Parekh and Kevin Flaherty said Wednesday they were comfortable with Yahoo!'s fourth-quarter revenue and earnings estimates, despite advertising revenue pressure. But Goldman Sachs analysts Michael Parekh and Kevin Flaherty said Wednesday they were comfortable with Yahoo!'s fourth-quarter revenue and earnings estimates, despite advertising revenue pressure.

"We believe that the seasonally stronger holiday quarter will allow Yahoo! to offset any weakness in Web advertising related to the slowdown in spending by cash constrained dot.coms and view our revenue estimate as conservative," the analysts wrote.

The analysts noted that fears of earnings misses unjustly preceded Yahoo!'s second- and third-quarter financial results, when the company beat Wall Street's estimates both times.

"Although the shares will likely remain volatile in the near term given these on-going concerns, we continue to view these periods of weakness as long-term opportunities for patient investors," the analysts wrote.

-- from staff and wire reports

|